You may not know it, but there is the possibility of requesting a deferral of the payment of the Social Security contributions. To do so, you need to meet a series of requirements that will give you the opportunity to apply for such deferral, as well as you will have to fill in the application form that you will be given at the Administrations of the General Treasury of the Social Security. To find out what the deferral of Social Security contributions implies and how to apply for it, stay until the end!

Is it possible to defer payment of social security contributions?

The answer is yes. It is possible to request the deferral of the social security contributions that are within the regulatory period for payment, except for the food as “workers’ contribution” and the contribution for occupational accidents and work-related illnesses.

In addition, it is very important to note that even if you submit an application for a deferral, Social Security is in charge of approving or denying it. But, by complying with all the requirements, there is a great chance that they will approve the deferral, so make sure you present the requirements well.

On the other hand, the deferral in the payment of the Social Security contributions will only cause two payments to be joined later on: the payment of the deferral as such and the insurances of the month that is in progress at the time you make the payment.

You may also be interested in: What is a patent and how to obtain it in Spain?

What does deferring the payment of Social Security contributions for the self-employed involve?

Deferring the payment of self-employed workers’ contributions represents a moratorium that allows the payment of debts contracted with the Social Security in a period longer and later than the regulatory payment dates.

The self-employed who have obtained the deferral can consider that they are “up to date” with their Social Security obligations. In other words, this will allow them to request a loan from a bank or to contract services with the Public Administrations.

Who can request a deferral of social security contributions?

The deferral of Social Security contributions can be requested by all self-employed individuals who pay Personal Income Tax (IRPF) or those who pay Corporate Income Tax (Impuesto de Sociedades).

So if you meet any of these two requirements, you already know that you can request the deferral of your self-employed fees. However, remember that requesting this deferral may generate a surcharge of 20%, which is also deferrable.

Which Social Security debts cannot be deferred?

As you already know, it is possible to defer the payment of Social Security contributions and tax surcharges for late payment. However, there are two types of debt that cannot be deferred, these are:

- The quota for occupational accidents and occupational diseases.

- The workers’ contribution, which includes employee contributions, if you are an employer and have employees under your responsibility.

You may also be interested in: Form 036 and 037: registering with the Tax Authorities

When can you request a deferral of social security contributions?

The deferral of self-employed contributions can be requested from the moment the regulatory deadline for payment has expired. In addition, there is a voluntary collection period during which this debt can be deferred.

In the event that this period has also elapsed, what is known as the “executive period” is triggered. In this period, the seizure of assets may take place.

However, until the Social Security notifies the debtor of the beginning of the “disposal of the assets”, the debtor still has the opportunity to request a moratorium on the payment of contributions or other dues.

If this is the case, the seizure cannot proceed until the request for deferral of the debt is resolved positively or negatively.

In addition, it is important to make it clear that the debt does not formally exist until the administration claims the debt or issues an order for enforcement. It is advisable to request the deferral before that and foresee the impossibility of paying the contributions in the immediate future.

How long do you have to pay the Social Security debt?

You must pay your Social Security debt within a maximum period of 5 years. Also, there is certain flexibility for the liquidation of the debt, both in the amount and in the terms and time of payment.

The repayment time can be found in the amortization table that you will be given once you have been granted the deferment. In addition, if you decide to pay off the debt early, you will be able to do so without any problem.

Where can you apply for a moratorium on the payment of self-employed contributions?

You may apply for a moratorium on the payment of Social Security contributions in two ways:

In both cases, Social Security will review the application. If you meet all the requirements, you will be granted the deferral of Social Security contributions.

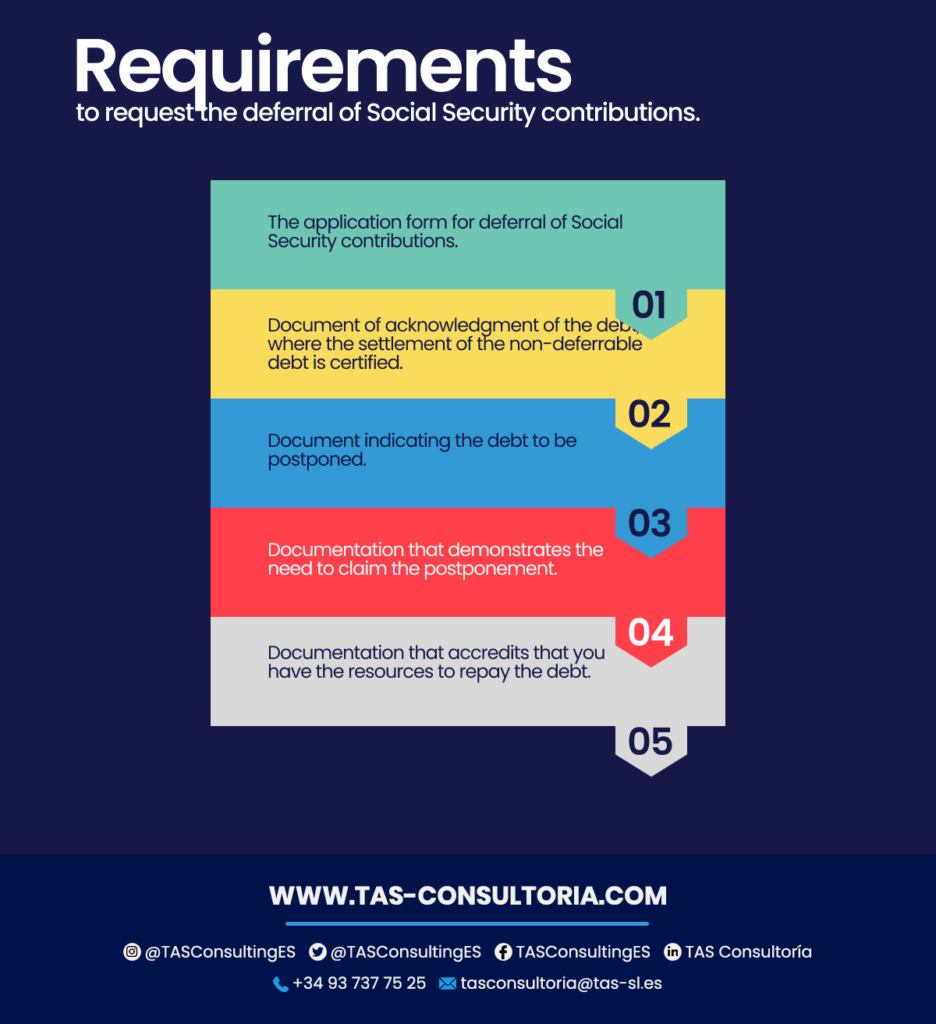

What are the requirements to request a deferral of payment of installments?

There is not really a list of specific requirements to request a deferral. Generally, the administration requests economic documentation.

However, everything will depend on the complexity of the file, the amount of the debt and the nature of the subject. This economic documentation is usually:

After submitting the documentation, you must wait for a response from the Social Security Agency.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

If you are interested in learning more about how you can defer your Social Security dues, I invite you to contact us through our email tasconsultoria@tas-sl.es.

We have an excellent team that can advise you on this tax process and much more. Do not miss this opportunity and request your free advice with the best professionals that will help you to boost your business.

Your email address will not be published .

Required fields are marked with *