In recent years, a practice has emerged that has generated controversy and concern in the Spanish labor scene: the hiring of false freelancers. In this article, we will explore in detail what illegal contracts are, why it is considered illegal to hire them, and the legal and economic implications. Find out and get a complete overview of the current situation in Spain.

What is a false freelancers ?

The term “false freelancers” refers to a person who works for a company or individual as if he/she were self-employed or independent. But, in reality, their employment relationship meets the criteria of a subordinate employment relationship.

It is important to keep in mind that false self-employment or misclassification is used by some employers as a way to avoid certain benefits and labor protections. But not only that, also to evade tax and social security responsibilities.

In other countries, there are specific legislations and authorities in charge of protecting labor rights. In addition to that, they are engaged in combating the misclassification of self-employed workers who should be considered employees.

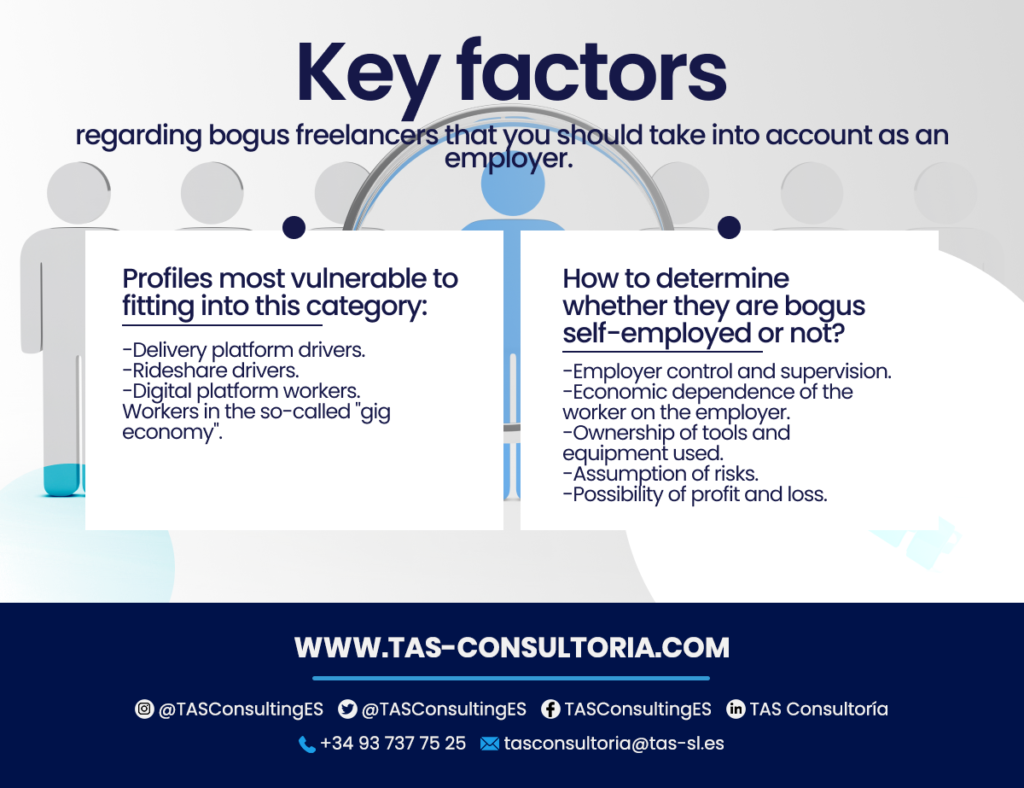

These regulations are intended to prevent the hiring of bogus self-employed workers. In that way, it can be ensured that workers receive adequate benefits and protections. These are:

- Minimum wages.

- Paid vacations.

- Unemployment insurance.

- Occupational health and safety insurance.

It is important to note that misclassification of self-employed workers can have significant legal and tax implications. This for both employers and workers. This being the case, one may be subject to legal disputes and labor rights claims.

In this regard, it is essential that employers comply with labor laws. Not only that, but they must also carry out a proper classification of their workers. This will help to avoid situations of false self-employment and ensure compliance with labor rights and social protections.

You may also be interested in: The labor market in Spain

Why is hiring bogus freelancers considered illegal?

As mentioned above, hiring false freelancers workers is considered an illegal practice. It involves misclassifying workers as self-employed when in fact they should be considered employees.

Even so, the reasons why hiring false freelancers in Spain is illegal are as follows:

Avoiding labor liabilities and costs

By classifying workers as self-employed, employers avoid compliance with labor obligations and associated costs. For example, the payment of social security contributions, severance payments and employment benefits.

Protecting labor rights

Self-employed workers have fewer labor protections than employees. By hiring bogus self-employed, workers are deprived of their basic labor rights, such as minimum wage, paid vacation, protection against unjustified dismissal, and job security.

Ensuring fair competition

Hiring bogus freelancers can generate unfair competition by allowing companies to artificially reduce their labor costs. This is detrimental to companies that operate legally and comply with all labor obligations.

