Registered in a Spanish municipality can have tax implications. This article explains how. Read on to learn more.

Is it necessary that the tax domicile and the register match?

Although they are commonly aligned, is their agreement mandatory, and are there any risks or consequences in case of discrepancy?

Should the tax domicile and the place of registration be identical? Although it may seem trivial to many, these questions are recurrent among taxpayers with tax and tax return implications.

According to the law, there is no need for the tax registration and the tax domicile to coincide, although it is usual for them to do so. In other words, being registered is not a limiting factor. However, it is important that the tax domicile and the tax registry match in order to avoid problems with the tax authorities.

The tax domicile is used by the tax authority for official notifications and communications. Therefore, it must correspond to the place where the economic or commercial activities are actually carried out.

In addition, it is important to keep both records (where you are registered and where you are taxed) up to date. This way you can guarantee the accuracy of the information in case of audits or any other review by the tax authorities.

You may also be interested in: Supporting deductible VAT before starting the activity

Under what law is this argued?

This information is extracted, among other sources, from a Supreme Court ruling dated October 9, 2001. It states that where you are registered should not coincide with where you file your taxes.

This ruling establishes that: “the Register of inhabitants and the Register of tax domiciles for tax purposes are independent administrative registers and are not automatically intercommunicated.

Therefore, the change of address in the Population Register does not automatically imply a simultaneous and parallel change of tax domicile. Nor does it replace the express tax declaration”.

It would be sufficient to argue that it makes sense for the tax domicile and the census registration to coincide. Considering that, the Personal Income Tax Law defines the former as the place where the taxpayer can be located in any of its relations with the Tax Administration.

In the case of an individual, the tax domicile will be that of his or her habitual residence, not where he or she is registered.

However, if you exercise mainly an economic activity, the Administration may consider as the next tax domicile where you carry out the administrative management and direction of the activity. Prevailing the one where the highest value of the fixed assets is located in case of indetermination of the place.

This approach already evidences a conflict by involving the usual residence. Since the tax authorities associate the tax domicile with the usual residence for tax purposes.

We can conclude that habitual residence and the place where you are registered are not synonymous. For the Treasury, the tax domicile is determined by the place where you have lived most of the time. Where you carry out your economic activity or the last location of your tax return.

You may also be interested in: How do withholding taxes for non-residents in Spain work?

So, how do changes of address work?

Changes of address are one of the most common problems. Both in the place where you are registered and in the tax domicile.

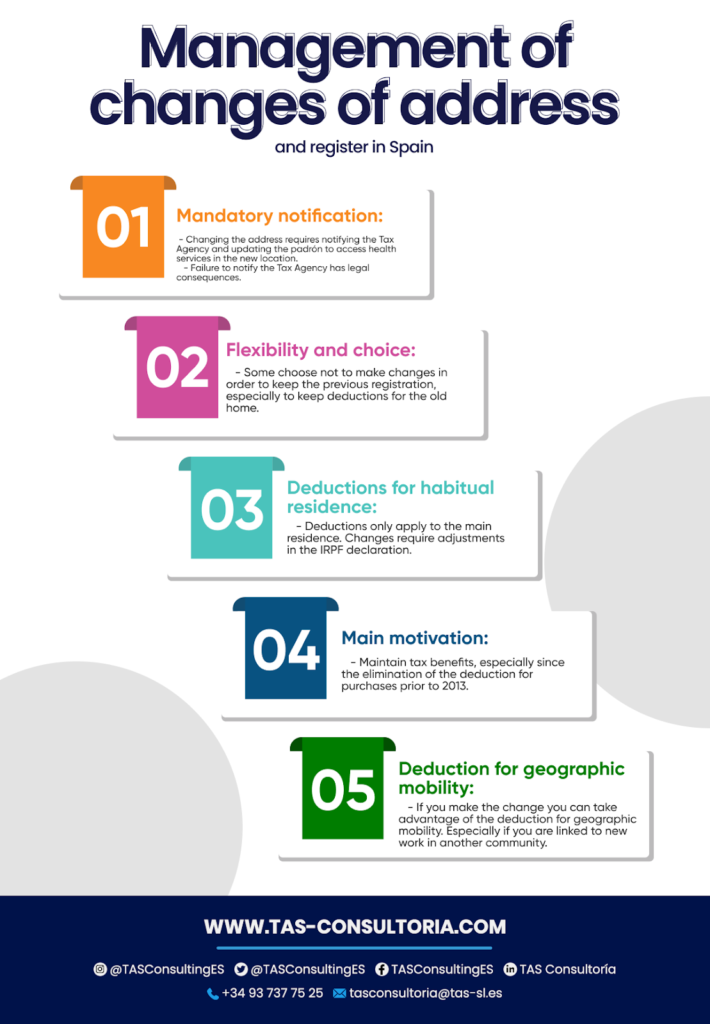

In general terms, when a taxpayer changes his address, he is obliged to notify the Tax Authorities and make the corresponding change in the taxpayer registry. Thus facilitating access to health services in the new location.

Notification to the Tax Agency is a mandatory requirement, and failure to do so may have consequences.

The reality is that many taxpayers choose not to make these changes specifically to maintain the previous registration in the padrón. This process is more flexible, as it is in the area of Public Health and Social Security.

The main motivation is usually the possibility of continuing to benefit from deductions for the old home. Especially since the elimination of the deduction for purchases prior to January 1, 2013.

It is important to keep in mind that the deductions only apply to the habitual residence and not where you are registered. If there is a change of residence and the new home does not meet this criterion, it is necessary to stop including it as such in the Personal Income Tax return.

In addition, in many cases, these changes can open the door to take advantage of the geographic mobility deduction. Especially if they are linked to a new job in a different community.

You can see the key points below:

What happens if you fail to notify the change of tax domicile?

Moving without updating it can result in a fine of 100 euros. In the case of the tax domicile of your economic activity, the consequences can be more serious. Including the possibility that the tax authorities may consider certain improvements or investments non-deductible and carry out an inspection.

Remember to keep your tax information up to date and where you are registered to avoid inconveniences.

Where do you have to complete the process to be registered?

The complication arises due to the fact that the Ley de Empadronamiento requires registration in the municipality of residence. Or, in case of multiple residences, in the one where you spend most of your time.

This is the reason why the register and the tax domicile tend to coincide, even though they are not legally obliged to do so.

However, there are exceptions to this rule. Therefore, it is possible, for example, to file your tax return in one place and vote in another.

You may also be interested in: Tax reform: what is the new 23% rate?

Registration in a Spanish municipality not only affects your official residence, but also has significant tax implications. From changes in deductions to tax obligations, every detail counts.

If you would like to further explore how being registered impacts your financial situation and discover strategies to optimize your tax responsibilities, we encourage you to subscribe to our library! Stay informed and make informed financial decisions.

Your email address will not be published .

Required fields are marked with *