In Spain, being self-employed gives you freedom and flexibility in your work, although it implies a great financial responsibility, as we see in the payment of social security contributions. In this sense, some autonomous governments have implemented measures to support the new self-employed. Among them, the zero quota for the self-employed stands out, which started to be applied from January 1, 2023. If you want to know more about this measure, keep reading this article!

What is the zero quota for the self-employed?

The zero quota for self-employed workers is a measure that seeks to support new self-employed workers in their labor trajectory. This initiative allows them not to pay 100% of the Social Security contribution for at least 1 year.

It was specifically designed to help overcome the economic crisis caused by the COVID-19 pandemic and to enable the self-employed to invest in their businesses and generate employment.

In certain autonomous communities in Spain, such as Madrid, Andalusia and Murcia, the zero quota is an aid for new self-employed workers that consists of a 100% rebate of their quota for 24 months. However, in the Balearic Islands, this rebate is only granted to female entrepreneurs and self-employed persons under 35 years of age.

On the other hand, La Rioja only grants this aid during the first 12 months. If the self-employed have net income below the Minimum Interprofessional Wage (SMI), this bonus may be extended for another 12 months in Madrid, Andalusia, Murcia and the Balearic Islands.

The purpose is to reduce the burden of expenses that the self-employed must bear after the implementation of the new contribution system in January 2023.

It is important to keep in mind that the beginning of a self-employed business is usually complicated, since it requires an initial investment that may not be generating the expected income due to the short duration of the business. Taking these factors into account, the Administration offers this opportunity to save resources.

You may also be interested in: How to invoice foreign customers from Spain?

What are the requirements to access the zero quota?

The zero quota measure for self-employed workers is added to the reduced flat rate as a complement to the aid for self-employed workers. In some Autonomous Communities, these professionals will be able to take advantage of a greater reduction.

However, the zero quota will only apply during the year 2023 and for those self-employed who register in that same year.

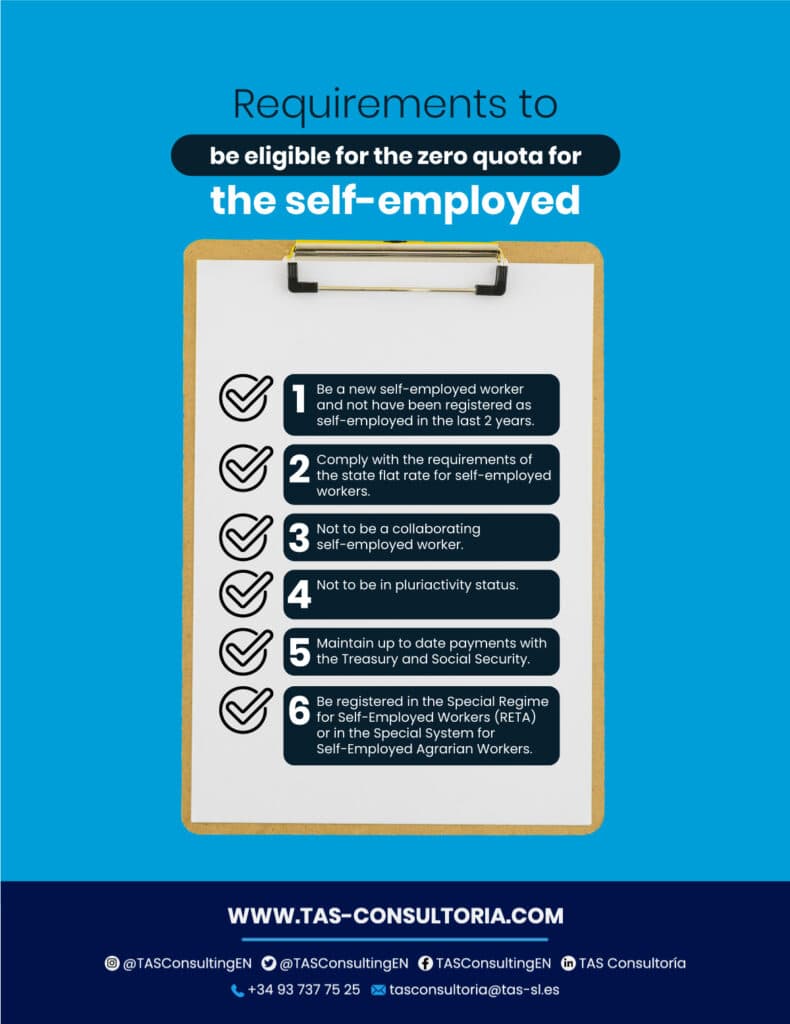

In addition to residing in some of the aforementioned autonomous communities, to qualify for the zero quota you need to meet these requirements:

What are the zero quota subsidy deadlines?

A maximum period of six months has been established to resolve each subsidy application for the self-employed, and this can be made up to three months after the first year of activity.