Some general consequences of hiring bogus freelancers include:

You may also be interested in: New labor reform in Spain 2021-2022

What are the penalties for hiring false freelancers in Spain?

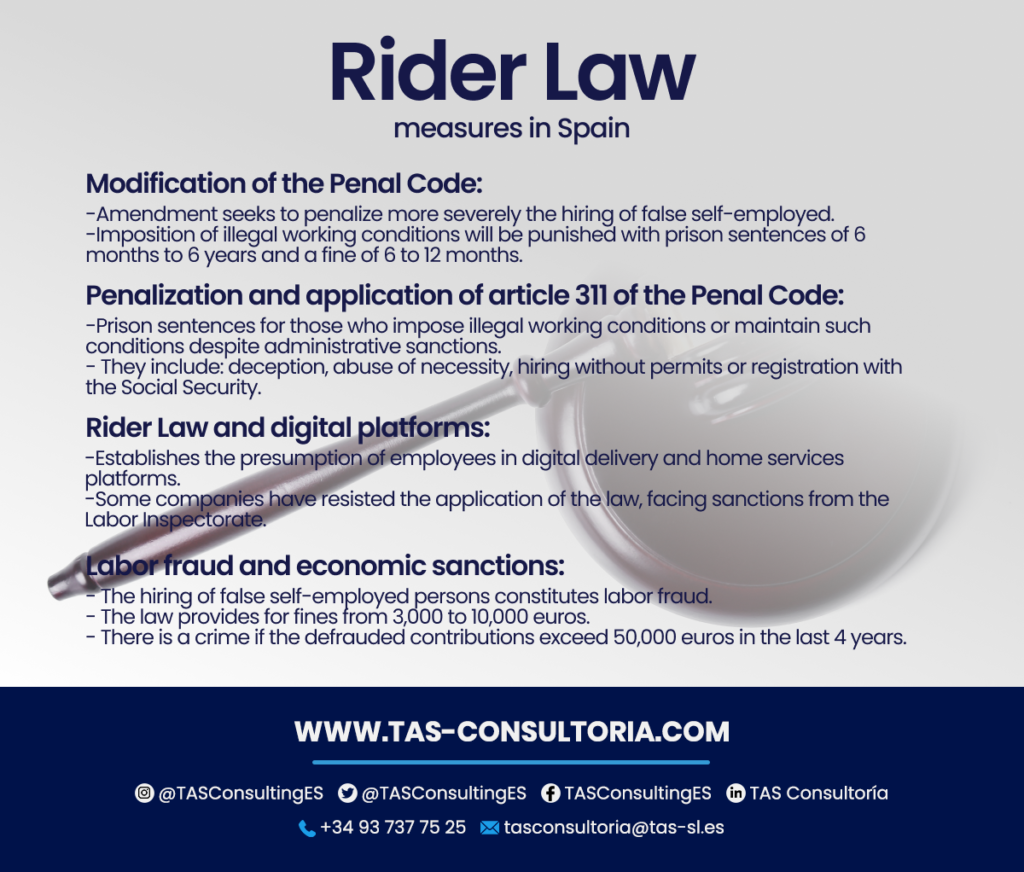

The Penal Code has been modified in order to penalize this practice more severely. This has been through an amendment submitted to Congress by the parliamentary groups of PSOE and Unidas Podemos.

Illegal acts such as the imposition of illegal working conditions, hiring under figures different from the employment contract. Even, maintaining conditions against requirements or sanctions, will be punished with imprisonment. The latter can range from six months to six years, in addition to having to pay a fine of six to twelve months.

A prominent example of the hiring of bogus freelancers has been in the field of digital delivery platforms and home services. This led the government to establish a law in collaboration with unions and employers. This law was called the “rider law”, which establishes the presumption that the employees of these platforms are salaried employees.

Although this law is about to be two years old, some companies such as Glovo have resisted its application. As a result, they have faced sanctions from the Labor Inspectorate.

The hiring of false freelancers constitutes labor fraud, according to the Law on social order infractions and penalties. This provides for fines ranging from 3,000 to 10,000 euros.

In addition, cases where the amount of the defrauded Social Security contributions exceeds 50,000 euros in the last four years may be considered a crime.

In the image below, you can review these measurements:

You may also be interested in: Minimum Interprofessional Wage: Spain and the European Union

Conclusion

The hiring of false freelancers has become an issue of great relevance and concern in the Spanish labor scene. Therefore, it is essential to be informed and take the appropriate measures to protect your business and comply with current labor legislation.

If you have doubts or need legal advice about hiring fake freelancers, we invite you to seek the support of specialized professionals who will guide you on the right path. Don’t wait any longer, secure the future of your business and take action today to avoid legal problems in the future. Request legal advice at tasconsultoria@tas-sl.es and protect your business now!

Your email address will not be published .

Required fields are marked with *