In Spain’s tax landscape, personal income tax withholdings play a crucial role and this year has important changes. If you are a taxpayer interested in optimizing your earned income and understanding the implications of these changes, learn the details!

Key change: not impacting the entire workforce

Law 31/2022, enacted on December 23, introduced a series of adjustments to the Personal Income Tax rules and regulations. It is the one referring to the General Budgets for the year 2023. These changes have a direct impact on the process of calculating personal income tax withholdings for next year.

Likewise, these amendments are varied, but in general terms they can be classified into two main categories:

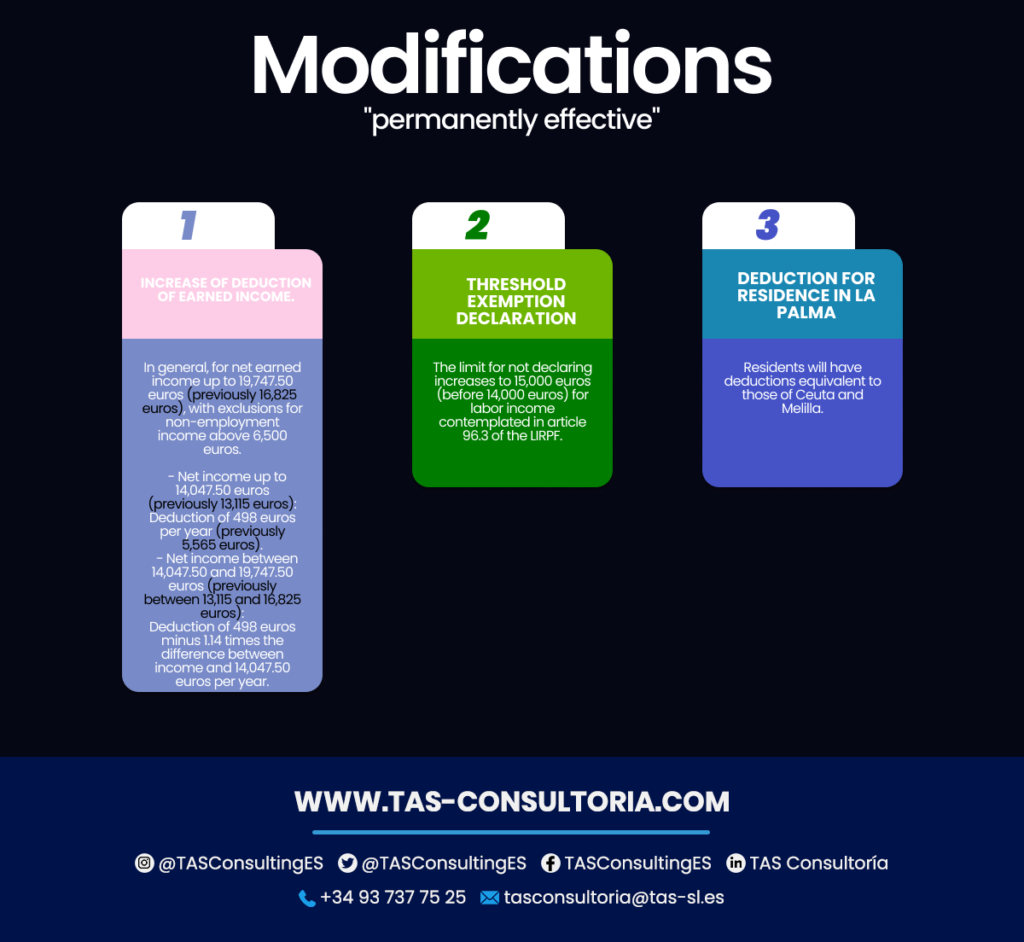

I. Permanently” effective modifications

These changes affect both the calculation of personal income tax withholdings in 2023, and the settlement calculation mechanism. Specifically for the Personal Income Tax return corresponding to that same year. This return will be filed between April and June 2024.

These modifications to personal income tax withholdings contemplate:

Also included in this category is a deduction for taxpayers with habitual residence on the island of La Palma. They will benefit from the same existing deductions for the residents in Ceuta and Melilla. In the same way in their work income.

