Are you thinking of moving to Spain or starting your own business in the country? One of the aspects to which you should pay the most attention is how the Spanish tax system works. Read on and find out about the main taxes for individuals and companies.

What is the Spanish tax system?

One of the main sources of financing of a State is the collection of taxes. When we speak of the Spanish tax system, we are referring to a set of taxes levied by the different levels of the Public Treasury.

In this sense, tax collection for Spain translates into the generation of coercive revenues that are intended to finance and cover the public expenses that may arise in the country.

You may also be interested in: Tax obligations for the self-employed in Spain 2022

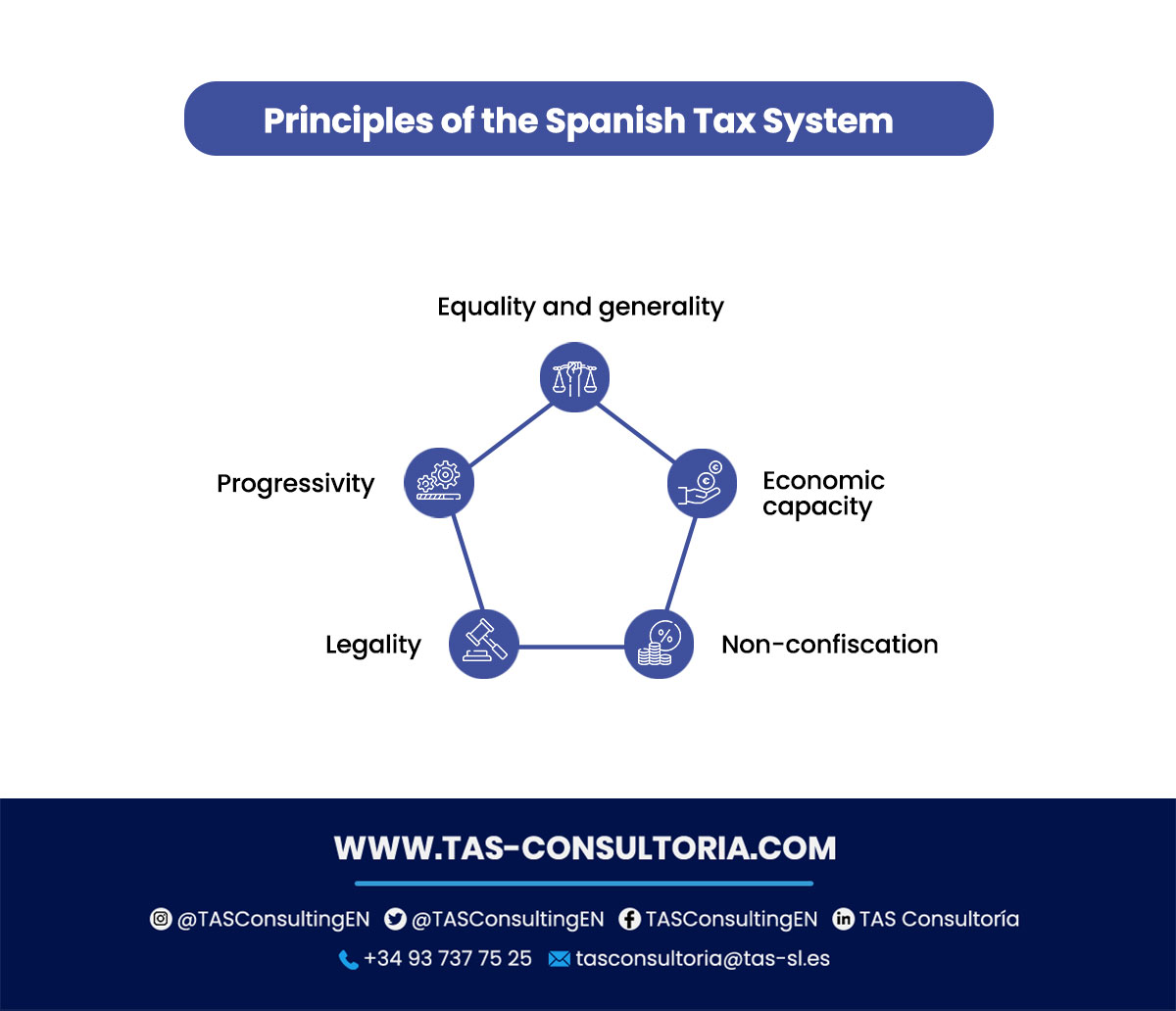

Principles of the Spanish tax system

Compliance with the Spanish tax system is mandatory for all Spanish citizens, as well as for business entities. To this end, the regulations are guided by five basic principles:

