Do you know the importance of your company’s social capital in its operation and development? We offer you an insight into the concept of social capital and how you can leverage it to improve the financial health of your company. Don’t miss the opportunity to get valuable tips that can make a big difference in your venture! Read on to learn more.

What is equity in a company?

Refers to the value in cash or in kind that the partners contribute to the company. But, without the right to an immediate return. In essence, this contribution is considered as a debt to the partners. Who, at any time in the future and following the corresponding legal procedures, can reclaim their contribution.

In other words, the capital stock represents the set of initial resources that the partners contribute to support the company’s operations.

Although these contributions are not necessarily in the form of money, they are assigned a value in monetary terms. Precisely to determine their real weight, whether they are computer equipment, real estate or other assets. Thus, their market value is assessed to understand the true magnitude of the contribution.

It is important to note that the regulation of the capital stock is contemplated in the Royal Legislative Decree 1/2010 of July 2, 2010. Which approves the revised text of the Capital Companies Law.

You may also be interested in: Expansion and Diversification Strategies

What is the capital stock structure?

The capital stock structure refers to how a company is financed and how its financial resources are distributed and classified. In your company you must evaluate the components within a specific calculation. To determine this, you need these data:

- Assets: cash, debts, property, equipment, among other assets of the company.

- Liabilities: payables to trade creditors.

- Equity: the difference between assets and liabilities.

- Legal reserve: 10-20% of annual profits according to the law.

- Previous results: profit or loss for the previous year.

Then, the capital stock is calculated as follows:

Shareholders’ equity – Legal reserve – Retained earnings.

The structure of equity capital may vary from one company to another and depends on factors such as: financing strategy, perceived risk, expected profitability and the company’s financial position.

An optimal equity capital structure is one that maximizes the value of the company and minimizes the associated financial costs. It is important for companies to maintain an appropriate balance between equity and debt capital. In this way, you ensure financial stability and long-term financing capacity.

Characteristics and functions of social capital

The capital stock of any company, regardless of its type, has these essential characteristics:

- Your contribution must occur at the time of founding the company, but may be increased or reduced at a later date.

- It acts as a guarantee in cases of bankruptcy and does not cover annual losses.

- It must meet minimum requirements, such as 3,012 euros for limited companies and 60,101.21 euros for corporations.

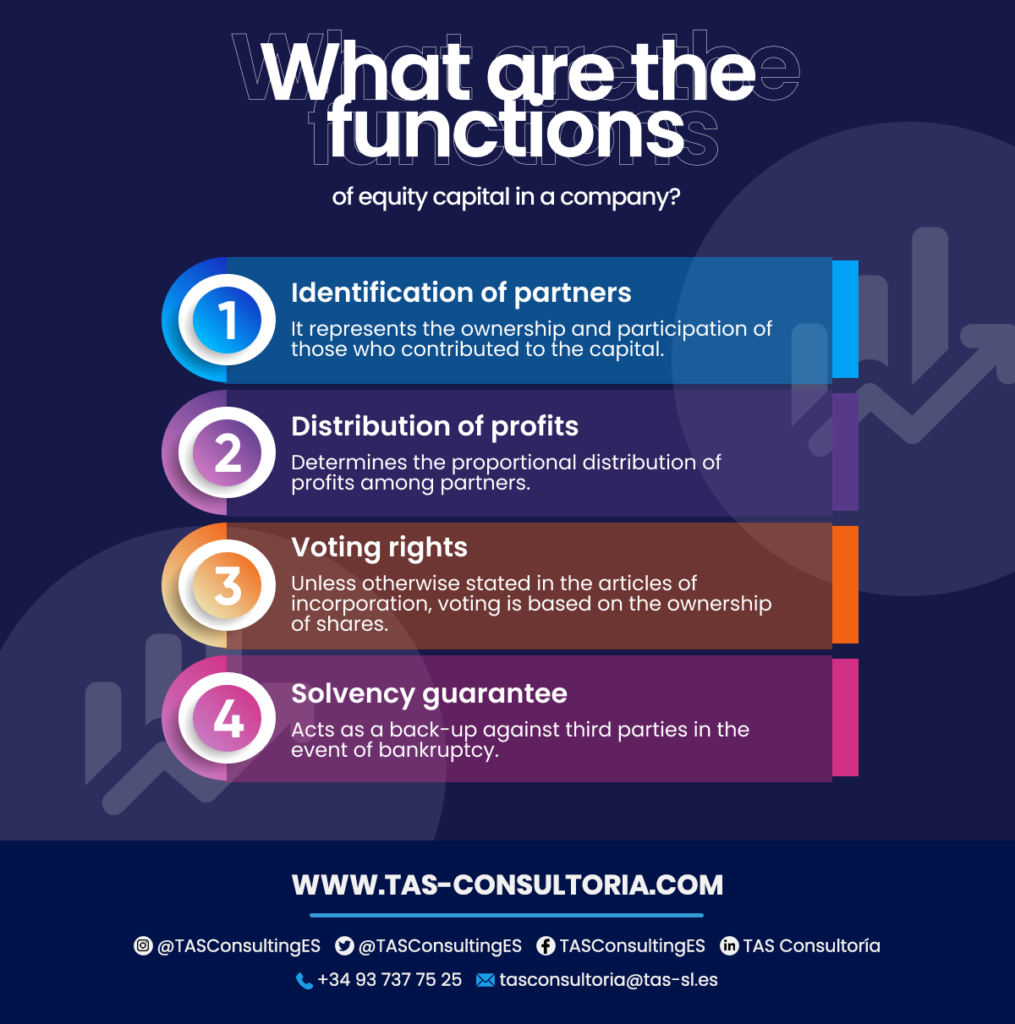

Now let us see how the capital stock fulfills various functions in commercial companies:

You may also be interested in: What is ROA and how to calculate it?

How important is the social capital of your company?

In their early stages, enterprises lack immediate income for their long-term sustainability. At this point, social capital emerges as an essential factor for economic development, without which business activity would be unviable.

The financial resources invested by shareholders in commercial companies can be used to:

- Finance the daily operation of the company. Such as expansion, research and development.

- Support for asset acquisition and other commercial activities.

- In addition, equity capital can attract other investors and lenders, which helps to raise additional outside capital.

- Equity capital can provide a layer of protection against financial risks. The company can have additional resources to face challenges and restructure if necessary. This is always to the extent that shareholders are willing to invest more equity capital in times of difficulty or loss.

- Equity capital is one of the key factors in the valuation of a company. The amount of equity capital invested contributes to determining the market value of the company. In addition to its share price in the financial market. This in conjunction with other elements such as: assets, liabilities and earnings.

How relevant is effective social capital management?

The wise allocation of equity capital from the outset is critical. Maximizing its potential implies making intelligent decisions about which areas to invest in: machinery, materials, salaries, real estate, among others, which implies an expense and, therefore, a reduction of capital.

This value also guides the company’s progression and growth. A proper analysis of social capital is essential to understand the real development opportunities. Managing social capital efficiently to convert it into future benefits is fundamental.

Many decisions made in the early stages of a company influence its long-term survival. Especially using the social capital available.

You may also be interested in: Business alternatives in Spain: 4 ways of doing business

Social capital is a valuable resource that can propel your company to success. Leveraging it properly is key to growth and stability. If you would like to explore further how to strategically apply social capital in your business: feel free to contact our experts!

We are here to help you develop the most effective financial strategies that will take your company to the next level. Don’t miss this opportunity and request an equity consultation with us today at tasconsultoria@tas-sl.es!

Your email address will not be published .

Required fields are marked with *