In the life of a self-employed, understanding and managing fixed expenses is essential to maintaining financial stability. Below, we share each of them with you and explore legal strategies that can help optimize them. If you want to get an in-depth look at how to manage your fixed expenses as a self-employed and discover ways to alleviate them, we invite you to read on!

We do not consider fixed expenses to be taxes

Self-employed people have regular and unavoidable fixed expenses, even though these expenses are not classified as taxes. These costs are essential for the operation and maintenance of the business, and must be considered strategically in financial management. We share with you the most important ones:

1. Costs related to banking entities

These commissions can be presented in different forms:

Commissions for the maintenance of your account.

2. Transaction fees.

3. Commissions for the use of the POS (both online and physical).

Each bank may have unique terms and your fixed costs may change. So it is essential to carefully analyze all available options. Choose the one that best suits your needs and offers the most favorable terms.

2. Supplies: electricity, water, telephone, internet, etc.

Do you work in a rented office? The fixed costs of electricity, water, gas, telephone and internet will be part of your responsibilities as a self-employed.

This means that you will be responsible for paying for these supplies used in the premises during the development of your professional activity.

The pandemic led many self-employed, who normally worked in a local office, to have to work exceptionally from home. This made them consider a possible deduction within fixed expenses. What happens in these cases and how much self-employed pay? We share with you some factors that you should take into account:

3. Domain, hosting and software

Regardless of the size of your company, you will certainly want to have a corporate email.

To have one, you will need to purchase a domain name and a web hosting service. This translates to more fixed costs on your pay list as a freelancer.

- The domain name can range from 10 to 30 euros per year. This is the cost associated with the use of your company name on your website and emails.

- As for web hosting, its cost varies according to the quality of the service. It can be between 10 and 20 euros per month or from 60 euros per year.

In addition to these fixed costs, you will have to invest in invoicing software. Especially if you want to carry out your activities, procedures or formalities securely and without errors.

You may also be interested in: How to obtain a loan in Spain?

Taxes payable as self-employed

In order to effectively reduce taxes, it is essential to be clear about the different types of taxes you are legally required to pay. These are detailed below:

1. Self-employed quota

We are talking about some main fixed costs that any self-employed professional faces.

This contribution corresponds to the payment of the social security contribution that every self-employed worker makes on a monthly basis. As of January 2023, this will be made through the contribution system for self-employed workers based on their actual income.

However, it is important to keep in mind that: if you are starting your activity as a self-employed, you have the possibility to apply for the flat rate of 80 euros per month.

2. Personal income tax (IRPF)

The well known IRPF is a tax that is applied on the earnings of any person in activity. Both self-employed and employed. In this sense, its calculation is based on the principle of progressivity; although it is not the only relevant factor to determine the amount to be paid. This is one of the key fixed expenses in your budget.

