Do you want to increase your retirement in 2023? If so, then you need to be aware of the most important developments that will allow you to maximize your pension and enjoy a comfortable retirement. As laws and regulations change in Spain, it’s crucial to stay up-to-date on how they will affect your benefits. Read on for everything you need to know about the latest pension and retirement news.

What have been the main changes in retirement in 2023?

Do you want to retire this year, get your benefits in order or increase your benefits? In either case, you have the option of carrying out all the necessary formalities related to Social Security from the comfort of your home. To do so, all you have to do is access its electronic headquarters and identify yourself with your digital certificate.

In this way, you will be able to make consultations and carry out all the necessary actions related to your pension, as well as request your work life report and any other management you may need.

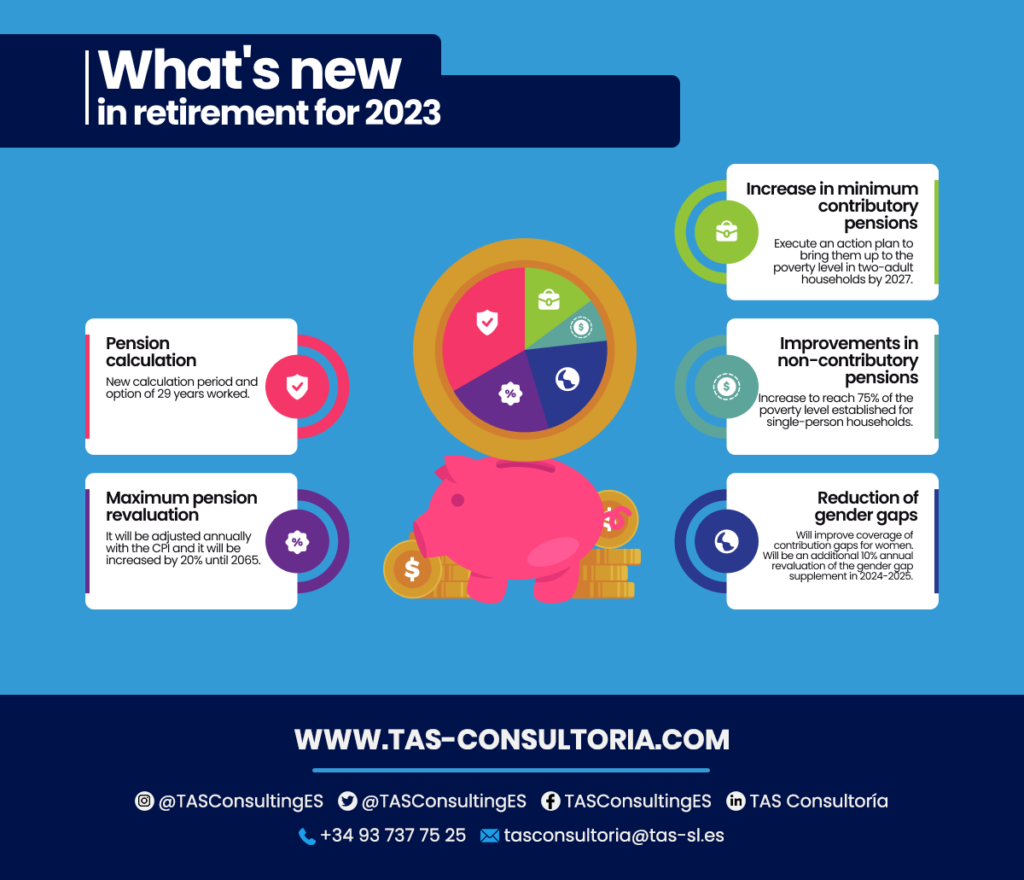

In order for you to be aware of the retirement news in 2023 and carry out the procedures without any inconvenience, we summarize the key points:

Pension calculation period changes for retirement in 2023

The reform agreed between the European Commission and the CCOO and UGT unions extends the pension calculation period until 2044, using the current 25 years. In addition, a new option has been established for calculating the pension, which will allow taking into account the last 29 years worked, excluding the 2 years with the lowest contribution.

This option will be progressively introduced between 2027 and 2038, until in the latter year the 29-year computation (minus two years) is fully applied.

The maximum pension will be revalued with the CPI.

Among the new measures for retirement in 2023 are maximum pensions revalued annually with the CPI. All this, plus an additional increase of 0.115 cumulative percentage points per year until 2050, which will amount to an increase of approximately 3%.

From 2051 to 2065, additional increases will be applied to reach a cumulative increase of 20% in the maximum pension at the end of the period. Subsequently, the convenience of increasing the total increase to 30% will be evaluated.

Increase in minimum contributory pensions

Another novelty within the retirement measures in 2023, is the proposal of an action plan to achieve the equalization of minimum contributory pensions, ensuring that by the year 2027, these will not be lower than the poverty level established for two-adult households.

As a result, there will be a gradual increase in the minimum pensions with a dependent spouse, in the period between 2024 and 2027.

Improvements in non-contributory pensions

Non-contributory pensions will experience an increase higher than the average revaluation of pensions, with the objective of reaching 75% of the poverty level established for single-person households by 2027.

