On April 25, 2024, the government of Spain activated the first aids for the agricultural and livestock sector. The Ministry of Finance and Public Function published the order in the BOE: it will be a 25% IRPF rebate for the livestock and agricultural sector as a result of the drought. Do you work in this sector? Learn here a little more about the IRPF reduction rebate and how it affects you!

What is Personal Income Tax (IRPF) and how is it applied to the agricultural and livestock sector in Spain?

Personal Income Tax (IRPF) is a tax levied on income obtained by individuals. In the case of farmers and ranchers, the IRPF can be applied to income obtained from agricultural or ranching activities.

Thus, farmers and ranchers must file an income tax return reflecting the income and expenses related to their activity. For this purpose, the tax to be paid is calculated according to the brackets established by the new contributions for self-employed workers that came into force in 2023.

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

What is the difference between personal income tax and personal income tax for agriculture and livestock?

Before discussing this point, it is important to point out that there are certain particularities in the tax treatment of farming and livestock farming activities in Spain. Among them, the application of certain deductions and tax benefits.

For example, there is the reduction of the taxable base by 5% or the application of a special regime of objective estimation. This is also known as “modules”.

It is also important to note that tax regulations may vary depending on different factors. Among them: the type of crop or livestock activity, the geographical location or the size of the farm.

For this reason, we always recommend that you seek advice from a tax advisor or the corresponding tax agency. This will allow you to obtain accurate and updated information on the tax treatment of agricultural and livestock activities.

What is the 25% IRPF reduction for the livestock and farming sector?

As we already told you, the Spanish Government, in an order published in the BOE, established a general reduction of the net yield of 25%. It may also benefit more than 800,000 farmers and stockbreeders who pay taxes through the module system.

This IRPF reduction means a reduction in the taxable base of approximately 1,807 million Euros for farmers and stockbreeders. This makes it the one that has had the greatest scope in the last decade. In this sense, it is expected that the order will have effects on the 2022 tax return, which has already been implemented.

You may also be interested in: Double taxation in Spain

What is the 25% personal income tax reduction for agriculture and livestock farming?

The IRPF reduction consists of a linear reduction that takes into account the drought and other economic consequences of the war in Ukraine.

The general reduction on the net module yield was generally set at 15%. However, it was raised to 25% for the agricultural, livestock and forestry sectors. This will determine the net yield by the objective estimation method.

Also, a 35% reduction in net income is established for the purchase of agricultural diesel and 15% for the purchase of fertilizer.

What other reductions are maintained by the affected sectors?

Some of the reductions that are maintained together with the new 25% reduction in personal income tax for the agricultural and livestock sector are as follows:

Reduction for light and feed

The reduction established last year for those who used electricity for irrigation is maintained together with the IRPF reduction. Likewise, this reduction also applied to those farmers who used feed purchased through third parties.

Specifically, the index applicable to livestock activities that feed livestock with feed and other products is set at 0.5. Of course, provided that it represents more than 50% of the products consumed. In addition, it should be noted that it applies to both intensive and extensive livestock farming.

According to the Ministry of Agriculture, a large number of reductions have also been made at regional, provincial and municipal level in other productions. For example, those approved for non-citrus fruit trees.

Insurance and funds

After the Council of Ministers, the Minister in charge of Agriculture explained that 317.7 million Euros were allocated to combined agricultural insurance. This through an agreement between Enesa and Agroseguro. Also, since 2018 the aid to this measure has increased by more than 50% with 410,000 policies.

In the case of funds for farmers and stockbreeders, a total of 292.7 million have been allocated to the autonomous communities. Of this amount, 207.9 million came from the State budget.

What does the Small Farmers Union think about IRPF reduction?

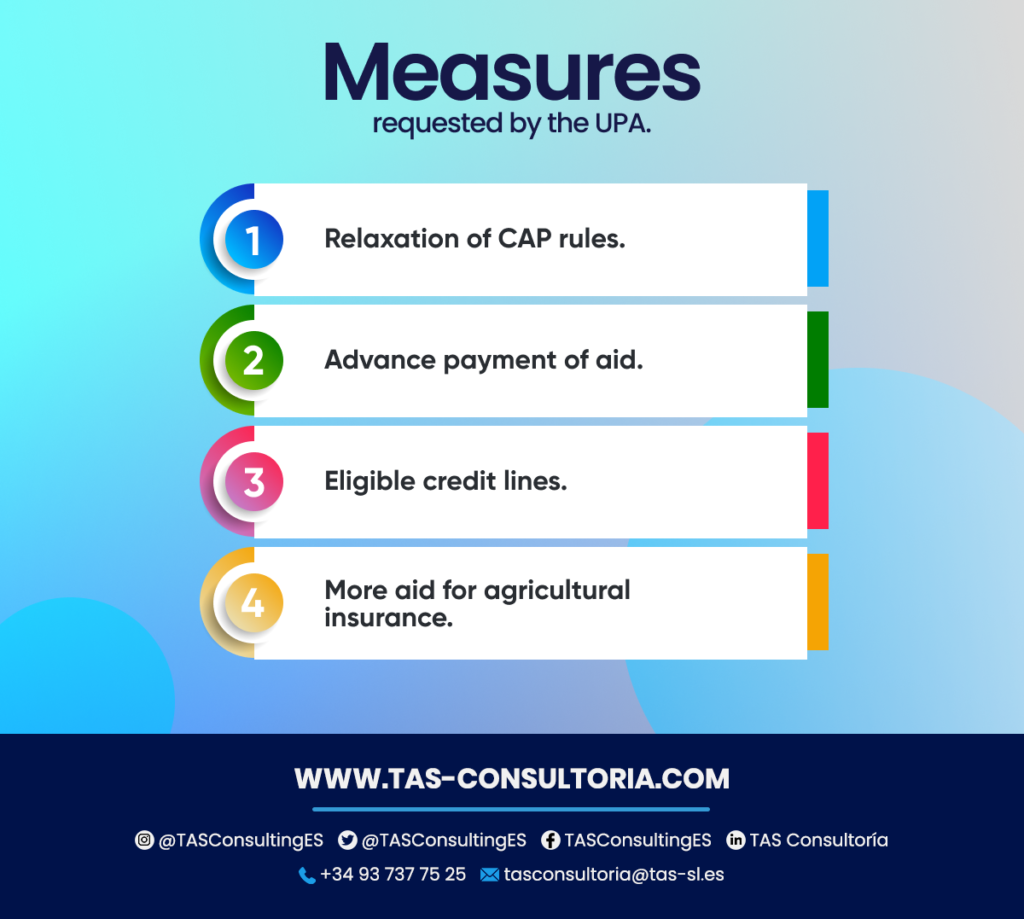

The Unión de los Pequeños Agricultores (UPA), considers that the 25% IRPF reduction for agriculture and livestock is an acceptable figure. This is a positive first step for the Spanish countryside. However, it considers that the losses generated by the drought will exceed the proposed 1,807 million euros.

In view of this, the UPA has requested a series of measures which are described below:

You may also be interested in: Tax benefits for the self-employed in Spain

Do you want to know more about how the new 25% IRPF rebate affects you? Do you need a tax advisor? Contact us through our email tasconsultoria@tas-sl.es. Our team will provide you with the best attention regarding this topic and many more.

Don’t miss the opportunity to keep up to date with Spanish law. Contact us and schedule your free consultation.

Your email address will not be published .

Required fields are marked with *