Traceability is a concept that has always been used to refer to the business world. As a consequence, it gives rise to the term known as accounting traceability, strongly associated with the financial management of companies. In this article we will tell you in depth what it is, how it is associated with the business world and how you can benefit from it to grow your business. Let’s go!

What is traceability?

In the accounting world, traceability refers to the ability to trace all accounting data and its context within the company’s own accounting. Thanks to traceability, it is possible to locate and pinpoint the origin of such data.

In this sense, accounting traceability is an essential concept for the financial management of any company. This is because it allows you to trace and document the origin and destination of your company’s economic resources.

In other words, it consists of keeping a detailed and systematic record of all the company’s financial transactions. This from its inception to its conclusion.

Thus, accounting traceability allows improving business management. This is due to the fact that it allows to have accounting data at hand and thus use them to generate information on the evolution and status of the company.

In addition, it allows to keep a precise and transparent control of financial operations. This involves recording and documenting every movement of money: income, expenses, investments, loans, payments to suppliers or collections from customers.

In that sense, accurate and complete accounting information is essential to make informed decisions. And not only that, but also for assessing the company’s profitability, meeting tax obligations and complying with accounting regulations.

You may also be interested in: E-invoicing: the new mandatory regulation for Spanish companies

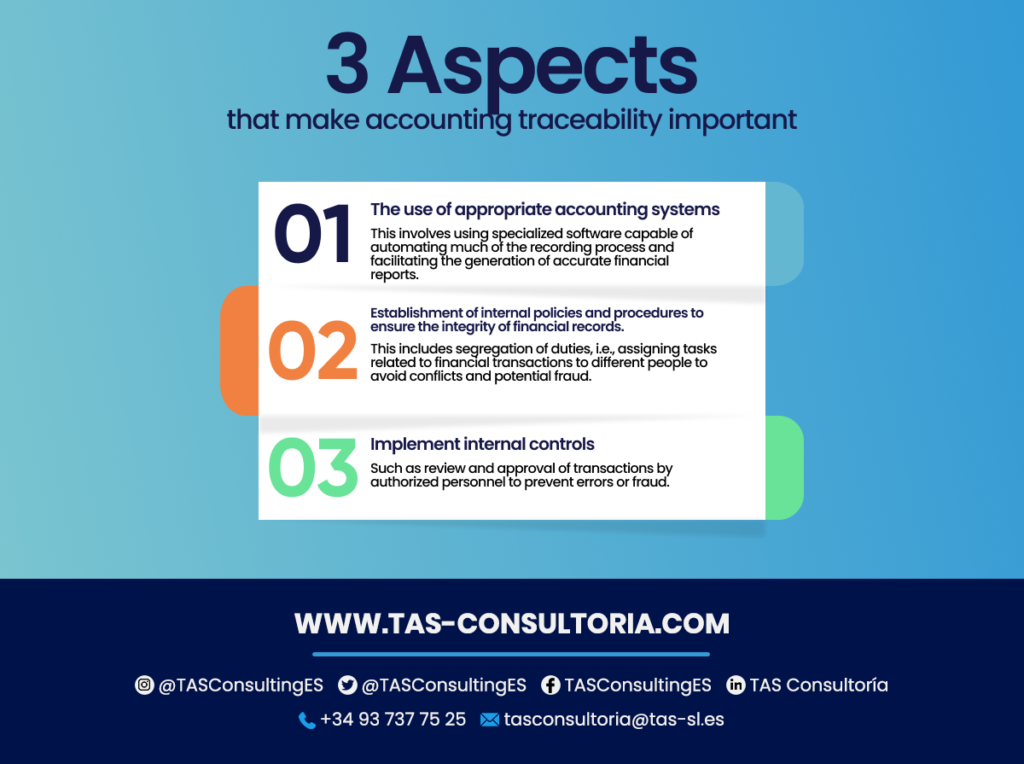

3 aspects that make accounting traceability important

Accounting traceability is essential for companies and many people in general because of several aspects that make it stand out in the financial world. The three main ones are:

Accounting traceability is not only important for companies, but also for other stakeholders. For example, investors, creditors and regulatory authorities. These entities may require accurate and transparent financial information to assess the financial health of the company and make informed decisions.

In addition, for some sectors, accounting traceability is a legal requirement to comply with specific regulations.

7 benefits of accounting traceability for your business

Accounting traceability can bring you numerous benefits, as it is essential to maintain effective control of financial operations. Here are some of the key benefits a company can gain by implementing it:

- Provides accurate and up-to-date financial information that facilitates decision-making on investments, costs, pricing, budgeting and business strategies

- It ensures that the company complies with applicable accounting and tax rules and regulations. This is because it maintains detailed and accurate records of transactions.

- It enables the detection of financial irregularities, such as internal or external fraud and accounting errors. Accounting traceability provides a detailed follow-up of transactions.

- You can evaluate the profitability of your products, services, projects and customers. This allows you to identify which aspects of the company are most profitable.

- Solid and reliable accounting traceability can help a company obtain external financing. Whether through bank loans, investors or business partners.

- Provides visibility and control over a company’s cash flows and financial resources. By analyzing accounting records, it is possible to identify process inefficiencies and unnecessary costs.

- Facilitates the generation of accurate and reliable financial reports, such as financial statements, balance sheets, income statements and cash flows.

In conclusion, by implementing a solid accounting traceability system, your company can improve its financial management and gain a competitive advantage in the market.

You may also be interested in: Basic guide to bookkeeping as a freelancer

How can you implement accounting traceability in your company?

To implement accounting traceability in your company, it is necessary to draw up a plan describing the process. This Traceability Plan should indicate the objective to be achieved, the strategy to be used and the scope it will have.

It is important to trace the entire process that underpins your operation from start to finish. In this way, you will be able to cover internal and external traceability.

In addition, it is important to have computer programs for accounting and by which it is possible to trace a data or trace its registration in a certain database. But, in the case of accounting, you have to draw a table of accounting information.

What is accounting traceability for?

The accounting traceability serves to be able to track all accounting data, as well as its context within the accounting of your company. With this you will be able to locate and pinpoint the origin of such data, which is related to different functions within the company and that can be of great help:

You may also be interested in: Collaborative accounting: what is it and what does it consist of?

In TAS Consulting, we are in favor of the digitalization of your company for its growth and expansion. Do you want complete advice on the subject? Contact us at tasconsultoria@tas-sl.es and our experts will take you step by step through the process. Don’t delay the success of your company, give the future a chance.

Your email address will not be published .

Required fields are marked with *