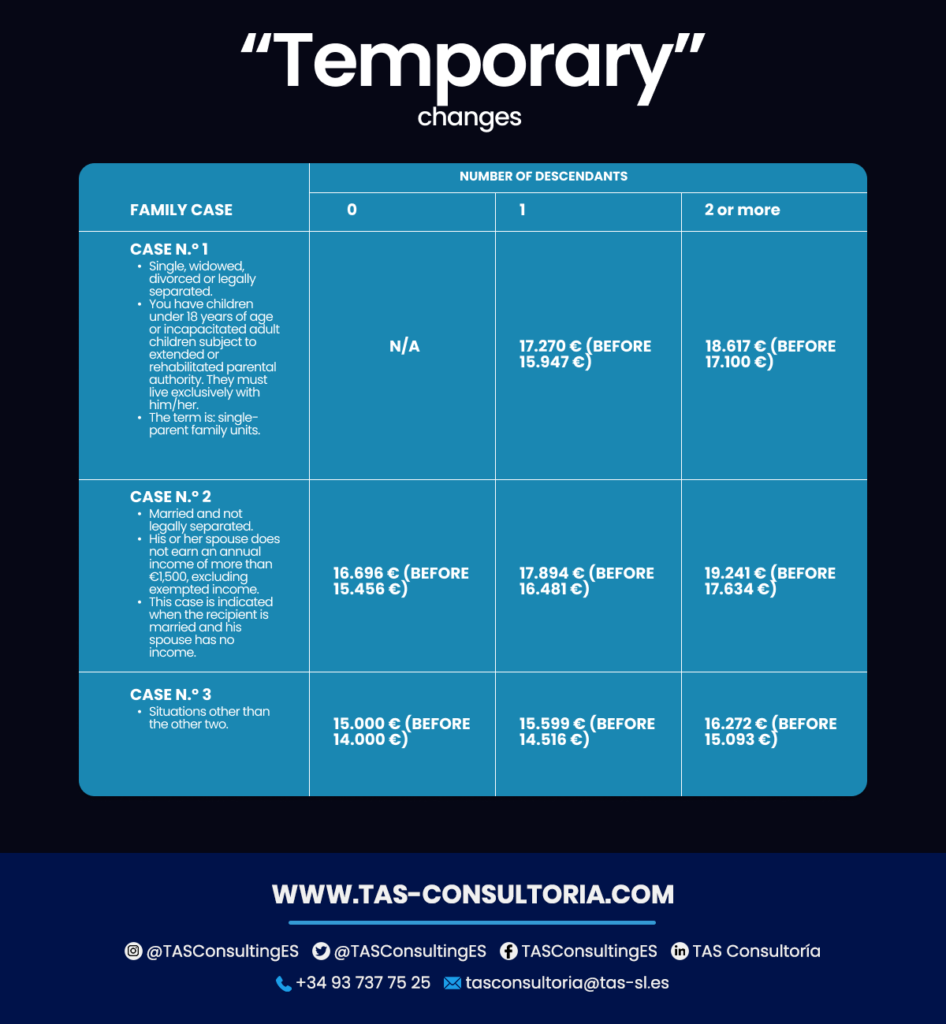

II. Temporary” changes

They only have an impact on the calculation of personal income tax withholdings during 2023. That is to say, it does not affect the liquidation process for the IRPF declaration.

These adjustments could reduce the amount of personal income tax withholdings during the year 2023. Thus, it would result in a higher net income for taxpayers. However, they will not affect the final amount of tax payable under the IRPF return.

Consequently, these changes will not alter the final result of the return. However, they may increase the cash flow available to the taxpayer throughout the year. This could cause those who would normally expect a smaller refund or even a balance due to experience different results.

Find out about the changes in personal income tax withholdings below:

The last temporal change shown in the image is relevant. When most of these adjustments in the calculation of personal income tax withholdings came into effect, the limit was different. This was before February 2023.

This threshold operated only for income below 22,000 euros. However, it is important to mention that this limitation only impacts on withholdings, not on the final calculation of the annual income tax return.

You may also be interested in: Substitute, complementary and corrective declarations.

What would temporary measures look like on earned income?

Let’s take an example to illustrate the difference between the withholding rate and the final tax. Let’s assume a case of:

- An employee with a gross annual salary of 25,000 euros.

- For this income level, the increase in the reduction of earned income would not apply under the new 2023 rules.

- This employee is married and has two children aged 3 and 25.

- Your spouse has no earned income (situation 2).

In 2022, your personal income tax withholding rate would have been 12.20% (‘3,050). With the new withholding calculation rules, the rate would be 9.90% (2,475 euros).

In this case, an increase of 575 euros can be observed in the net amount available. This is due to the reduction in personal income tax withholdings.

However, your annual tax return will still maintain the same rules for 2023 as for 2022. Since the “permanent” increase in the reduction of net earned income does not apply to your income level.

This reduction of annual IRPF withholdings of 575 euros could result in a lower amount to be refunded. In this case, in your IRPF 2023 tax return, compared to 2022, you could also change your refund situation to a payable amount, or even a higher payable amount.

You can see several of these situations in the following chart:

You may also be interested in: Types of taxation in Spain: direct and indirect taxes

A summary of the new measures on personal income tax withholdings

The modifications introduced will not affect all workers. All under the Budget Law for 2023 and Royal Decrees 1039/2022 and 31/2023. This will affect only those who are in one (or more) of the following situations:

- Your net earned income in 2023 does not exceed €19,747.50. After applying, if applicable, the reductions for irregularity.

- They are expected to have gross annual earned income during 2023 that does not exceed €35,200. In addition, that the limit defined in article 85.3 of the IRPF on the withholding amount applies to them. This is a limit affected by the new thresholds excluding mandatory withholding.

- They are generating labor income since the beginning of the year from the performing, audiovisual and musical arts. As well as those who perform technical or auxiliary activities necessary for these disciplines.

The changes in IRPF withholdings for 2023 for earned income are a significant step forward in the tax field. These updates can have a substantial impact on your personal and professional finances.

You may also be interested in: News on the Tax and Customs Control Plan [2022].

To make the most of these opportunities and ensure you are making the right decisions, choose an up-to-date and expert tax advisor. Our team is dedicated to finding the best benefits for your specific case. Don’t wait any longer, apply now for an advisory through tasconsultoria@tas-sl.es and start maximizing your tax advantages for income tax withholdings!

Your email address will not be published .

Required fields are marked with *