Companies frequently use discounted invoices to reduce prices. But, in addition, these are a commercial strategy that is increasingly used by freelancers for different reasons: to obtain liquidity, customer loyalty or to collect an invoice in advance. If you are interested in knowing how you can add discounted invoices to your accounting, this article is for you, don’t miss the details!

What is a discounted invoice?

A discounted invoice is a document that reflects a purchase transaction. It is a deduction from the taxable amount of the item or service being purchased.

This type of invoice usually helps entrepreneurs or freelancers to increase their liquidity. In this way, it is possible for them to pay their suppliers or workers before the stipulated time.

In addition, it is an infallible method for securing older customers or attracting new ones. Not to mention that it is a type of discount that allows you to negotiate with your customer at the time of payment and at the same time will allow you to obtain a greater flow, so you can generate new business opportunities.

You may also be interested in: Basic guide to bookkeeping as a freelancer

Types of invoice discounts

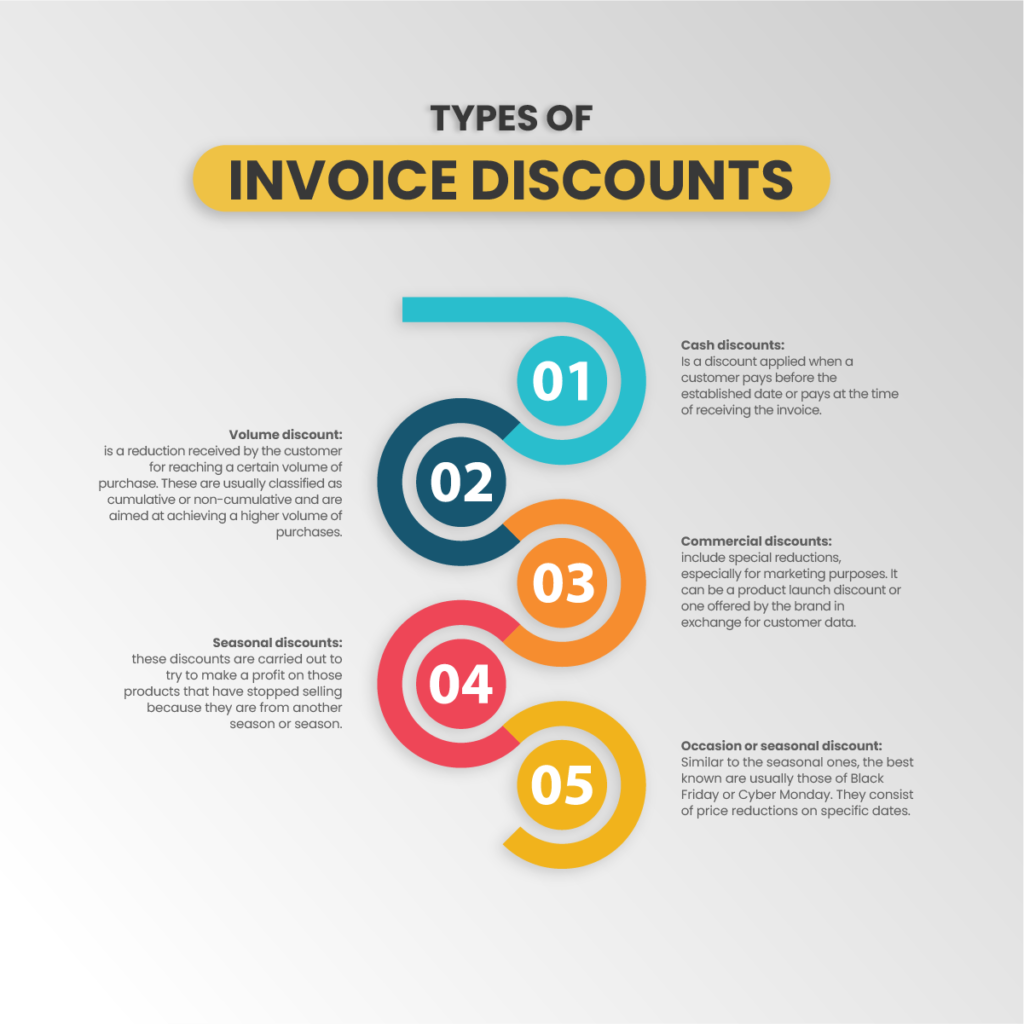

This type of discount will depend on the objective you have as an entrepreneur, since it is possible to make different types of discounts on the invoice.

It is also important to keep in mind that there are two general types of discounts: generic discounts, which affect all your customers equally; and individual discounts, which apply to specific customers.

