The depreciation table is an essential accounting tool for the self-employed and SMEs. Knowing how to use it properly is essential to comply with current tax regulations in Spain. In this article, we explain how to use an amortization table effectively for freelancers and SMEs. Read on and find out how to optimize your finances!

How does an amortization table work for the self-employed and SMEs?

The depreciation schedule is a financial tool used to calculate and plan the depreciation of a fixed asset over time. Depreciation is the process by which the value of an asset is gradually reduced due to use, wear and tear, and obsolescence.

A depreciation table shows how an asset will be depreciated over its useful life. Generally, it does so in the form of a table with detailed information on payments, interest and the remaining balance.

Below, we explain their importance for companies and freelancers:

Helps to calculate depreciation

Calculating the depreciation of fixed assets is essential for the self-employed and businesses, as it allows them to spread the cost of the asset over its useful life. This is achieved through the use of the depreciation schedule. In this way, the actual cost of the asset and its impact on the company’s earnings can be determined.

In other words, the amortization table provides a systematic way to make this calculation. This is fundamental for the correct financial management of any business.

Improved expense planning

Depreciation is a non-cash expense that affects a company’s profitability. This table allows the self-employed and businesses to plan and forecast future expenses related to fixed assets.

By having a clear idea of future expenses, they can make informed decisions about acquiring new assets or renovating old ones.

Facilitates accounting

An amortization table is important to maintain the accuracy of accounting records. Depreciation and amortization are important expenses that must be recorded correctly to ensure the accuracy of a company’s financial statements.

Without an amortization table, accounting becomes more complicated and error prone.

Regulatory compliance

Any depreciation table is necessary to comply with legal and tax requirements. Businesses and self-employed individuals must keep accurate records of depreciation and amortization of their fixed assets to comply with tax or accounting regulations.

You may also be interested in: Basic guide to bookkeeping as a freelancer

How is depreciation calculated?

Depreciation of fixed assets refers to the gradual reduction in the value of an asset over its useful life. This accounting practice is important to accurately reflect the depreciation of a fixed asset on a company’s balance sheet.

On the other hand, depreciation is a key concept in accounting and finance, which refers to the decrease in value of a fixed asset over time due to wear and tear and obsolescence.

This decrease in value is recorded as an expense in a company’s financial statements and is used to calculate fixed asset costs.

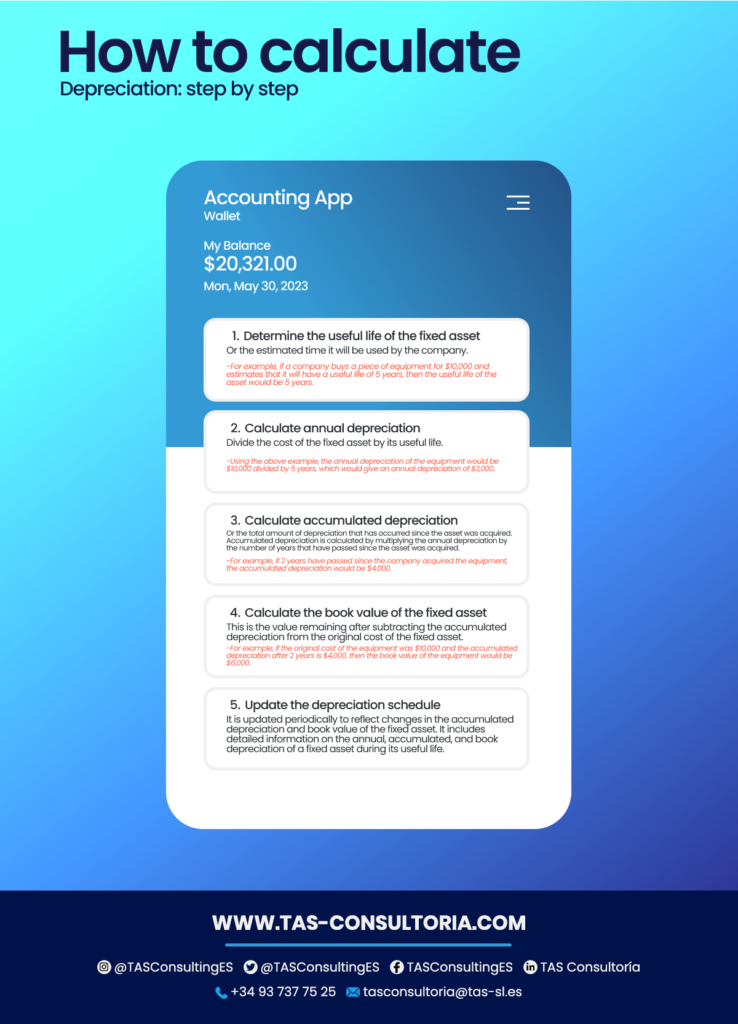

Here are the steps to calculate the depreciation of an asset using a depreciation table:

What are the most common methods used by the self-employed and SMEs to calculate depreciation?

There are several depreciation calculation methods you can use, each with its own advantages and disadvantages.

Here are the three most common methods for use in your amortization table:

You may also be interested in: Is it possible to hire personnel as a freelancer in Spain?

What are the tax benefits of the amortization table for the self-employed and SMEs?

In the business environment, it is common to acquire fixed assets, such as machinery and equipment, which are used for the development of the companies’ daily activities.

It is important to keep in mind that the depreciation of these fixed assets, in addition to being a necessary accounting practice, can bring important tax benefits for self-employed and SMEs. We share with you the most important ones:

Knows the depreciation tables and calculates correctly

The first thing you should do is familiarize yourself with all the options that exist for creating an amortization table. Make sure you understand the different methods and how they apply to your assets. If in doubt, consult an accounting or tax expert.

Be sure to calculate depreciation using the proper procedure. Most accounting software has a function that can help you with this process.

Take advantage of tax deductions

Asset depreciation can be used as a tax deduction in many countries. Be sure to take advantage of this deduction in your depreciation table to reduce your tax burden.

Keep a record of discarded assets

When an asset is disposed of or sold, it is important to keep a detailed record of the transaction. This will allow you to calculate any capital gain or loss and update the corresponding depreciation tables.

Keep your tax records organized

Keeping your tax records organized is essential to being able to use the depreciation schedule effectively. Use an online or paper accounting system that allows you to keep detailed records of your assets and transactions.

You may also be interested in: Collaborative accounting: what is it and what does it consist of?

The depreciation table is an essential tool for any self-employed or SME that wants to keep precise control of the depreciation of its fixed assets and maximize its tax benefits. By following the right steps you can comply with both tax and accounting regulations and avoid financial penalties.

If you need help in managing your accounting and your amortization table, do not hesitate to contact our experts. We offer personalized support and a significant cost reduction for your company. Contact us at tasconsultoria@tas-sl.es for more information.

Your email address will not be published .

Required fields are marked with *