The self-employed digital certificate is a means of guaranteeing your identity on the Internet and therefore it is essential that all self-employed workers can count on it. In addition, the incorporation of more freelancers to the system of electronic notifications of the Social Security has given a warning about the importance of the certificate. To find out what is the value of the self-employed digital certificate for you, stay until the end and join us!

What is the digital certificate?

The digital certificate is a document issued to be able to verify your identity online unequivocally when carrying out procedures with the public administration.

For example, when you want to know your points on your driver’s license, make your tax return or any other direct procedure with the administration, the certificate will allow you to identify yourself.

In short, the substitute for usernames and passwords in public administration is the digital certificate.

You may also be interested in: Regulations for e-commerce in Spain

Why should the self-employed have a digital certificate?

By being forced to join the RED system, the self-employed gained a strong reason to acquire this document. However, the main reason for having this type of certificate is given by the need to carry out electronic procedures that are part of the administrative obligations of the self-employed.

That is to say, the obligations that have to do with the Special Regime for Self-Employed Workers (RETA), Social Security and the Tax Authorities.

What procedures can you manage with the digital certificate for the self-employed?

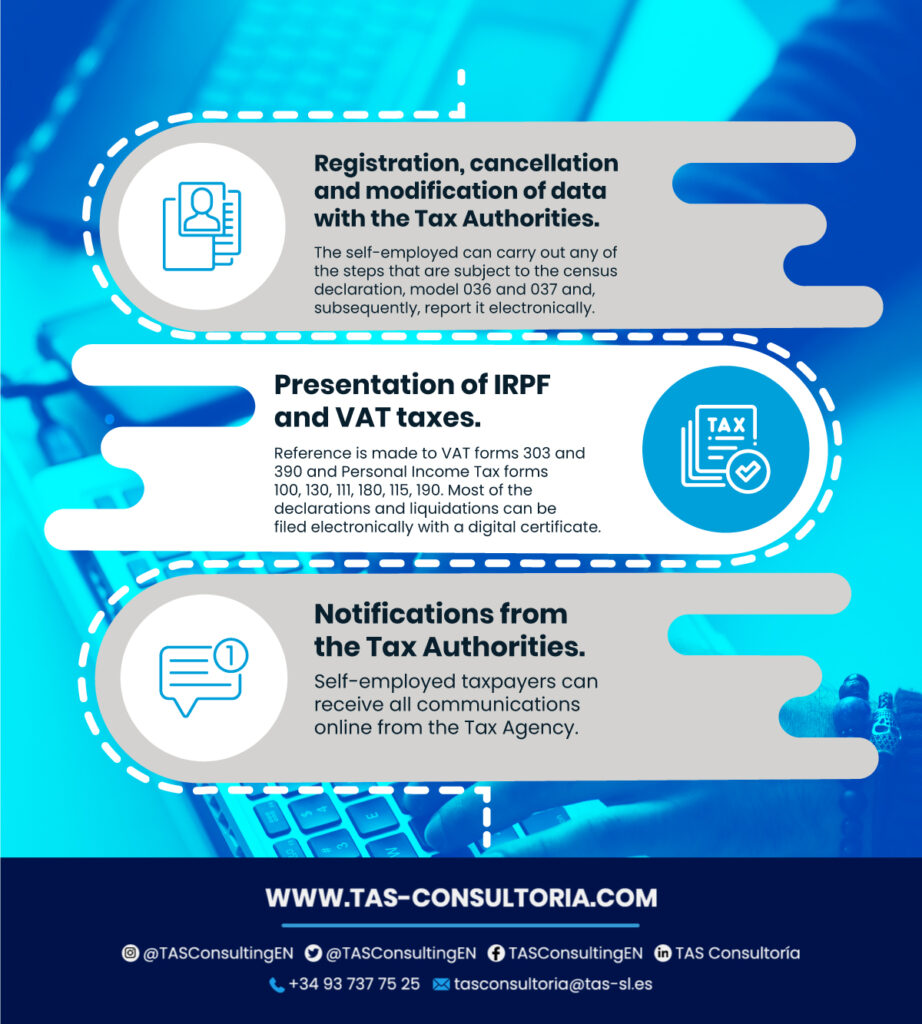

With the self-employed digital certificate you will be able to carry out multiple formalities related to the Social Security, the Treasury and the RETA. Through it, you will also be able to get all the information you need to carry out these formalities. Some of these are:

Tax formalities with digital certificate of natural person

These are the procedures that you can carry out with the digital certificate of natural person as part of the procedures of the autonomous digital certificate. These include:

It should be noted that, unlike the RED system, the Treasury does not yet require a digital certificate from individuals for electronic processing, since you can carry out these actions with Cl@ve PIN or reference number.

Procedures that can be carried out in the Special Regime for Self-Employed Workers (RETA) with the digital certificate

Just as you can carry out tax formalities as a self-employed person, you can also carry out other types of formalities related to the RETA, among which the following stand out:

The social security advises the self-employed who are registered in the electronic notification system to log in at least once a week because the notifications expire after 10 days.

You may also be interested in: E-invoicing: the new mandatory regulation for Spanish companies

How can you apply for a standalone Digital Certificate?

Applying for your digital certificate in the traditional way can be a tedious and complex process. We tell you all the steps to follow to request your certificate through the FNMT:

- Configure your browser to avoid problems.

- Enter the FNMT website.

- Request the certificate.

- Wait for the code to continue to the next steps.

- Prove your identity at a registry office with your ID card and the application code.

- Download the certificate.

If you think that following all these steps is a lot of work and a waste of time, here is another faster and easier way to obtain the digital certificate. All you have to do is contact Gestion Direct.

How can you obtain the digital certificate with Gestion Direct?

With Gestion Direct you can apply for your digital self-employed certificate without worrying about having to go to the tax office, queuing up in long lines and, finally, leaving aside the annoying formalities that this process requires.

In addition, you will have a digital certificate that is completely legal and that will make any administrative procedure you need easier. For example, you will be able to request your work life, pay your taxes online and much more with GD Certificates.

In addition, with the certificate issued by Gestion Direct you will be able to easily manage the administrative processes of your business. For example, you will streamline your relationship with the tax authorities and centralize access to your identification.

In that sense, to request your Digital Certificate with GD Certificates, you only have to follow 3 simple steps:

- Order online.

- Make payment.

- And wait only 30 minutes to get your certificate.

You may also be interested in: The road to digitization of the public sector in Spain

Do you want to know more about how you can apply for the Digital Certificate with Gestion Direct? Just contact us through our email tasconsultoria@tas-sl.es.

We have the best advisors who will be able to properly explain the operation of this service. Do not miss the opportunity to get your digital certificate to boost your business!

Your email address will not be published .

Required fields are marked with *