Reducing gender gaps through gap filling

It is planned to improve the coverage of contribution gaps for women, which will allow an additional 10% increase in the annual revaluation of the gender gap supplement during the 2024-2025 biennium.

You may also be interested in: Pros and Cons of Venture Capital Fund Financing

How is your retirement pension amount determined?

In the context of retirement planning in 2023, it is important to consider the retirement benefits offered by Social Security. These vary depending on your age, the length of your working career and the contributions made to Social Security during that period.

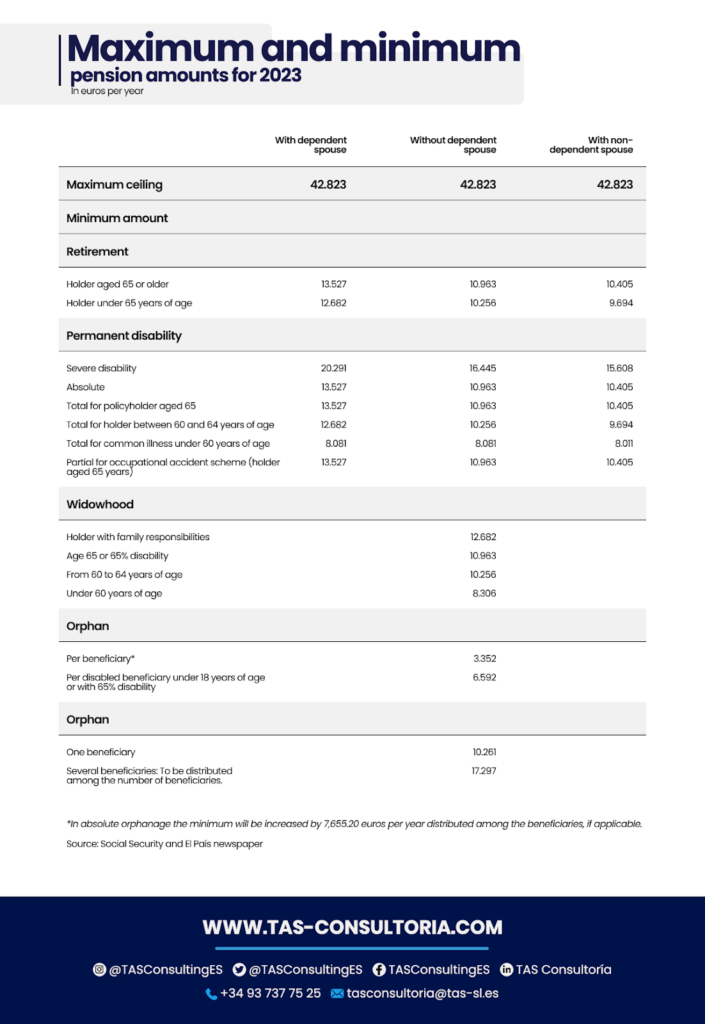

These pensions are classified as contributory and can be assessed in a range that includes both the highest (maximum) and lowest (minimum) amounts.

The maximum pension for retirement in 2023 will be €42,829.29, an increase of €240 compared to 2022. In addition, it is important to bear in mind that minimum pensions also vary depending on the pensioner’s age and whether or not he/she has a dependent spouse, ranging from €13,526 to €9,694 per year.

It is essential to have a savings plan and a solid financial strategy to complement these benefits. You can review this table which explains in detail the different calculations that can be made:

You may also be interested in: How to obtain a loan in Spain?

5 tips to increase your retirement in 2023

- Financial planning

The first step to enhancing your retirement is to have a solid financial plan. Determine your monthly expenses, create a realistic budget and set a savings goal based on your age, current income and long-term financial goals.

- Wise investments

In addition to saving regularly, investing wisely is key to growing your retirement in 2023. Common options include 401(k) plans, IRAs and stocks. Diversify your investments across different industries and asset classes to minimize risk.

- Working part-time

Working part-time can be an effective strategy for increasing your retirement income in 2023. Look for jobs that are related to your skills and hobbies, and that allow you to work from home to stay socially active and feel valued.

- Starting a business

If you’ve always had a dream of starting your own business, retirement may be the perfect time to make it a reality. Be sure to do thorough market research and create a solid business plan to maximize your chances of success.

- Investing in real estate

Investing in real estate can be a great way to generate passive income and increase your net worth in retirement. You can buy a rental property or invest in real estate investment trusts (REITs) to gain exposure to the real estate market without the need to purchase a physical property.

With retirement beginning in 2023, it’s important to take the time to carefully plan your finances and ensure a solid financial future. The innovations and tools that are available today can help you maximize your income and ensure a worry-free retirement.

You may also be interested in: Keys to increase the capital of your company

If you would like more information or personalized advice on how to plan for your retirement in 2023, feel free to contact our experts for a consultation at tasconsultoria@tas-sl.es. Don’t wait any longer! Start planning your financial future today so you can enjoy your retirement in 2023 to the fullest.

Your email address will not be published .

Required fields are marked with *