Compliance with money laundering laws is crucial to ensure transparency and legality in economic operations. In Spain, these regulations are fundamental to prevent illicit activities and maintain the integrity of the financial system. If you want to know the essential steps to comply with these regulations and avoid legal risks, read on! Ensure the correct management of your financial assets.

What is money laundering control?

The ongoing anti-money laundering effort encompasses a wide range of strategically designed measures and procedures. These measures work in synergy to achieve comprehensive monitoring of financial transactions. With the primary focus on intercepting and stopping the flow of funds originating from illicit activities.

The team collaboratively intertwined the tactics used. With the fundamental purpose of creating an insurmountable barrier to prevent the entry of this money into the legitimate financial system.

Every measure and every protocol is an obstacle for those who seek to exploit loopholes in legality. Especially, to do money laundering (hide the true source of their funds).

In this context, established regulations play a crucial role. It goes beyond being a set of rules. It is a protective shield that stands in defense of the integrity of our financial system.

Its purpose is not only to prevent and detect suspicious transactions. It is also about building a robust and reliable financial structure.

Each pillar of these regulations seeks to reinforce the foundations on which our economy is built. And it ensures that money flows are transparent, traceable and backed by legal and ethical activities.

This coordinated fight against money laundering is woven into the fabric of responsibility and civic commitment. It is a collective effort that, by strengthening financial defenses, promotes a fairer and more equitable society.

You may also be interested in: Reform of the Alien Law: what’s new 2022

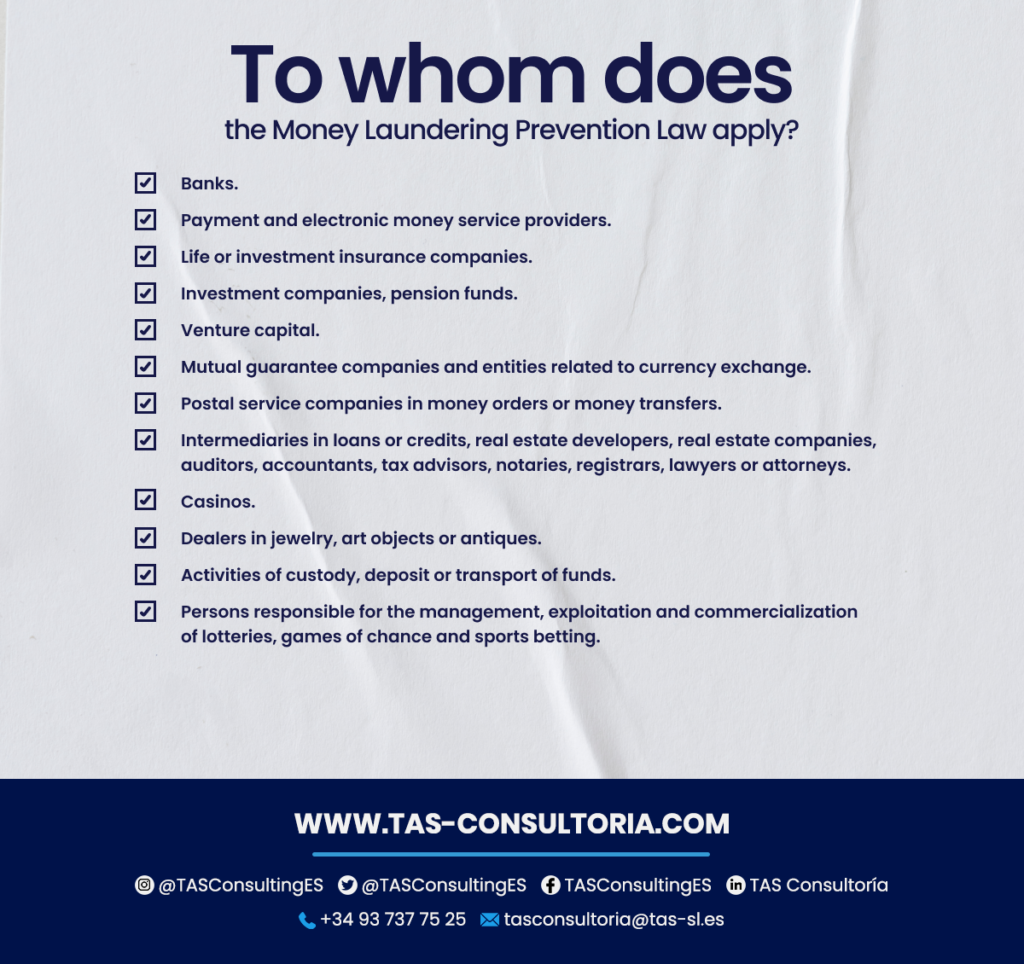

To whom does this legal regulation apply?

Legislation in Spain establishes that the Money Laundering Prevention Law must be applied on a mandatory basis to entities such as:

- Banks.

- Payment and electronic money service providers.

- Life or investment insurance companies.

- Investment companies, pension funds.

- Venture capital.

- Mutual guarantee companies and those related to currency exchange.

Postal service companies related to money orders or money transfers are also subject to this law. Along with credit intermediation processes, real estate developers, real estate companies, auditors, accountants, tax advisors, notaries, registrars, lawyers or attorneys.

On the other hand, businesses or profiles such as:

- Casinos.

- Jewelry merchants.

- Art objects or antiques.

- Those who carry out activities of custody, deposit or transportation of funds.

- As well as those responsible for the management, exploitation and commercialization of lotteries and other games of chance, including sports betting.

Don’t forget to have the checklist with all these entities at hand:

These extensive regulations are designed to address a wide variety of economic and financial activities. This is with the objective of preventing money laundering and terrorist financing.

You may also be interested in: From the MOSS regime to the OSS regime: what is it all about?

How to ensure compliance with the money laundering prevention law?

Below, we will explain the essential pillars on which obligated individuals or organizations must base their actions:

Appointment of an expert and controller

It is imperative to appoint an expert within the business environment. He or she must be dedicated to supervise and execute the provisions established by the law on the prevention of money laundering.

This professional will be in charge of establishing the necessary measures and the appropriate protocols. With the purpose of preventing and avoiding any type of transaction linked to funds of illicit origin.

Representative before SEPBLAC

It is essential to designate an official representative before the Executive Service for the Prevention of Money Laundering (SEPBLAC). This designation ensures direct and efficient communication with the regulatory entity. This ensures the proper implementation of the policies and guidelines established by law.

Comprehensive training

All team members must have a thorough knowledge of the regulations in force in this area. To achieve this, the organization must provide adequate training in this area.

This involves providing specialized courses that enable employees to fully understand their responsibilities and commitments. All in the context of money laundering prevention.

Compliance procedure

The company must develop and implement a compliance procedure that applies to all customers. Both new and existing, all with whom operations are carried out.

This process ensures due diligence and constant follow-up. Specifically regarding the verification of the lawful origin of the funds involved in commercial transactions.

We are in an increasingly monitored and regulated economic environment. It is crucial to be aware of the provisions of the money laundering law. Ensure legality and transparency in your financial transactions.

Keeping your business in line with these regulations not only avoids possible sanctions. It also protects your reputation and the integrity of your assets.

You may also be interested in: What is the new Insolvency Law about?

If you are looking for reliable legal and tax management to help you navigate this complex scenario, count on us! Our team of experts is ready to advise you to keep your business structure free of illicit errors. Contact us at tasconsultoria@tas-sl.es and guarantee a path to compliance with the money laundering law.

Your email address will not be published .

Required fields are marked with *