Have you benefited from an inheritance? Understanding how this event influences your income tax return is essential to make the right financial decisions. We explain how an inheritance affects your tax obligations and how you can manage it efficiently. Read on to make sure you maximize your benefits and comply with current tax regulations, let’s go!

Is it necessary to declare the inheritance tax that has been paid in the Personal Income Tax (IRPF)?

If you receive an inheritance and you must declare it, it is important that you know that the inheritance tax is levied on the capital gains derived from the inherited properties. Both at the time of the adjudication and in its liquidation.

The heir, then, will have a period of six months to liquidate the tax from the moment of death. However, he/she has the option of requesting a single extension of time for another six months.

In order to obtain this extension it is necessary to make the request before the first five months of the original term have elapsed. Once approved, the extension will begin to be counted upon expiration of the initial six-month period established by law.

You may also be interested in: Can a foreigner drive in Spain?

What is the impact of receiving an inheritance on the income tax return?

It is crucial to consider the income generated by the inheritance in the IRPF. Therefore, beneficiaries should keep the following in mind:

If you obtain income from shares or bank deposits from the inheritance, this income must be reported in the IRPF. Also, you must do the same tax procedure if you receive a property intended for rent or decide to lease an inherited dwelling. Likewise, the income from such lease must be declared in the income tax.

If you decide to sell a property received by inheritance, in addition to paying the municipal capital gains tax to the Town Hall, you must report certain information. You are also obliged to report the capital gain obtained by selling the inherited property in your income tax return.

What is the amount you can receive without justification?

It is important to take into account something related to bank transfers from an inheritance. And it is that there is a regulation that establishes certain limits before it is necessary to justify the origin of the funds.

In this sense, transfers up to 3,000 € have the particularity of not requiring the obligation. Banks do not require you to report these transactions. This means that banks are not required to report transactions for amounts below this threshold.

However, when the amount of the transfers exceeds 3,000 euros, the situation changes. The Tax Administration, in this case represented by the Inland Revenue, does get involved.

The authority ensures that the origin of the inheritance gains being transferred can be justified. This process aims to ensure transparency in financial transactions and prevent possible illicit activities or tax evasion.

In situations where such transfers are made on a frequent or regular basis, you should exercise caution. For, if adequate justification is not provided or details of the legitimate origin of such funds are omitted, you are at risk.

There is a palpable possibility of being subject to further investigation by the tax authorities. Therefore, it is essential to be prepared to demonstrate the legality and authenticity of the funds if required.

You may also be interested in: All about unemployment in Spain 2022

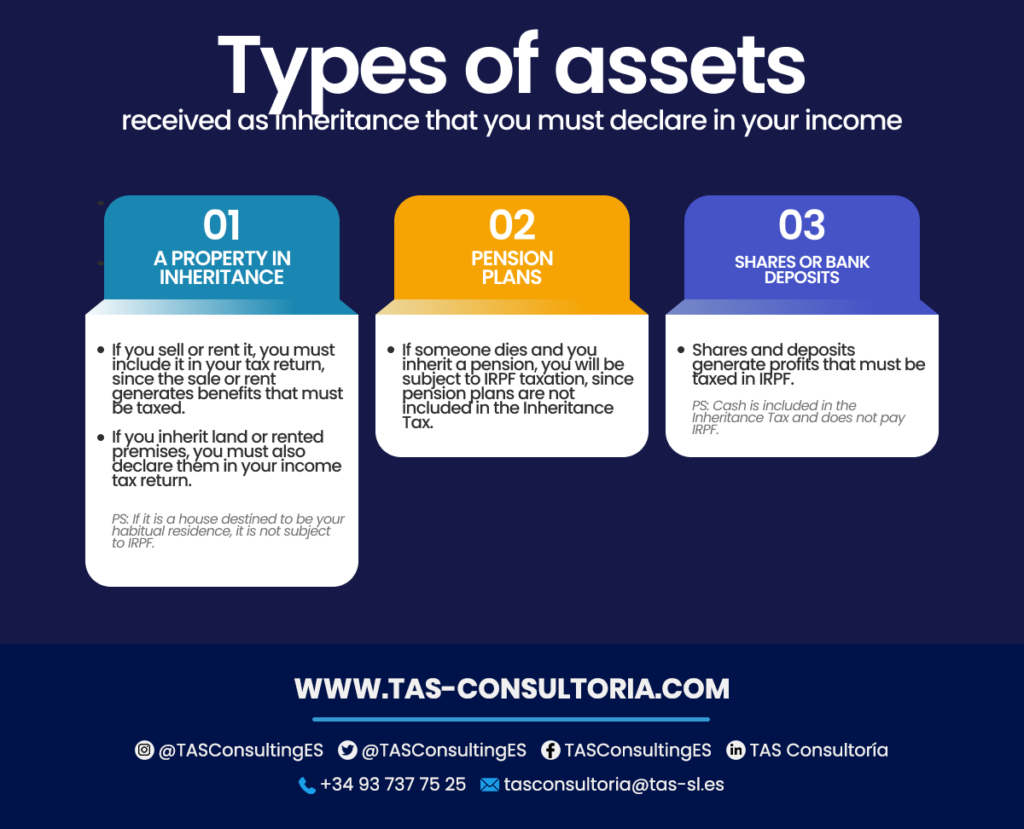

Cases of assets received as inheritance that you must declare in your income tax return

Are you wondering in which situations you should declare in your income tax return the assets received by inheritance? Don’t worry, here we explain what are those specific cases that require special attention.

When you inherit assets, it is essential to understand one premise. Although the assets themselves are not included on your income tax return, you must report the benefits you derive from them. Take a look at these specific cases:

1. You receive a property as an inheritance

- If it is a property destined to be your habitual residence, it is not subject to personal income tax.

- If you sell or rent it, you must include it in your tax return. Since the sale or rental generates benefits that must be taxed.

- If you inherit land or leased premises, you must also declare them in your income tax return.

2. Inheritance of pension plans

- If someone dies and inherits a pension, you will be subject to IRPF taxation. This is because pension plans do not fall under the Inheritance Tax.

3. You receive shares or bank deposits

- Shares and deposits generate profits that are subject to personal income tax.

- Cash is included in the Inheritance Tax and is not subject to personal income tax.

You may also be interested in: How to defer the payment of taxes in Spain?

If you need more information on how to manage these aspects, do not hesitate to contact us at tasconsultoria@tas-sl.es! Our team of experts is here to advise you and help you every step of the way.

Receiving an inheritance can be a complex process from a tax perspective, but you don’t have to face it alone. Our team of tax management experts is here to help you navigate all the details and make decisions.

Don’t hesitate to contact us to schedule a personalized consultation. Make sure your income tax return and other fiscal aspects are in order, we are here to make the whole process easier for you!

Your email address will not be published .

Required fields are marked with *