Find out everything you need to know about the corporate income tax installments. To plan your next year successfully, ensure the financial health of your company by complying with your taxes. Read on for more details!

What are the payments on account of corporate income tax installments?

Corporate income tax installments (or not) of corporate income tax represent sums of money advanced during the course of the tax period. This is a prelude to the payment of the tax liability.

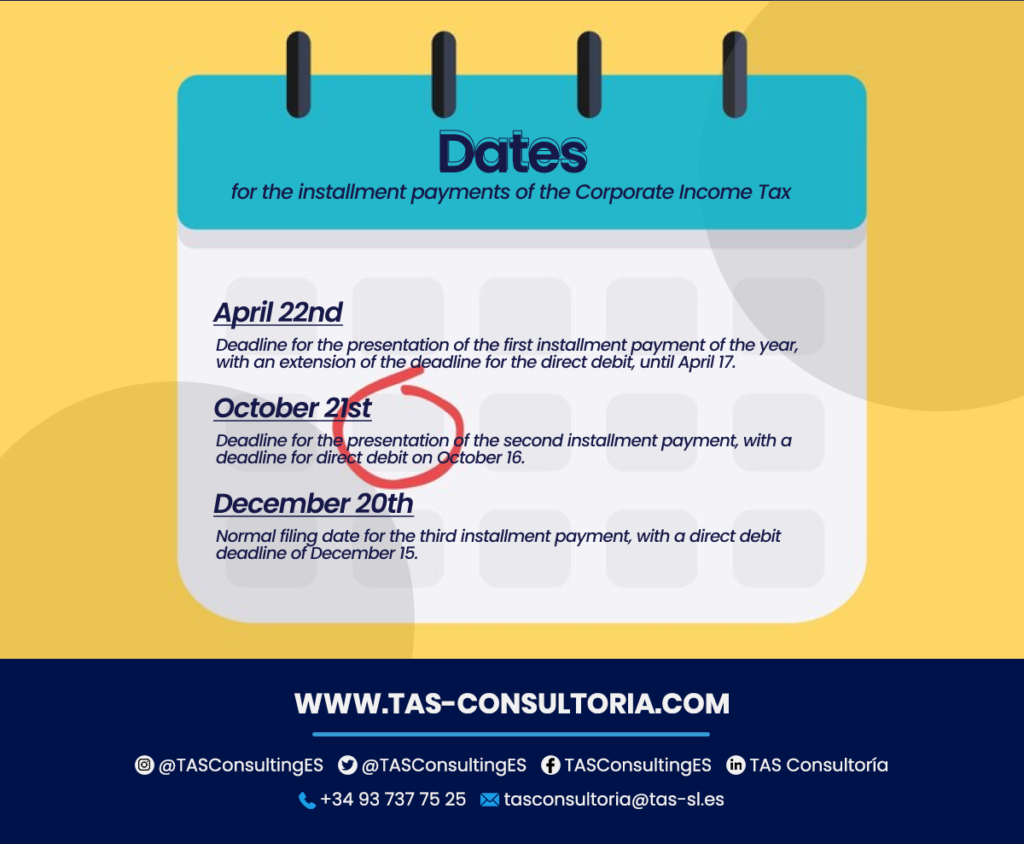

The dates associated with the installment payments are crucial in this process. Specifically those made in the months of April, October and December of each fiscal year.

At the appropriate time, these advanced amounts will be deducted when the corresponding tax return is filed. This usually takes place on July 25 of each year, using form 200.

You may also be interested in: How does the equivalence surcharge work in Spain?

Classification of payments on account for Corporate Income Tax purposes

In the context of corporate income tax, we identify three categories of payments on account that play an essential role in the tax system:

Installment payments

In most companies, the most relevant form of corporate income tax installments. These payments are made autonomously on three occasions during the fiscal year. Specifically in the months of April, October and December. This action is carried out through the use of form 202.

Withholdings on income

Some types of income are subject to withholding at the time of receipt. This includes, for example, certain income from dividends or real estate leases.

Income on account

Income on account, in essence, shares a similar dynamic to withholdings, but is applied to income in kind.

This being so, the declaration through form 200 serves the function of balancing the differences between what should have been paid and what has already been paid. As a consequence, this process may result in an additional payment to the tax authorities or in a tax refund.

