In the Spanish financial and tax sphere, depreciation plays a key role in business asset management. Would you like to know how accelerated depreciation sales work? In this article, we will detail the concept of accelerated amortization sales and the benefits they can bring to your business. Find out how to make the most of this financial strategy to optimize your assets and maximize your profits.

What is accelerated asset amortization?

Accelerated depreciation is a method of calculating and distributing the payments necessary to cover the cost of an asset over its useful life.

Unlike other types of amortization, accelerated amortization does not require constant payments. Instead, they involve making higher payments at the beginning and gradually decreasing them over time.

This approach helps owners to recover the initial investment more quickly and reduce future payments. This being so, taxpayers calculating their net yield will be able to apply these depreciations for tax purposes. This yield can be calculated using the direct estimation method or either of its two variants.

This option applies to new assets in property, plant and equipment, real estate investments and intangible assets. Of course, as long as they comply with the requirements mentioned below.

You may also be interested in: How does the equivalence surcharge work in Spain?

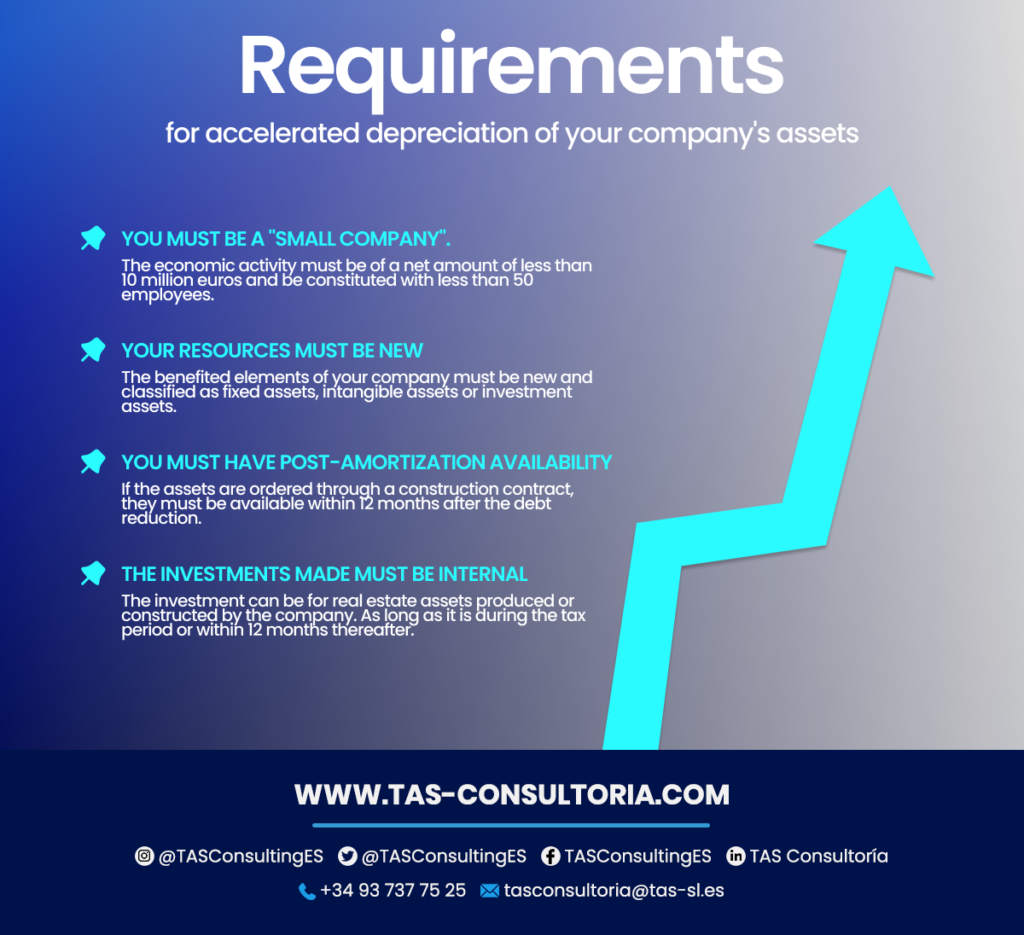

Key requirements for accelerated amortization

In order for accelerated depreciation to take place, the company must be classified as small.

The items benefiting from accelerated depreciation must be new and classified as fixed and investment assets. In addition, intangible assets must also be new and must be related to economic activities.

You may decide to order items under a construction performance contract during the fiscal year. If so, it is important that they are available for use within 12 months after completion of the work.

In addition, you can also invest in physical assets, such as machinery or intangible assets, such as software. It can even be real estate investments that are built or produced by your own company.

Below is a brief summary of the requirements:

You may also be interested in: Tax benefits for the self-employed in Spain

How do deductible accelerated depreciation for new assets work?

The new assets that make up the company’s equity are equipment or real estate. But, so are intangible assets such as copyrights or trademarks. All of these can benefit from an accelerated depreciation rate.

This percentage is equivalent to twice the maximum coefficient established in the official depreciation tables. It is important for you to bear in mind that these are found in the Corporate Income Tax Law. This is possible with the direct estimation method. On the other hand, in case of using the simplified method, you would use the depreciation table contained in the Order of March 27, 1998.

In the case of intangible assets, whose useful life cannot be reliably estimated, the amortizations are different. For this, you apply a percentage of 150 percent to the deductible amount according to article 12.2 of the LIS.

This article establishes that these assets can be deducted annually up to a maximum limit equivalent to one twentieth of their amount (5%).

Example: deductible accelerated depreciation for a new bending and bending machine for sheet metal or bars

Mr. TAS is engaged in the manufacture of locksmith and artistic forge articles in his business activity. This example is one of the most common examples of accelerated depreciation.

Its net income is determined by the direct estimation method, normal mode. In fiscal year 2020, the turnover of its activity amounted to 2,800,000 euros.

In July 2021, it purchased a new sheet metal and bar bending and bending machine for 36,000 euros. This included the cost of accessories. The machine was available for use in November 2021 and started operating on December 1, 2021.

To calculate the deductible accelerated depreciation corresponding to the machine during fiscal year 2021, you apply:

- The maximum straight-line depreciation rate according to the tables, which is 12%. However, as it is considered a small company, accelerated depreciation can be applied.

- The accelerated depreciation rate is calculated by multiplying the maximum straight-line rate (12%) by 2, resulting in 24%. The accelerated depreciation for fiscal year 2021 is determined as 24% of the value of the machine. That is, (24% of 36,000 euros) divided by 12 months, equals 720 euros.

You may also be interested in: What is the Financial Transaction Tax?

If you are interested in implementing accelerated depreciation as a strategy in your business and want personalized advice, our team of experts is here to help you. Learn how they can boost the growth and success of your company, take advantage of this opportunity and contact us now at tasconsultoria@tas-sl.es!

Your email address will not be published .

Required fields are marked with *