In the business environment, recovering unpaid VAT is a necessary task. Especially when some customers face economic difficulties. Spain, like many countries, faces this challenge. Discover effective strategies to recover the VAT due to you and ensure the financial stability of your company. Ready to optimize your finances? Read on and take control of your tax collection.

Can you recover unpaid VAT and how to do it?

A frequent situation that can arise is when a customer fails to pay an invoice. In this scenario it is possible to start taking steps to recover VAT that was charged. Specifically, after one year has elapsed since the creation of the transaction.

However, if your company’s annual turnover is less than 6,010,121.04 euros, another scenario occurs. The waiting period for initiating these procedures is reduced to six months.

In any case, regardless of the scenario, the period available to make these arrangements remains six months. This time is crucial to act diligently and recover any VAT due.

However, if your client files for bankruptcy before these deadlines expire, you must advance the proceedings:

- Generate a corrected invoice within three months. It must be from the publication in the BOE of the order of contest.

- Send it to the debtor (with a copy to the insolvency administrator). Carry out this procedure by means of burofax in order to have a record of the sending within the indicated term.

- You will have one month from the issuance of the corrected invoice to inform the Tax Authorities. Always using the specific form available at its Electronic Headquarters, which has made such correction.

You may also be interested in: How to defer the payment of taxes in Spain?

How to be aware of these contests and deadlines?

A frequent question is how to be properly informed of the exact moment when the order of declaration of insolvency is published? Here you have the key information to be aware and be able to recover VAT from your delinquent customers.

The insolvency administrator is responsible for communicating this situation to all creditors. However, sometimes this process is delayed. This increases the risk that you may not be able to make the rectification in time.

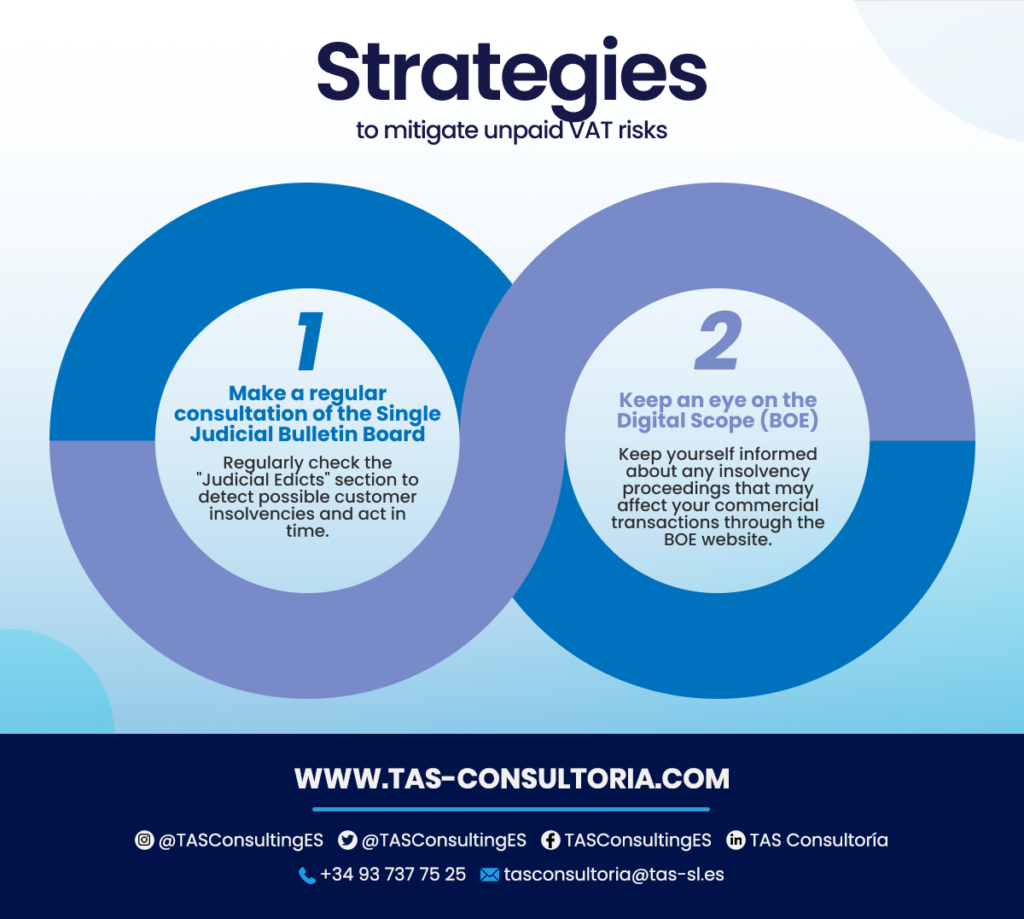

Here are two strategies to reduce this risk:

- Do you suspect that a client is heading for insolvency? It is advisable that you make periodic consultations in the Single Judicial Edictal Board of the BOE. Specifically in the “Judicial Edicts” section.

There you will find the announcements of insolvency proceedings. This will allow you to keep an active watch on possible insolvency proceedings affecting your clients.

- In the digital realm, it is essential that you keep an eye out for announcements and updates on the BOE website. Keep abreast of news and alerts related to contests that may have an impact on your business transactions.

Getting ahead of these situations is crucial to make timely decisions in the management of your VAT recovery procedures.

Take a look at this material and keep it handy:

You may also be interested in: What is the new Insolvency Law about?

What happens if the deadline is exceeded?

In this context, it is essential to understand that we are facing an issue of incompatibilities. If your client enters into insolvency proceedings and exceeds the three months to make the rectification, unfortunately, you will lose the opportunity to recover VAT.

Even if the general period of six months or one year to claim has not yet been exceeded. Remembering that this term is from the moment the operation is generated. This incompatibility has a logical basis: after the aforementioned procedures, the Treasury becomes the VAT creditor before the insolvent client.

In this process of recovering VAT, the delinquent debtor must deduct that VAT. For the simple fact that the deadline for non-payment has passed. In this sense, he must do it as less VAT that he has paid in his taxes. Specifically when making the periodic declaration corresponding to the date on which the rectifying invoice is received.

On the other hand, in the case of insolvency proceedings, the tax authorities must include such VAT in the list of creditors of the insolvent party. In addition, due to the deadlines stipulated in the insolvency law, after the three months it may encounter difficulties in doing so.

However, there is one exception:

The deadlines for VAT recovery are compatible if the insolvency proceeding is declared after the general recovery period has passed. Either due to the passage of six months or one year, or due to insolvency proceedings.

It is essential to underline this detail. Your company does not remember to carry out the rectification procedures? Those within the windows that open after six months or a year have elapsed. Of course, since the generation of the invoice.

Well, there is still a possibility to recover VAT in case the defaulting customer enters into insolvency proceedings at a later point in time. However, the opposite does not apply.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

Looking to recover VAT on an unpaid invoice? We know that this situation represents a considerable financial challenge. Also, that the process of recovering VAT may seem complex at first. But, with the right information and the right guidance, it is entirely feasible.

Don’t hesitate to take advantage of our specialized services to get a personalized accounting consultation. We can answer your questions about how to effectively recover VAT, contact us today at tasconsultoria@tas-sl.es and take the first step towards successfully recovering your VAT!

Your email address will not be published .

Required fields are marked with *