However, the Administration also sets a two-month deadline for the payment of the aid. Therefore, if a new self-employed person registers in January 2023 and takes advantage of the Reduced Rate, he/she could receive the reimbursement of his/her contributions corresponding to that year in November 2024.

Also, it is possible that the zero quota will have a retroactive effect, which would allow self-employed workers who have already registered before the measure comes into force, but who meet the requirements to be eligible, to also benefit from the zero quota. This is a measure that may be changed in the future.

You may also be interested in: Is it possible to hire personnel as a freelancer in Spain?

How does the zero quota benefit you as a freelancer?

When registering with Social Security, the self-employed have to pay their own contributions, which gives them access to various benefits such as sick leave, maternity/paternity leave or retirement. However, the amount of these benefits will depend on the amount of contributions made.

Unlike salaried employees, who rely on their employer’s contribution, the self-employed must pay these contributions on their own account, which can amount to around €300/month.

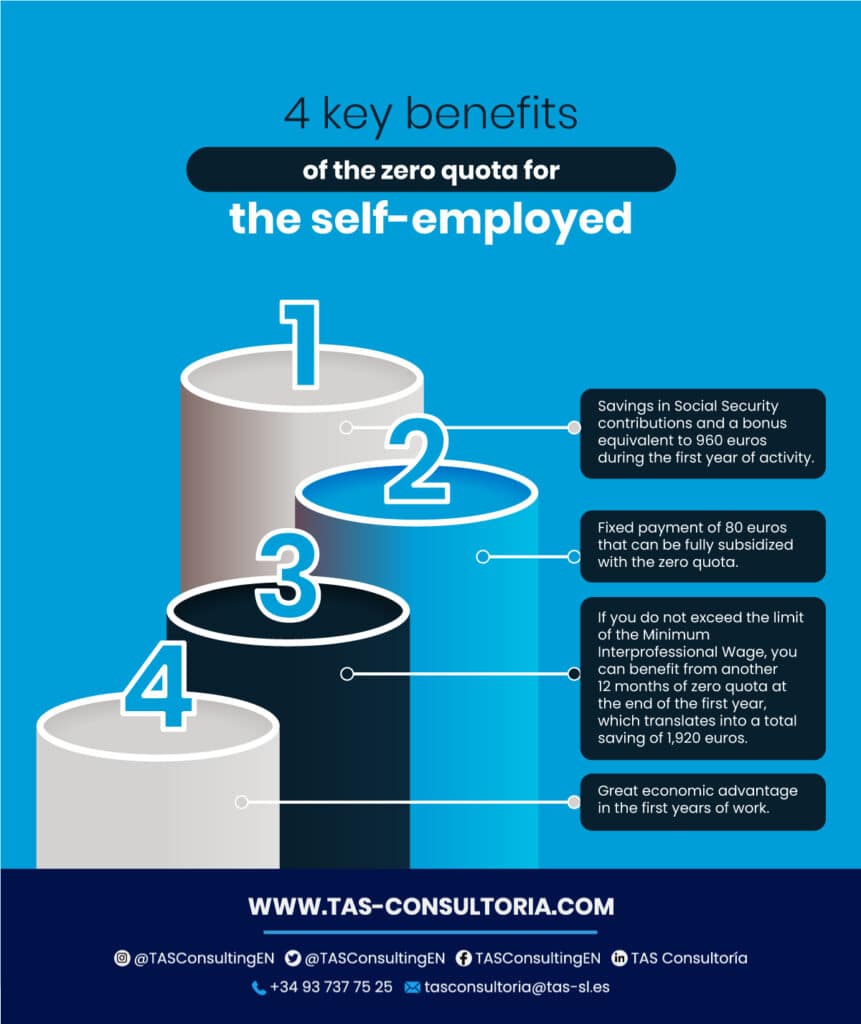

That is why the zero quota seeks to alleviate the financial burdens of self-employed workers and help them boost their businesses. We share with you the main benefits:

How would savings work with the zero quota?

Let us explain with an example. Suppose you are a professional with a monthly income of €1,000 during your first year. In this case, you would have to pay a fee of €275 per month. However, if you apply for the reduced rate, you will only have to pay €80 per month, which means a saving of €195 per month, equivalent to an annual saving of €2,340.

With the zero quota, which is only available for professionals in the three Communities mentioned above, the annual savings would be even greater, since the €80 monthly reduced rate would not have to be paid. In total, the annual savings would be €3,300 if we take into account that no contribution would have to be paid.

You may also be interested in: What is the Financial Transaction Tax?

If you need tax advice on the zero tax rate or any other question related to the management of your business as a self-employed, do not hesitate to contact us at tasconsultoria@tas-sl.es.

In our consultancy we have experts in the field that will help you in everything you need to improve your finances and optimize your resources. Do not miss the opportunity to improve your financial situation and contact us now!

Your email address will not be published .

Required fields are marked with *