Have you ever wondered how to bill financial expenses related to deferrals, bill refunds and late payment interest? You’re in the right place. We provide you with the information you need to make more informed financial decisions. Do you want to optimize your business billing? Read on and find out how!

When is VAT applied to interest on deferral or late payment for customers?

When considering the application of VAT to deferral or late payment interest granted to a customer, it is crucial to determine when it should be included in the VAT calculation.

This issue is relevant both if we wish to apply Law 3/2004 on combating late payment in commercial transactions, which, in its article 7, allows to charge interest for late payment. Or if the customer requests a deferral with a financial surcharge. In both cases, it is essential to understand whether VAT should be part of the equation or not.

The answer to this question is simplified by considering the time at which such interest is determined. If such interest is established prior to the date on which the transaction takes place, then it should be included in the taxable base for the calculation of VAT. In other words, in situations where interest is fixed prior to the event that triggers the business transaction, VAT applies to such interest.

If the interest is fixed after the accrual date of the transaction, it should not be considered in the VAT taxable amount. In this situation, the interest is not part of the original transaction. Therefore, they are not subject to tax. In other words, VAT does not apply to interest if it is determined subsequent to the transaction.

You may also be interested in: How to obtain a loan in Spain?

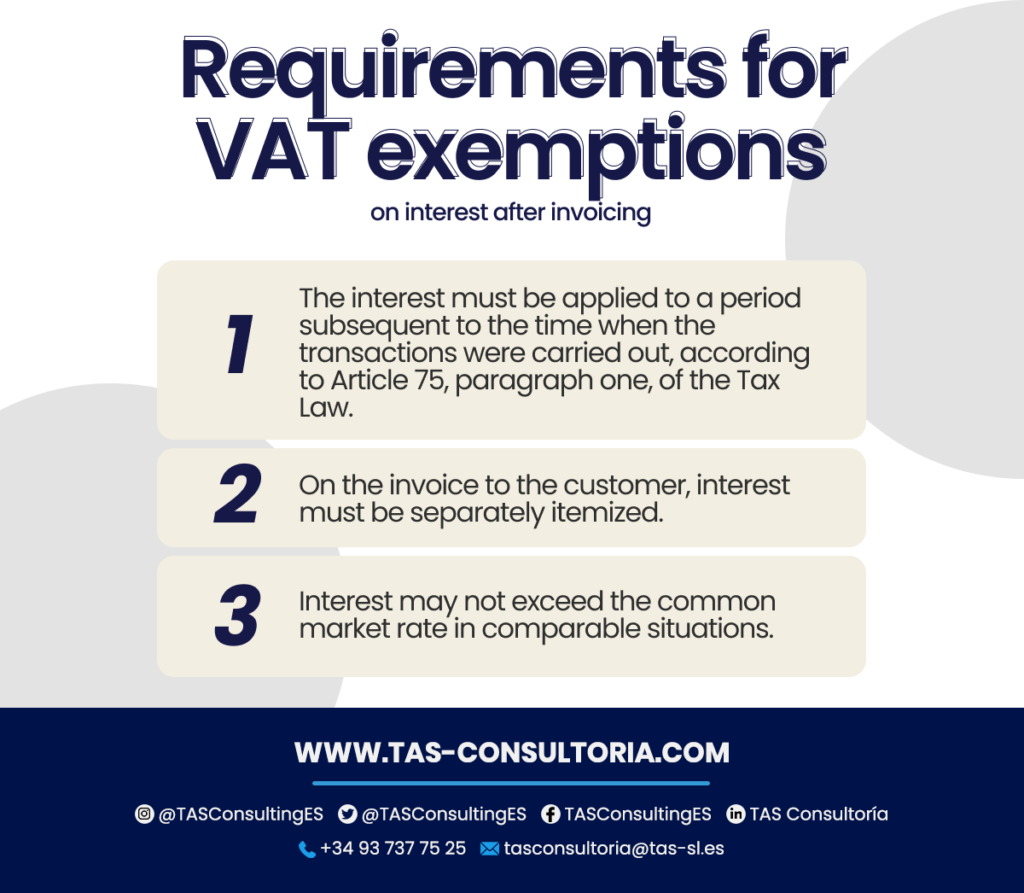

What are the regulations for VAT and subsequent interest on invoicing?

According to tax regulations, interest charged at a later time will not be subject to Value Added Tax (VAT). Provided that the following requirements are met, according to the Guidelines of the Directorate General of Taxes (DGT 0173-02, DGT V0357-12):

An essential point to highlight is that, when including these VAT-free deferral interests in the invoice, it is necessary to incorporate the phrase “exemption by virtue of the provisions of Law 37/1992”. Especially in Article 20, paragraph one, number 18, letter c). This ensures that the tax regulations are complied with and that the interest will not be subject to VAT.

What is the tax treatment of financial expenses for the return of bills of exchange?

When you are faced with the situation that you have been refunded a bill of exchange and this has generated bank charges, it is essential to understand the tax treatment of these charges.

The Directorate General of Taxes (DGT), in its resolution V1932-09, establishes a key principle:

- Do you choose to pass on to your customers the bank charges related to the return of bills of exchange? Well, these expenses have a compensatory nature and, therefore, should not be included in the taxable base of the Value Added Tax (VAT).

This distinction is essential, as it determines whether bank charges should be taxed with VAT or not.

In this case, as they are considered as indemnification, they are excluded from the VAT taxable base. This means that the tax does not apply to these expenses. It is important to highlight that this interpretation of the DGT provides clarity in the treatment of these expenses in the tax field.

You may also be interested in: Keys to carry out a capital increase in your company

What happens in cases of return commissions?

With regard to the fees associated with the return of direct debit bills, promissory notes or any other instrument that has not been paid on time, it is essential to understand that the purpose of passing on these costs to the customer is to compensate him.

Therefore, these expenses are not considered part of the tax base of the underlying transaction. Consequently, they are not subject to Value Added Tax (VAT) in their own right.

In this context, it is not strictly necessary to issue an invoice to document these commissions that the bank has passed on to the customer. Instead, a receipt or an expense note is sufficient to justify these costs.

However, if for reasons of convenience or simplicity you choose to issue an invoice without VAT to the customer for return expenses, it is essential to assign it a different serial number. This ensures that the invoice is not included in the register of invoices issued or in any box of the 303 or 390 forms.

It is important to remember that the amount of invoices issued without VAT for deferral or late payment interest charged to the customer should not be reported in the self-assessment of tax (form 303). However, these amounts must be included in the annual VAT summary (form 390).

You may also be interested in: How to partially cancel an ICO loan?

Conclusion

Successful invoicing of financial expenses is a fundamental step in keeping your finances in order and complying with tax regulations. If you would like to itemize and invoice your financial expenses in detail or have additional questions: request an accounting consultation with our experts!

We are here to help you optimize your financial situation and clarify any doubts you may have. Do not hesitate to contact us and take the next step towards a better control of your financial expenses.

Your email address will not be published .

Required fields are marked with *