Due to the economic problems that the self-employed must face, the expenses of maintenance and stay that are incurred in the development of professional activities are deductible since 2018. These deductions are what are known as self-employed per diem. To find out how these per diems work and when you can deduct them, stay until the end of this article, where we will be telling you everything you need to know and more.

What is the self-employed per diem?

The self-employed per diem are considered those expenses that are generated by the development of your work activity and that, therefore, it is not up to you to pay. That is to say, they are the expenses that you have to deduct according to the Law of Urgent Reforms of the Self-Employment of 2018.

This law aims to equalize the conditions of salaried employees and the self-employed. This means that the self-employed can deduct from their personal income tax and VAT the expenses, both for accommodation, meals and travel, which can be justified as necessary to work.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

What taxes can per diems be deducted?

The self-employed per diem expenses resulting from the work activity you perform can be subtracted from both your income tax and VAT returns. That way, they will not affect your economy so much.

What this means is that what you eat or drink for work can be subtracted from the amount that you have to pay for personal income tax as a deductible expense. This way you will pay a lower tax and, in the case of VAT, it also enters as a deductible expense and you would declare it in the form 303 as a deductible expense of the meal.

Which self-employed per diem are deductible?

A living expense deduction can be made for food and travel expenses. An example of self-employed per diem can be gasoline expenses, travel by public transport or hotel stays. Of course, as long as they are work-related.

This is because the pace of life of the self-employed, and the kind of work they do, it is common that they are forced to resort to restaurants to be able to eat without altering the work activity. In addition, to this we must add all the meals with clients that are usually mandatory in order to close certain deals.

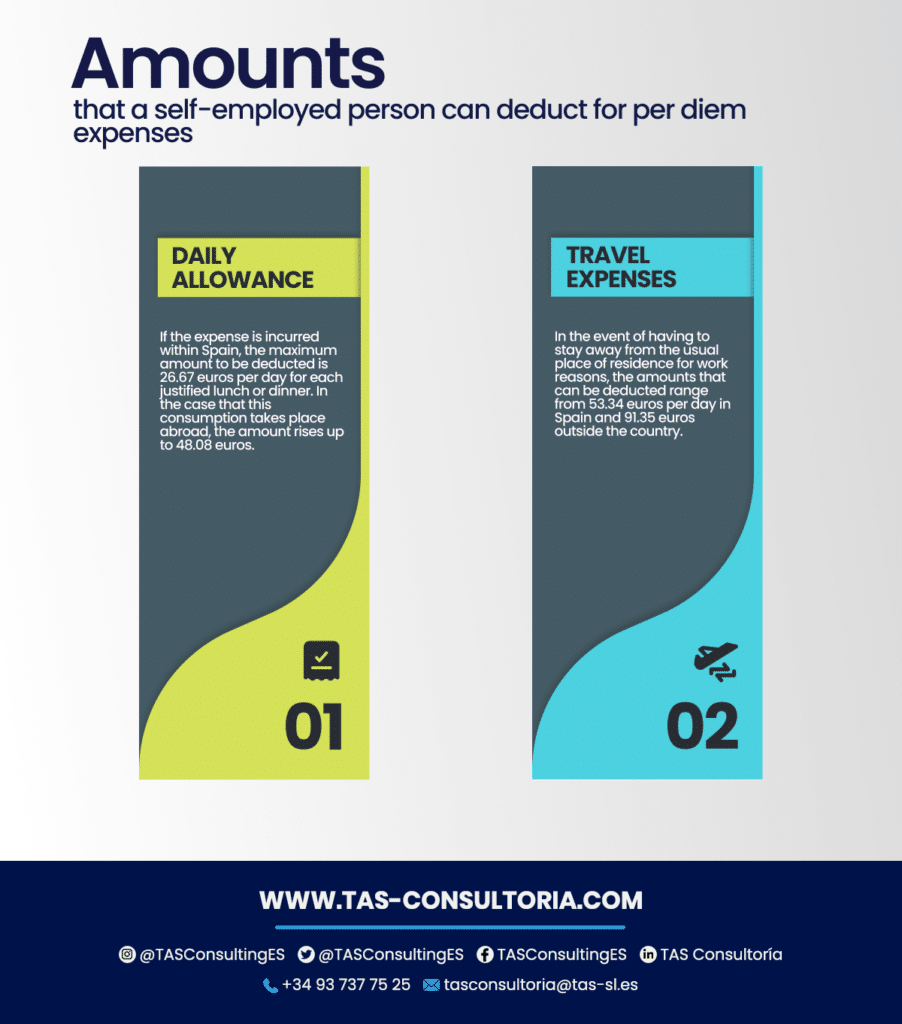

What amounts can you deduct as a self-employed person for per diems?

