If you are a taxpayer in Spain, you should know how a notice by appearance may affect you. This modality of notification, used by the Tax Administration, has important implications in your relationship with the tax authorities. Read more and get all the information you need!

Have you received a communication from the Tax Agency (AEAT) with information about an act or a resolution?

It is not preferable to receive numerous letters of correspondence from such an entity. Therefore, it is crucial to know certain aspects to protect your rights in this context.

The Tax Agency notifies the taxpayer to confirm receipt of a specific procedure. These notifications communicate a certain resolution or administrative act. Taxpayers must make payments within the established legal deadlines to avoid affecting their rights.

In this regard, you should consider that the period established to respond begins to run from the moment you receive the notification. That is to say, from the moment you receive it.

Taxpayers must understand this dynamic to ensure that deadlines are properly met and their rights are safeguarded in the face of communications from the Tax Agency.

You may also be interested in: VAT rates in Spain: updates 2022

Key Factors of the Tax Agency Notifications (AEAT)

One of the crucial aspects in the tax field is to understand the notification process and its scope. Where does this fundamental practice take place? Taxpayers or their representatives can choose where to receive notifications for procedures that they have initiated. There may be no express indication. In that case, the tax authorities will make the notification at the domicile of one or the other.

The Tax Agency may notify taxpayers in different places, depending on the specific circumstances of the ex officio procedure. Taxpayers may be notified at their tax domicile, their place of work, or the place where they carry out their economic activity.

Who can receive tax notifications? Tax authorities may deliver tax notifications to any person who is present at the place or address indicated by a taxpayer or their representative, after identifying the person, even if the taxpayer or representative is not present.

Neighbors of the community of owners can even accept tax notices. For example, the doorman of the building, security guards, relatives of the taxpayer, among others.

Now, what is notification by appearance?

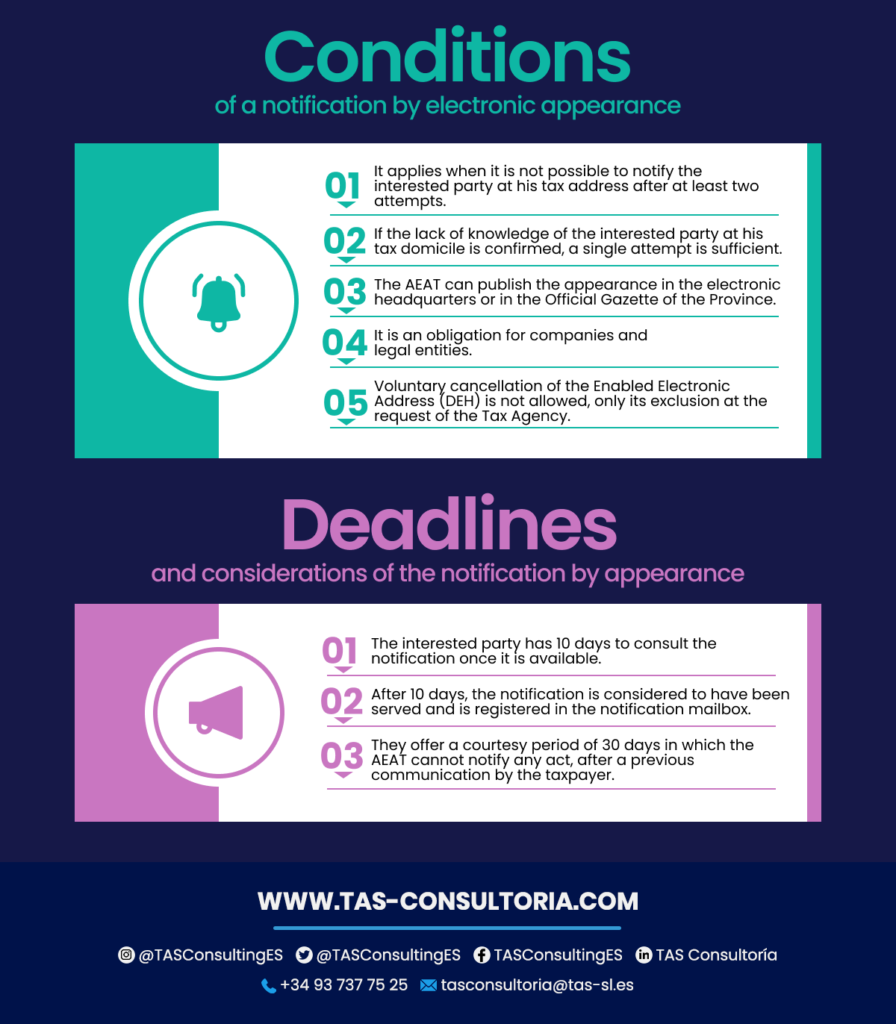

Tax authorities will deliver tax notifications to the interested party or their representative at their tax domicile, if possible. Attempting it at least twice. If the interested party is unknown at their tax domicile, a single attempt to notify them will be enough.

In this case, the AEAT may publish once for each interested party, either in the electronic headquarters or in the Official Gazette of the Province, said appearance. Taxpayers must comply with the notification requirement within 15 days.

Regarding the electronic tax notification, it is relevant to highlight that it applies to companies and other legal entities. The Tax Agency does not allow voluntary cancellation of the Enabled Electronic Address, only its exclusion at the request of the interested party.

It is essential to bear in mind that from the moment the notification is available, the taxpayer has 10 days to consult it. Tax notifications may be considered to have been issued after this time, as shown in the notification mailbox.

Taxpayers have a courtesy period of 30 days, during which the Tax Agency cannot notify any act, provided that the taxpayer has made a previous communication.

If you have any doubts, keep this material with the key points handy:

You may also be interested in: Form 036 and 037: registering with the Tax Authorities

How can taxpayers avoid submitting documentation after the deadline?

It is undeniable that, since the declaration of the state of alarm due to COVID-19, the Tax Agency continues to send summons to taxpayers to present their allegations, appeals, and other necessary procedures.

Taxpayers have 15 to 30 working days to provide and send documentation in some cases. Taxpayers may have difficulty submitting documentation due to the closure of tax offices and the reduced operation of the postal service as a result of the state of alarm.

This raises the possibility that you may not be able to respond to the requirement within the stipulated time, which may seem unfair. In view of this, you should seek advice from expert professionals who will help you avoid tax problems.

You may also be interested in: What are the penalties imposed by the Tax Agency?

If you still have doubts or need more clarity on how this process affects your tax obligations and your financial situation, we encourage you to consult with us.

Our experts are ready to provide you with advice tailored to your needs, giving you the precise guidance to navigate this complex aspect of the Spanish tax system. Don’t let unanswered questions worry you, contact us at tasconsultoria@tas-sl.es and get the help you need to make informed decisions and control your tax situation optimally!

Your email address will not be published .

Required fields are marked with *