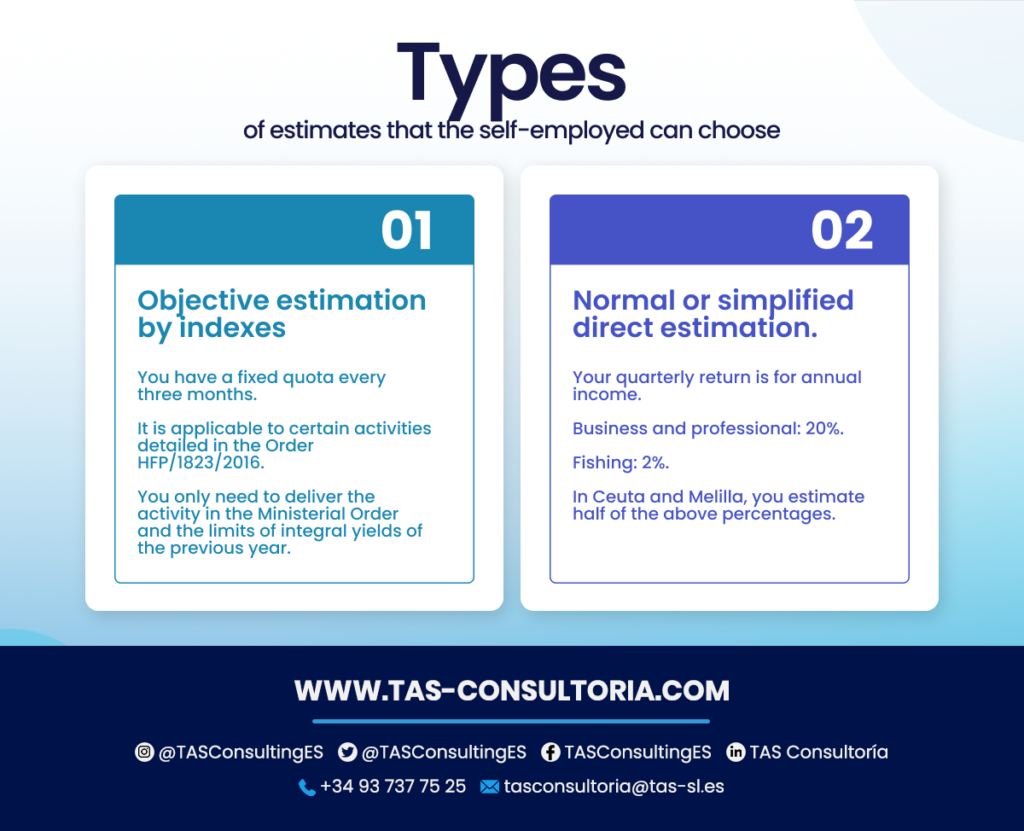

In fact, the self-employed can opt for different regimes depending on their activity. Namely, income earned or full income, and depending on the selected regime, apply certain deductions. This being so, it is crucial to choose the right regime, as this choice can reduce the amount of tax to be paid. The self-employed can opt for one of these regimes:

3. Value Added Tax (VAT)

VAT, an indirect tax, is levied on consumption and not on taxpayers’ profits. The self-employed should understand its calculation and its different taxation regimes in Spain to optimize its application. We share with you the main ones and which should be included in the fixed expenses:

Deductible and accrued VAT

- Difference between VAT paid for the acquisition of goods/services (deductible) and VAT charged to customers (accrued).

- A positive aspect is that you get the credit of the difference. A negative aspect is the possible request for a refund.

Types of taxation regimes in Spain

- General regime:

- Quarterly presentation.

- Percentage of 21, 10 or 4 percent according to activity, product or service, unless exempted.

- Simplified regime:

- For those who choose to contribute with objective estimation, except if they renounce to this form.

Cash VAT

- Introduced by article 23 of Law 14/2013.

- Allows VAT to be paid when invoices are collected, until December 31 of the year following the transactions.

- Optional and limited to self-employed with annual income of less than 2 million euros.

You may also be interested in: Tax benefits for the self-employed in Spain

10 expenses you can deduct as a self-employed : optimize your tax obligations

Now that you are clear about what taxes you have to pay as a self-employed, it is useful to know which regime can provide you with greater benefits. Especially what fixed expenses you can deduct (if you apply the direct estimation regime). Here are some recommendations:

Operating consumption

Goods necessary for your professional or business activity, such as raw materials.

Wages and salaries

Includes employee salaries, overtime, travel expenses, among others, if you have employees.

Independent professional services

Deduction of the amount for the services of professionals such as lawyers, notaries, economists, etc.

Living expenses

Fixed expenses for meals related to professional activity, deductible if they meet certain criteria.

Housing utility expenses

Portion of expenses for water, gas, electricity, telephony, etc., related to the space used to work at home.

Lease and royalty expenses

Rental of physical space or materials for your professional activity, as well as the use of patents or trademarks.

Health insurance premiums

Deduction of health insurance premiums for you, your spouse and children under 25 years of age.

Other external services

Includes fixed costs for transportation, insurance premiums, banking services, advertising, etc.

Consider cash VAT

Although it does not involve savings, this regime allows you to manage the payment of VAT in a more flexible way, delaying payments in certain situations.

You may also be interested in: Learn about the new quotas for the self-employed 2023-2031

We encourage you to seek the support of an accounting and tax advisor specialized in self-employed if you want to improve your performance. Get the support you need to optimize your role as a taxpayer and improve your financial situation.

Schedule personalized advice through tasconsultoria@tas-sl.es! Find out how to alleviate your fixed expenses and meet your tax obligations in the best possible way.

Your email address will not be published .

Required fields are marked with *