Buying a home is an important financial investment that can affect your tax declaration in Spain. In this article we will share with you key information about each situation that may arise, in tax terms, so that you can increase your savings benefits and learn about the options available. Read to the end to make the right decision when declare primary residence, come on!

Mortgage subrogation as an option to save on tax contributions

If you already save on utilities when you file your taxes, for example, is there an option related to filing for your primary residence?

Indeed, it does exist: subrogation. It is a way to save on your mortgage by looking for a better loan option.

This involves transferring the debt to another bank, which may result in a lower interest rate and monthly payment. This option is available to both those selling their home and those who simply wish to change banks.

When you subrogate your mortgage to reduce your payment, you can only change the following aspects:

- The interest rate. This is the main reason to subrogate the mortgage of your primary residence.

- The amortization term. Allows you to extend or shorten terms, although this is not very common.

- Loan fees. In particular, the early amortization fee if you plan to pay off part of the mortgage early.

The first two items will help you pay less each month on your mortgage and the second and third will help you save on your total mortgage.

You may also be interested in: Requirements for travel to Spain [2022].

Most common case: hedging against interest rate fluctuations in mortgages

If you purchased a home and want to declare it your primary residence with a variable rate mortgage, and interest rates are rising, you may want to consider switching to a fixed rate mortgage.

However, there are alternatives that can protect you from interest rate increases. All without having to incur the costs of paying off and establishing a new mortgage, such as interest rate hedging contracts.

These contracts may vary in their modality, but, generally, they work as follows:

- If the Euribor rises above a rate previously agreed with the bank, you will receive compensation equal to that excess. This is to compensate for the increase in interest paid on the secured loan.

- On the other hand, if the Euribor decreases, you will have to pay the difference to the bank.

The Euribor (Euro Interbank Offered Rate) is a reference rate used by banks in the euro zone to exchange short-term deposits among themselves. The Euribor is published every business day and is the reference rate for long-term mortgage loans.

He would indicate the movements for the coverage of the interest rates of your habitual residence. Its value is calculated from the rates at which the major banks in the euro zone lend money to each other.

You may also be interested in: All about unemployment in Spain 2022

Deduction for declaring primary residence

The mortgage deduction is an easy way to save on income tax. However, after the IRPF reform in 2012, it is no longer an option available to everyone.

Currently, only those who purchased their home before January 1, 2013 and who have used the mortgage deduction in 2012, or in previous years, can continue to enjoy this deduction.

In addition, it is a prerequisite that the mortgage loan has been used for the purchase of the main residence.

The calculation of the deduction for home purchase in your IRPF may be affected by the disbursements and collections related to your mortgage loan formalized before 2013.

In the event that you receive money from the bank thanks to the interest rate hedge, you must subtract these amounts from the deduction base. However, if interest rates go down and you have to pay, you can increase the deduction base with the amount paid.

For example, if you paid 8,000 euros in installments during the year and charged 1,050 euros for the interest rate hedge in Case A. Or you paid 800 euros for such coverage in Case B.

Deduction for housing in case of marital separation

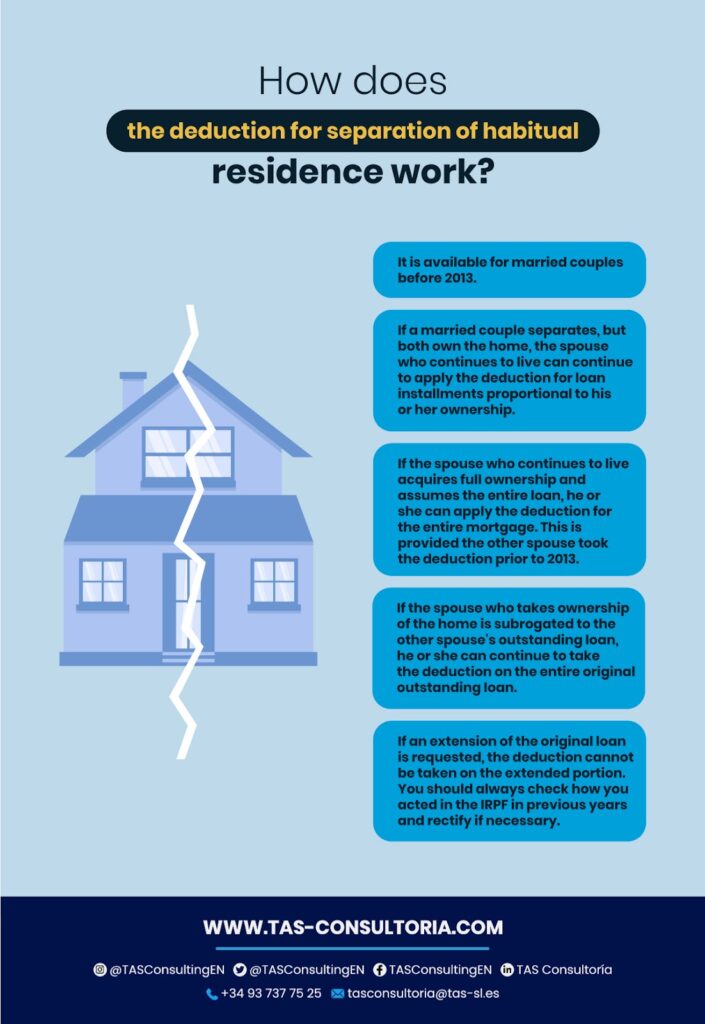

The deduction for the acquisition of a primary residence is available for married couples who purchased their home before 2013.

If a married couple separates and one spouse acquires 100% of the property, the spouse who continues to live in the house can continue to apply the deduction for the loan installments he/she pays. This will be proportional to his or her percentage of ownership.

The tax authorities have recently modified their criteria. It now allows applying the deduction both for the original part and for the part acquired from the other spouse if certain conditions are met.

It is possible that one of the spouses stays in the habitual residence and is subrogated in the pending part of the other one. In this case, you can continue to apply to the deduction, especially on the original outstanding loan.

If you request an extension of the loan, you will not be able to apply the deduction on the extended part. If you are in this situation and you acquired the part of your ex-partner’s habitual residence in previous years, you should verify how he/she acted in his/her IRPF and rectify the non-compliant declarations.

You may also be interested in: Hiring a real estate agency: what should you know?

It is important for you to know that buying a home can have different tax impacts depending on its use and characteristics. As experts in tax consulting in Spain for more than 40 years, we know all the options and opportunities for tax deductions in relation to home purchases.

Evaluate all the options to save on taxes. Request a consultation with us today about the next steps when declaring your primary residence and we will provide you with personalized help to get the best result. What are you waiting for? Contact us at tasconsultoria@tas-sl.es.

Your email address will not be published .

Required fields are marked with *