Principle of equality and generality

It refers to the fact that all Spaniards are equal before the law, and all must pay taxes.

Principle of economic capacity

The Treasury will take into account the income capacity or wealth possessed by a person to impose the amount to be paid when facing the tax regime.

Principle of progressivity

Continuing with the previous point, if a person demonstrates greater earning capacity, he/she will have to pay taxes progressively.

Principle of non-confiscation

In this case, taxation may not exceed the taxable income or assets. The obligation to comply cannot entail the loss of the taxpayer’s estate in its entirety, since it would put him in a situation of indigence and, therefore, the loss of his taxpayer status.

Principle of legality

According to Article 133 of the Constitution, the only body that has the power to establish taxes is the State, subject to compliance with the Law.

You may also be interested in: Tax advantages offered by the Canary Islands

Tax administration in Spain

Now that you know what the Spanish tax system is all about, we want to tell you a little about how taxes are managed in the country.

In general terms, all taxes in Spain are regulated in accordance with the Spanish Constitution, the General Tax Law, the General Budget Law, the laws regulating taxes and their associated regulations.

In this way, it is established that the fiscal competences are assumed in Spain by the State and its Autonomous Communities. Below is a summary table of the direct and indirect taxes applied to the Spanish territory:

The Autonomous Communities and taxes

In Spain, a common tax regime has been established in most of the Autonomous Communities, not to mention the existence of a foral regime corresponding to the former Kingdom of Navarre and the Basque Country.

However, within the so-called common regime, the State is in charge of collecting major taxes such as personal income tax, VAT and excise taxes, thus assigning 50% of the amount collected (for personal income tax and VAT) to each of the regions, and 58% (in the case of excise taxes) to each of them.

In addition, the regional governments are responsible for managing the performance of certain taxes such as Wealth Tax, Inheritance Tax, Gift Tax, Transfer Tax and Stamp Duty.

This means that it is possible to notice differences in the existing taxes from one region to another, since local authorities have the power to increase or decrease the percentage stipulated for each tax.

There is also the possibility that in some Autonomous Communities you may find your own taxes, which are not applicable in other regions. However, according to the Council of Economists in Spain, these taxes represent a low revenue collection.

According to the latest study by the Foundation for the Advancement of Freedom and the Tax Foundation, Madrid, the Basque Country, the Canary Islands and Castilla y León are the most competitive regions in terms of Spanish taxes.

In the case of personal income tax, there is a large difference by locality. Thus, in this tax, there is an autonomous community bracket added to the state bracket, with Madrid, the Canary Islands and La Rioja having the lowest figure (9%), leaving an aggregate of 18.5%, and Catalonia having the highest (12%), leaving an aggregate of 21.5%.

Aragon, Valencia and Catalonia are currently considered to be the least competitive Autonomous Communities in terms of taxation, due to higher taxes.

Another relevant aspect to highlight is the elimination of the Inheritance and Gift Tax in Castilla y León, which translates into a tax benefit for direct relatives by avoiding taxing assets that have been taxed in the past.

In relation to the Wealth Tax, although it is a tax that exists in all the Autonomous Communities, some regions apply incentives for the disabled, or allowances that can reach 100%, such as Madrid and Andalusia, and others 50%, as is the case of Galicia.

You may also be interested in: What are the penalties imposed by the Tax Agency?

We know that Spanish taxation can generate many doubts, so our team of experts at TAS Consultancy is available to explain in depth how the tax system works, advise you on how to make your tax returns and keep your business up to date. Call us toll free at +34 93 737 75 25, or log on to our website and contact us!

Your email address will not be published .

Required fields are marked with *