The higher personal income tax withholding in Spain is a concept that can boost companies. Even so, do you know what it means and how you can benefit from it? Here we will tell you what it is and how it works, stay until the end and find out the details, come on!

What is the application for withholding in excess of personal income tax?

The request for withholding in excess of the IRPF is a request that is filed with the Tax Agency. With it, it is possible to apply to an amount higher than the IRPF.

In other words, it is a useful tool for those taxpayers who wish to lower their income tax rates. If done properly, it can be a great help for taxpayers to save some taxes.

To request the withholding above the IRPF, you must fill in the withholding request form. In this, you will have to indicate your personal data, tax situation and the amount of withholding you wish to apply. Once completed, you must present it to the Tax Agency.

You may also be interested in: What is the NIF in Spain and how to obtain it?

How does the higher personal income tax retention occur?

When a person obtains income subject to withholding, such as salaries, pensions or income from economic activities, the payer is obliged to withhold a portion of such income and transfer it to the Tax Administration. This withholding acts as an advance payment of the tax that the taxpayer must pay at the end of the tax year.

Backup withholding occurs when, due to various circumstances, the percentage applied is higher than what would normally apply. This may occur if the taxpayer is in two situations. One, he/she has irregular income; or, two, there is insufficient information available to determine the appropriate withholding rate.

It may also happen that the taxpayer does not file Form 145. This is a declaration of personal and family data that affects the calculation of the withholding tax.

Thus, the purpose of the withholding tax is to ensure that the appropriate amount is collected during the fiscal year. Thus, it is possible to avoid possible situations of insufficient collection.

However, it may happen that the withholding is higher than the actual amount of tax that the taxpayer must pay. In that case, an excessive tax burden may be generated and affect your liquidity.

It is important to note that the higher withholding does not imply a higher tax payable at the end of the tax year. When filing the corresponding income tax return, the taxpayer may offset the excess withholdings and request a refund of the amounts withheld in excess.