In this regard, we will tell you which are the most frequent discounts that will be applied to your bills:

How can you apply the discounted invoices?

To apply your invoices with discounts, it is necessary to comply with the invoicing regulations mentioned in article 6 of the Royal Decree 1619/2012 of November 30. This decree approves the regulations governing invoicing obligations.

This regulation states that all invoices must contain a description of the operations and include all the data necessary for the determination of the taxable base of such tax. All this is defined in articles 78 and 79 of the Tax Law.

According to this law, it is necessary for the invoice to contain the unit price of the products or services purchased without taxes and then reflect the taxable base with the discount. Once the discount is specified, the invoice must be made in the same way as a normal invoice, while still including the mandatory data.

You may also be interested in: Is it possible to hire personnel as a freelancer in Spain?

How is invoice discounting accounted for?

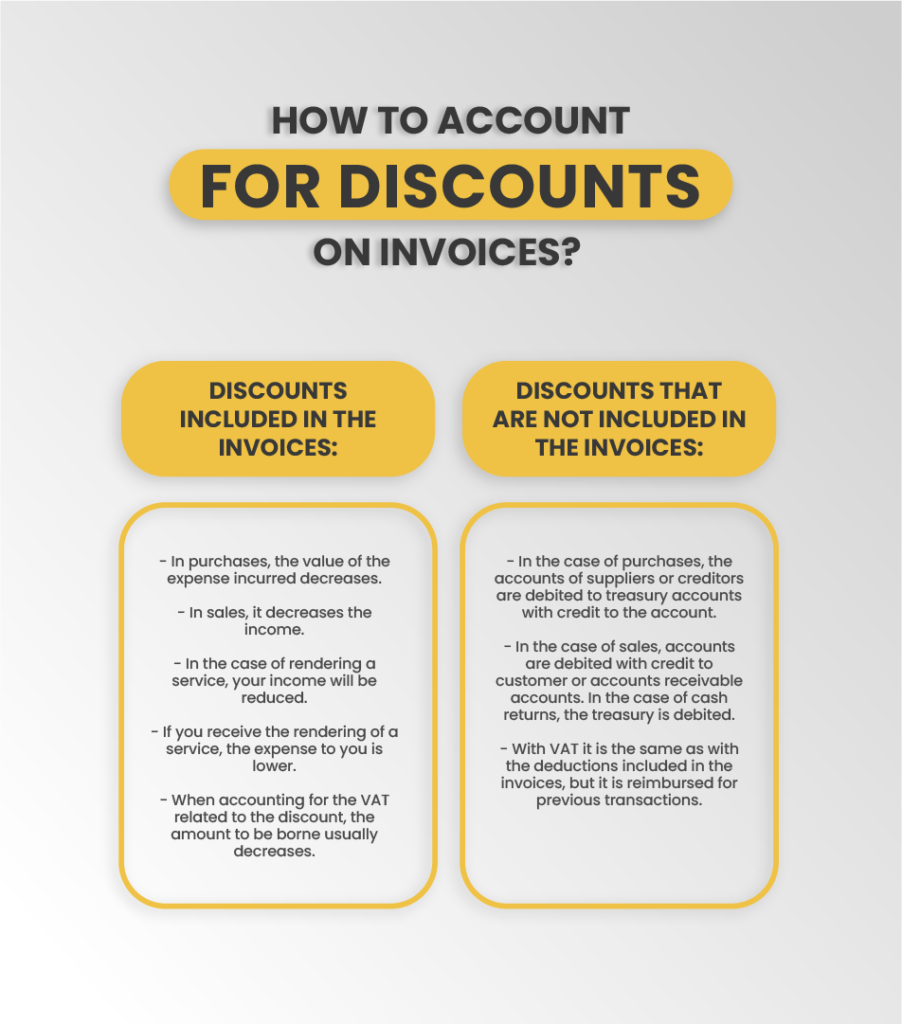

The way discounts are accounted for on invoices will depend on the method and type of discount you apply, such as those included in invoices and subsequent discounts.

In the event that the discount is considered in the invoices, it will be reflected as a lower amount in the operation, classified as follows:

You may also be interested in: Collaborative accounting: what is it and what does it consist of?

If you want to know about discounted invoices and how you can apply them as a freelancer, I invite you to contact us at our e-mail address, tasconsultoria@tas-sl.es. You will be able to get advice from excellent specialists who will provide you with the information and help you need. Contact us and ask for your free advice.

Your email address will not be published .

Required fields are marked with *