Understanding the VAT deduction is essential to optimize your taxes. In the field of real estate supplies in Spain, the input VAT deduction plays a fundamental role. Do you want to know how it works and how you can make the most of it? Read on to discover effective strategies and key tips to help you optimize your tax deductions.

Deductible VAT and supplies

Recently, the Economic-Administrative Court issued a resolution regarding the deduction of VAT or Value Added Tax. Always supported in essential supplies for the operation of a property, such as electricity, water, gas and others.

This ruling is beneficial for taxpayers. It clarifies and establishes guidelines on how to correctly apply the deduction of this tax on such supplies.

You may also be interested in: VAT rates in Spain: updates 2022

VAT on current goods and services

The tax sector of current goods and services subject to VAT establishes the following:

Entrepreneurs and professionals who carry out taxable and non-exempt activities have the right to deduct input VAT on the acquisition of goods and services for their activity.

However, in order to make this deduction, it is essential that certain requirements are met:

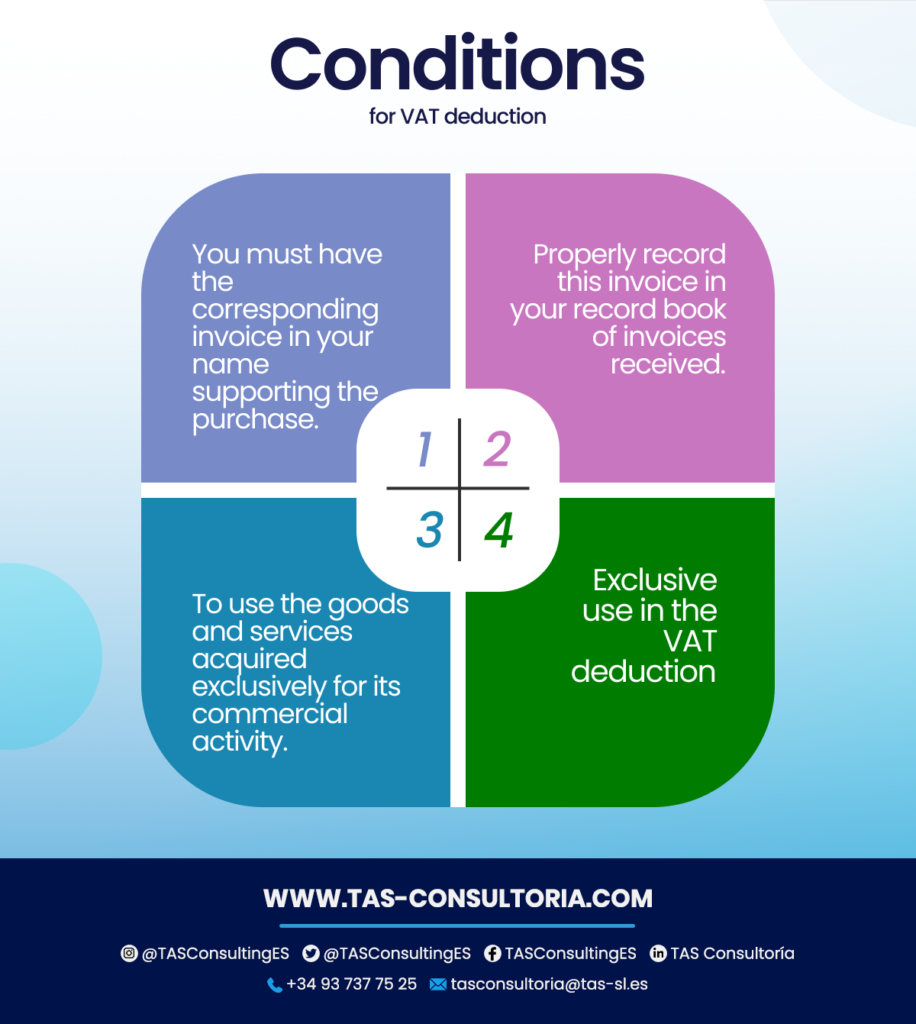

Conditions for VAT deduction

Here are three essential conditions that must be met in order to be able to deduct input VAT:

It is important to emphasize that this use must be exclusively for business or professional activity. Being that they do not allow any partial or total use for particular purposes. For example:

- If a businessman uses a cell phone for both business and personal purposes, he will not be able to deduct VAT.

- This rule also applies to assets to be used for more than one year. Also, with an acquisition value not exceeding 3,005.06 euros.

- If a businessman buys a laptop computer for 1,200 euros plus VAT and uses it both for his business and personal use. In effect, he will not be able to make the VAT deduction at any percentage.

You may also be interested in: Taxes in Spain for foreigners

VAT applicable to investment goods

This case applies if you buy goods for your business for 3,005.06 euros or more and they are intended for the business activity. That is, do you plan to use them for at least one year (called investment goods)? The requirements for the VAT deduction are the same as in the previous case. It is relevant to know that in this situation, you can use them partially for personal purposes.

Deductibility in proportion to business use

In the case of shared use, generally, the input VAT is deductible in proportion to the business use you make of the asset. However, special treatment is granted to vehicles such as cars, mopeds and motorcycles. These are presumed to be 50% used for the development of the activity. Therefore, input VAT can be deducted initially at that percentage.

Housing-related supplies

Regarding the consideration of supplies (such as electricity, water, gas) in a dwelling, the following occurs. The VAT deduction must consider both private and business use, the Treasury has a specific criterion.

According to their approach, the VAT incurred on the acquisition can be deducted in proportion to the business use. For, it is an investment good. However, it is important to note one point. In the case of supplies, which are considered current expenses and not investment goods, no deduction is possible.

What is the TEAC’s perspective and interpretation?

Recently, a relevant resolution of the Central Economic-Administrative Court (TEAC) has questioned this interpretation of the Treasury. The resolution argues that VAT on supplies is also deductible in proportion to the business use of the property. All in accordance with the EU VAT Directive in Article 168. Also, EU law requires that Spanish regulations be interpreted in accordance with EU directives.

An example of a proportional VAT deduction is as follows

A concrete example that clarifies this concept is the following. Imagine a businessman who uses 25% of the total floor area of his home to conduct his business.

- In this scenario, the VAT deduction may be 25%. The VAT paid on the acquisition of the property, thus reflecting the proportion of use destined to its commercial activity.

- Likewise, the same proportion of 25% may also be applied. Specifically to deduct the VAT corresponding to the supplies of such property used for its business activity.

This proportional deduction methodology is based on the principle of accurately reflecting the degree of use of the property. In other words, what does the business owner use the property for in the context of his business? This ensures that the VAT deduction is equitable and fair, taking into account the actual use to which the property is put for business purposes.

It is essential to understand this proportionate application of VAT on capital goods. This allows you a proper recognition of the taxes related to the business activity. It provides a solid basis for tax compliance in accordance with current regulations.

You may also be interested in: VAT exempt activities: in which cases does it apply?

This approach, in short, seeks to promote transparency and correct taxation. Especially in the area of procurement of goods and supplies in the business context.

Every euro deducted counts and can make a difference to your finances: feel free to contact us at tasconsultoria@tas-sl.es for an expert consultation on VAT deduction! We are here to provide you with the necessary guidance and optimize your tax strategy.

Your email address will not be published .

Required fields are marked with *