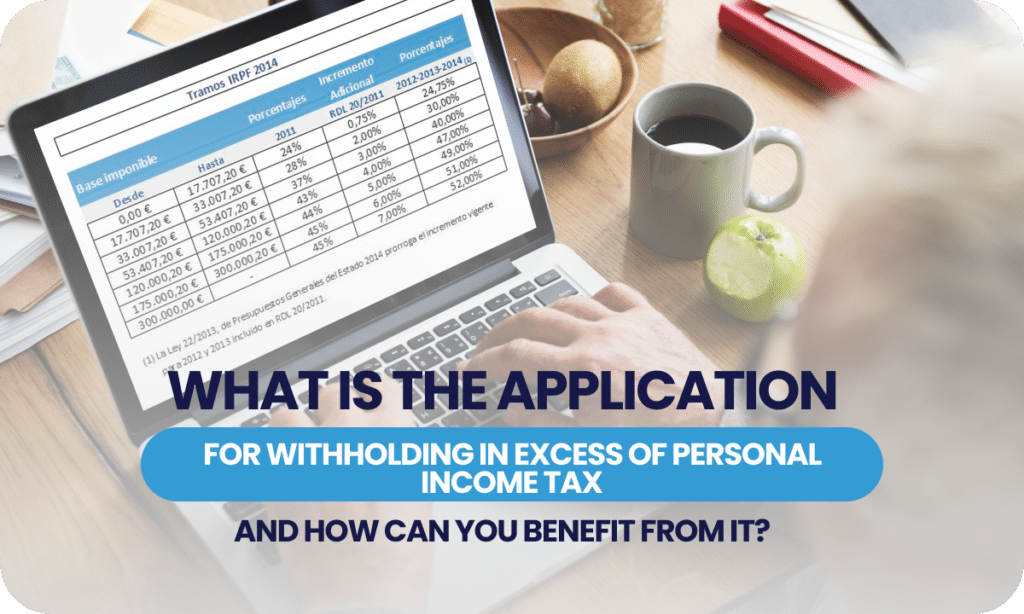

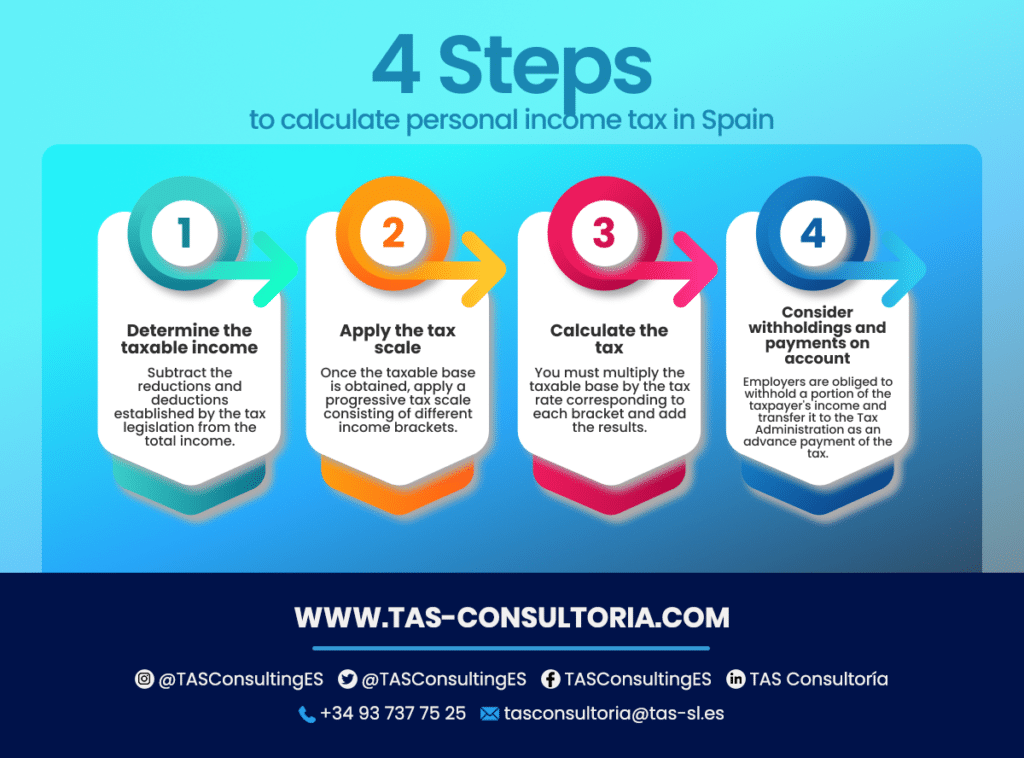

How is Personal Income Tax (IRPF) calculated?

The calculation of Personal Income Tax (IRPF) in Spain is carried out through a progressive system. This means that the tax is applied in a staggered manner according to the taxpayer’s income levels. Below you will find the key elements of the IRPF calculation in Spain:

It is important to note that there are differences in the application of personal income tax depending on the autonomous community in which you live. Some communities have the capacity to establish their own tax rates and additional deductions.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

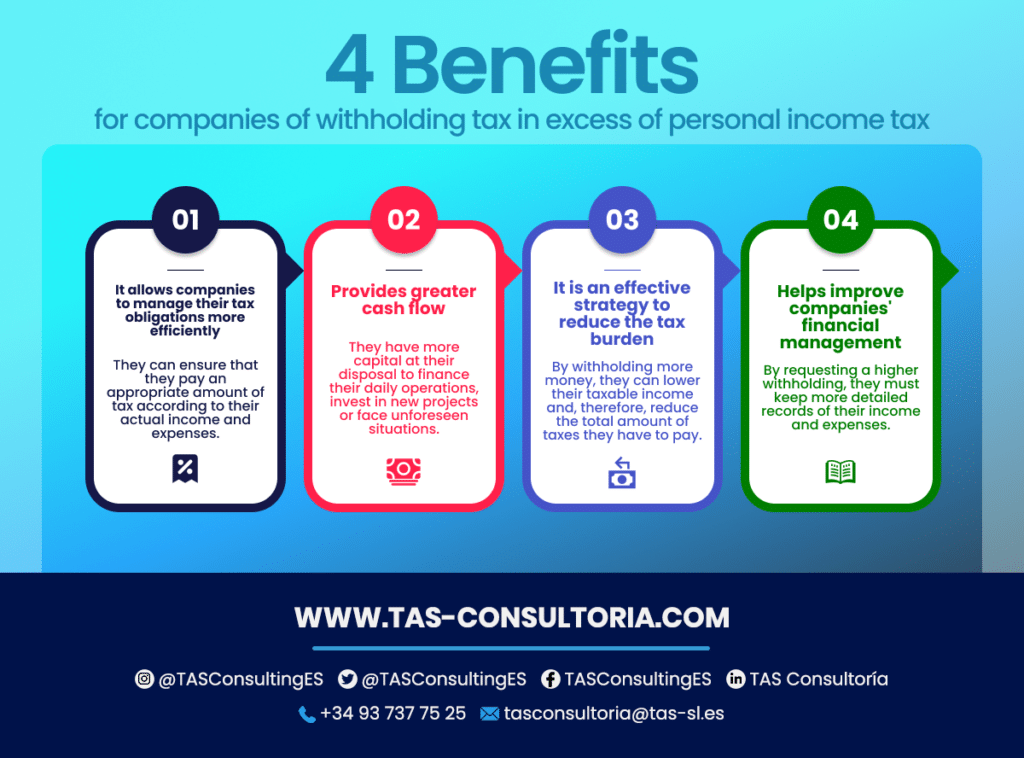

4 benefits of claiming higher income tax withholding for companies

As we told you, backup withholding refers to a request made by a company seeking to withhold a higher percentage of its income for income taxes. Below, we explain the 4 main benefits of this application:

We must emphasize that the request for backup withholding must be executed properly and in compliance with current tax regulations. Therefore, we recommend you to seek professional advice before making any decision in this regard.

How does the higher personal income tax withholding benefit individuals?

The higher personal income tax withholding has several long-term benefits for individuals. For example, if you have income from different sources and the sum of these exceeds the tax exempt limit, the higher income tax withholding can help you avoid having to pay a significant amount of tax at the end of the tax year.

In addition, backup withholding can also avoid paying penalties due to underpayment of taxes.

You may also be interested in: What are the penalties imposed by the Tax Agency?

Do you want to know more about the types of withholding taxes that exist in Spain and get advice on how to apply for them? Contact us through tasconsultoria@tas-sl.es where our professionals will provide you with the necessary attention. Schedule your free advice and keep up to date with the taxation of your company.

Your email address will not be published .

Required fields are marked with *