One of the biggest concerns for business owners is the payment of taxes. No matter how big or small your business is or what kind of activity you do, you must always file income tax returns and related taxes on a consistent basis. As a result, we bring you this article, where you will find the techniques to keep your company’s tax payments up to date. Let’s go!

What does the payment of taxes consist of?

The payment of taxes is a tax levied without consideration and whose taxable event is constituted by businesses, acts or facts that manifest the economic capacity of the taxpayer.

One of the most important is the IRPF, applied to the total income and yields obtained. In addition, if for tax purposes a person resides in Spain, he/she must pay taxes. These will correspond to all the assets owned in any country, as long as their patrimony exceeds a minimum amount.

That said, other important taxes in Spain are the direct taxes. If you do not know them, they are the ones you will see below:

- Non-Resident Income Tax (IRNR)

- Corporate income tax (IS)

- Inheritance and Gift Tax (ISD) autonomous communities)

- Wealth Tax (IPN)

You may also be interested in: How to defer the payment of taxes in Spain?

Why is it important to have your taxes up to date?

The importance of payment of taxes lies in the fact that it is the way in which governments finance public services and infrastructure essential for social welfare.

In short, taxes are used to finance. But what things? Services, education, health care, public safety, and road and bridge construction.

In addition, these are also used to fund social programs such as social security and unemployment insurance. Also, it is important to keep your taxes up to date, as they help to maintain a fair and equitable judicial system.

You should know that taxes are based on the taxpayer’s ability to pay. That is, those with higher incomes pay more than those with lower incomes. In this way, it is possible to reduce economic inequality and ensure that everyone contributes to the common good.

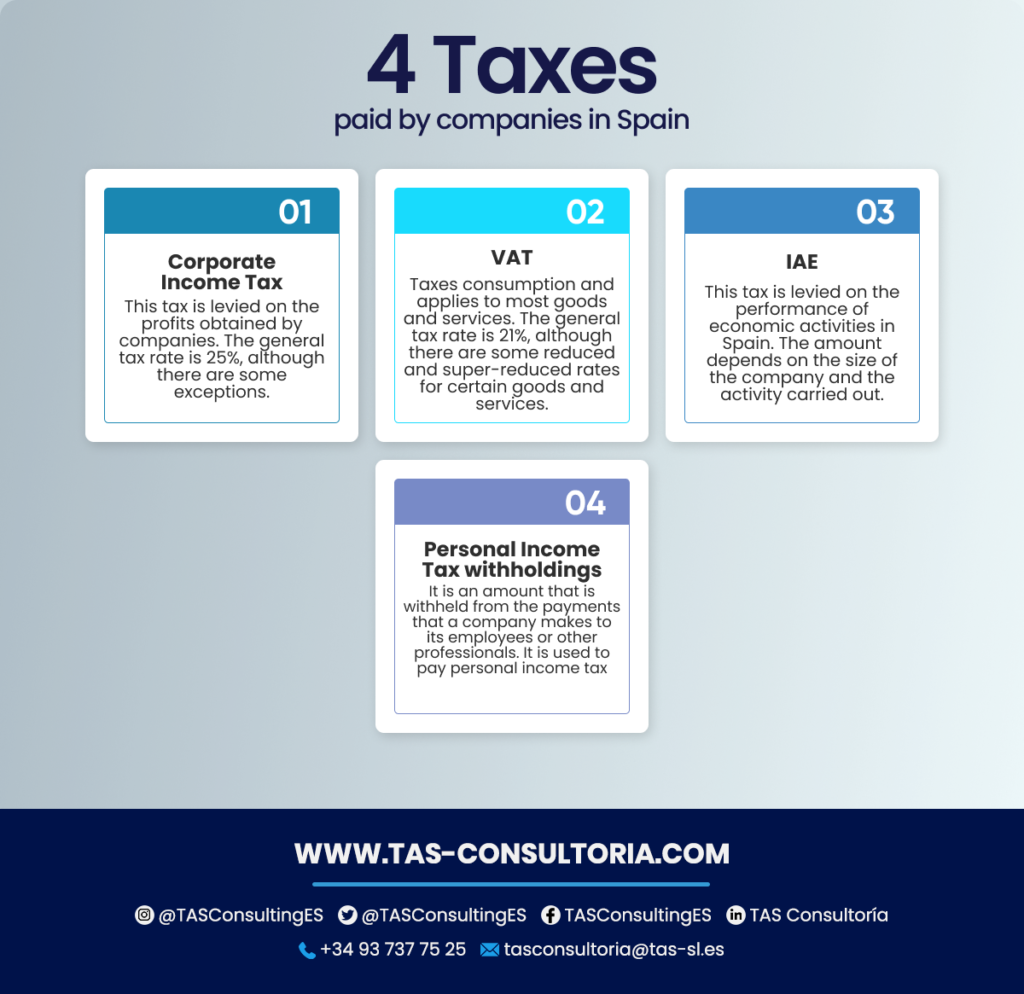

4 taxes paid by companies in Spain

Companies in Spain are subject to several taxes, some are direct and others indirect. However, we will talk about the 4 most important taxes that are usually levied on them:

You may also be interested in: Types of taxes in Spain: direct and indirect taxes

3 Techniques to verify your company’s tax payments

To check that you are up-to-date with your company’s tax payments, you can follow the following techniques. We assure you that they will become your best allies at the time of verification:

Check with the AEAT

The first way to check your company’s tax status is to check with the IRS. They and their electronic services allow you to check your tax status and whether you are up-to-date.

On the AEAT website, you can consult your filed tax returns. In this way, you have access to several returns that you have filed and that you want to consult in order to know the general tax payment status of your company.

Use specific software for accounting control

Accessible and intuitive programs can be used to make it possible to consult in real time the status of your taxes from any device and in a much more accurate way. An online program that we recommend implementing in your tax payment verification tactics is GD ERP.

With GD ERP you can manage your business productively and access your company’s information, managing each area in real time. All from a single platform.

From the accounting point of view, this program allows you to perform all processes quickly, easily and centralized thanks to artificial intelligence. In addition, it is a software that:

- Connect your banks and reconcile transactions in an automated way.

- Enter your invoices through images, without having to transcribe. The data of your invoices are automatically incorporated.

- And much more.

Calling on experts and tax advisors

Another option to verify the payment of taxes is to hire a professional. In TAS Consulting we have the best professionals to help you check the tax status of your business.

We can also provide you with the best human capital and give you peace of mind. In this sense, you do not have to worry about your tax liability and we can provide you with the best information whenever you want it.

You may also be interested in: What is the Financial Transaction Tax?

If you would like more information about payment of taxes, I invite you to contact TAS Consulting at our e-mail address tasconsultoria@tas-sl.es.

As we already told you, we have a great team of professionals who can provide you with all the help you need, in addition to providing you with the information you need about the process and more. So contact us and request a free consultation.

Your email address will not be published .

Required fields are marked with *