What are the deadlines for payment of corporate income tax installments?

Form 202 plays a fundamental role in the corporate income tax installments to the Treasury. Its filing is mandatory and must be made exclusively electronically. Either by the declarant himself or through an authorized representative.

With respect to the deadlines for filing this installment payment form, the following deadlines are established:

April

The presentation of the corporate income tax installments to the Tax Authorities is made during the first 20 calendar days of this month. If the payment is made by direct debit, the term is reduced to 15 days. This installment payment corresponds to the liquidation of the tax period in force as of April 1 of each year.

October

Form 202 of the corporate income tax installments to the Tax Authorities must be filed on October 20. In the event of falling on a Saturday or non-business day, the deadline is moved to the first business day immediately following.

The direct debit date follows the same criteria, being extended to the same number of days as the filing date. This installment payment affects the settlement of the current tax period as of October 1.

December

The last deadline for filing form 202 of thecorporate income tax installments to the Tax Authorities to the Tax Authorities is December 20. It is not moved despite falling on a weekend. The deadline for direct debit is also December 15. This third installment payment is related to the liquidation corresponding to the tax period in force on December 1.

Therefore, for the year 2024, the following key dates need to be taken into account:

Requirements and exemptions for corporate income tax installment payments

The presentation of the form 202 of the corporate income tax installments to the Tax Authorities to the tax authorities is an obligation for certain taxpayers. Its net amount must reach or exceed 6,000,000 euros. Always at the beginning of the tax period to which the installment payment refers.

However, for those entities whose results do not generate a revenue obligation, the presentation of the model will not be required.

In turn, there are certain entities that enjoy exemptions from corporate income tax installments to the Tax Authorities to the tax authorities. Therefore, they are not obliged to file the corporate income tax installment payment form. These include:

- Economic interest groupings and special temporary joint ventures.

- Entities with tax rates of 0% or 1%.

You may also be interested in: What is the Financial Transaction Tax?

Elements and sections of the Model 202

Model 202 is structured in different blocks of boxes that address different essential aspects:

In addition to these blocks, there is one more annex. One that is completed only if the net turnover exceeds 10 million euros. Detailing additional information relevant to the calculation of the fractioned payments.

Procedures for calculating installment payments to the tax authorities

The calculation of corporate income tax installments to the Tax Authorities to the tax authorities is broken down into two different modalities, each with its own particularities:

1. General application mode

The calculation base is established taking as a reference the gross tax liability of the last tax period. Deductions and allowances applicable to the taxpayer are applied to this base. As well as the withholdings and payments on account corresponding to said period.

Once this base has been calculated, a fixed percentage of 18% is applied to it. This percentage is used to determine the amount to be paid as an installment payment.

2. Optional mode

You will need it to make your corporate income tax installments to the Tax Authorities in a specific situation. Only if the net turnover exceeds 6,000,000 euros. In this modality, the calculation basis is determined using the part of the taxable income corresponding to the first three, nine or eleven months of each calendar year.

A percentage resulting from rounding down the tax rate by five sevenths is applied to this base. For example: if the tax rate is 25%, when rounded down, the resulting percentage would be approximately 17.86%. But, it is rounded down to 17%.

After this multiplication, you subtract the allowances, withholdings, payments on account and the fractioned payments to the Treasury corresponding to the same fiscal year. The difference obtained represents the amount to be paid as an installment payment.

What is the procedure to change the calculation method?

Do you wish to opt for the second method of calculation for tax payments in installments? You must follow a specific process, and here we explain how:

Use form 036 to exercise this option in February of the year in which you want it to take effect. This applies even if your tax period does not coincide with the calendar year.

The deadline to make this change is established as follows:

- If your tax period differs from the calendar year, you have 2 months from the beginning of that tax period.

- In case the beginning of the tax period and the deadline for making the first installment payment overlap: the change may be made at any time within that period. This must occur in less than 2 months.

You may also be interested in: Supporting deductible VAT before starting the activity

Don’t leave your corporate income tax installments to the Tax Authorities to the IRS up in the air. Plan your next fiscal year with our experts and ensure your company’s financial peace of mind. Contact us now at tasconsultoria@tas-sl.es!

Your email address will not be published .

Required fields are marked with *