A self-employed person may tax on meal allowances or travel expenses as stipulated in the Law on Urgent Reforms of Self-Employment and may not exceed the limits set forth therein. These limits are:

These limits are immovable, which means that there is no documentation that you can present to extend them. However, it is advisable to take advantage of these deductions, as they can represent a good saving at the end of the fiscal year.

You may also be interested in: How to invoice foreign customers from Spain?

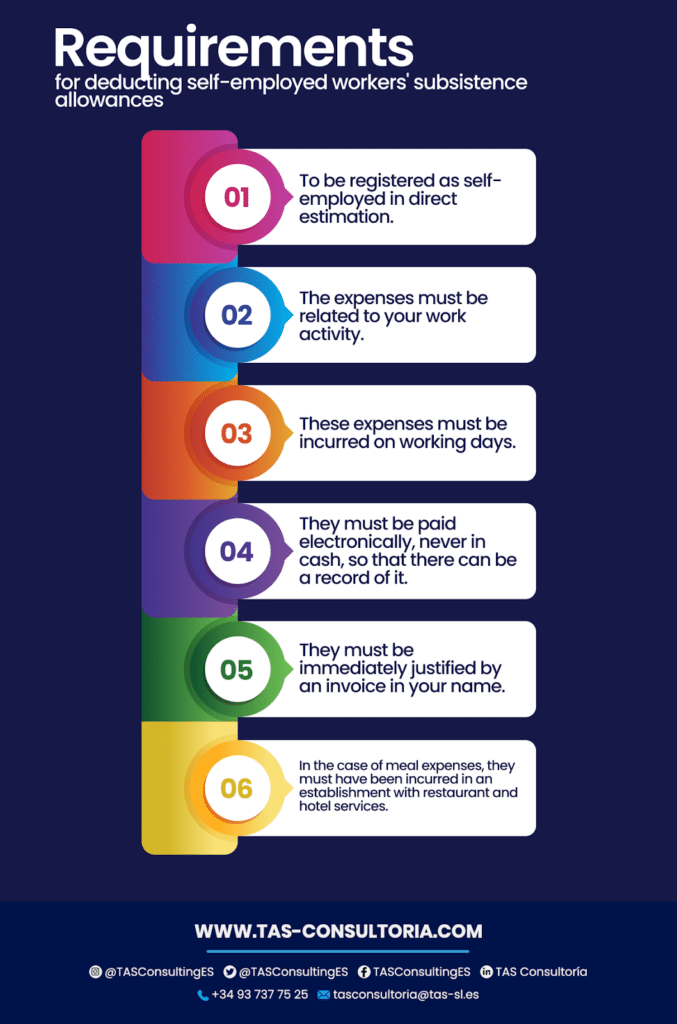

What are the requirements to be able to deduct self-employed per diem?

In order to deduct the self-employed per diem, a series of requirements must be fulfilled so that this is given correctly and all always under the law. Next, we will show you the requirements that are usually requested:

How can you justify deductible per diem expenses to the tax authorities?

In order to justify the self-employed per diem to the tax authorities, the most important thing is to have an invoice that proves the expense. This invoice must include your name, your surname, your tax ID number, the date and place of the expense, as well as the amount you have paid.

Also, you should take into account that expenses exceeding the maximum amounts cannot be justified as per diems and should be included as normal non-deductible expenses in your tax returns.

Also consider that it is advisable to keep your invoices for four years. This is because the IRS may always want to do a review during this period of time.

What if you cannot substantiate a deductible expense?

If you cannot justify the need for the self-employed diet to the tax authorities, you should know that you may suffer different consequences, which can be detrimental to you and your business. The consequences we are talking about are:

- The expense will be borne by you, so you will have to modify your VAT and personal income tax returns.

- A surcharge of between 50% and 150% of the expense may apply.

The most advisable is to be very conscious of your expenses if you intend to deduct them as part of your allowances.

You may also be interested in: Tax benefits for the self-employed in Spain

If you want to understand more about the self-employed per diem contact us through our email tasconsultoria@tas-sl.es. In our office we have the best professionals, all specialized in tax law, legality and finance. Do not wait any longer and contact us and get a free advice from the best team.

Your email address will not be published .

Required fields are marked with *