What is the new State guarantee and how will it benefit first-time homebuyers?

On May 9, the Spanish government approved a measure to guarantee 20% of the mortgage for first-time homebuyers. It is believed that this measure may benefit more than 50,000 people: among family members and young people up to 35 years of age. To learn more about this State guarantee, stay until the end, go on!

How do endorsements work?

Simply put, a guarantor is a contract where one entity or person assumes the payment of a debt of another, in the event that the former is unable to pay. This person, known as the guarantor, agrees to fulfill the obligation from all assets. Of course, as long as a limit to the liability is not established.

For this type of contract to be valid there must be a written record. In addition, this may be for an indefinite or limited period of time and may be agreed to cover all or part of the debt.

You may also be interested in: Hiring a real estate agency: what should you know?

What is the State guarantee recommended by the Spanish government about?

The Spanish Government recently approved a guarantee that will cover 20% of the mortgage for those who need to buy their first home. This is a measure aimed at people who are financially solvent, but do not have sufficient savings to afford the initial investment.

This means that, while the bank finances 80% – which is usually the most common – the State guarantee covers the other 20%. This allows people to take out a 100% mortgage.

How does the State guarantee work?

As we told you, the State will guarantee 20% of the mortgage as long as the client is unable to pay the mortgage due to a specific situation. This means that the State will not make an automatic disbursement of the money. Instead, it will only be an aid for particular situations.

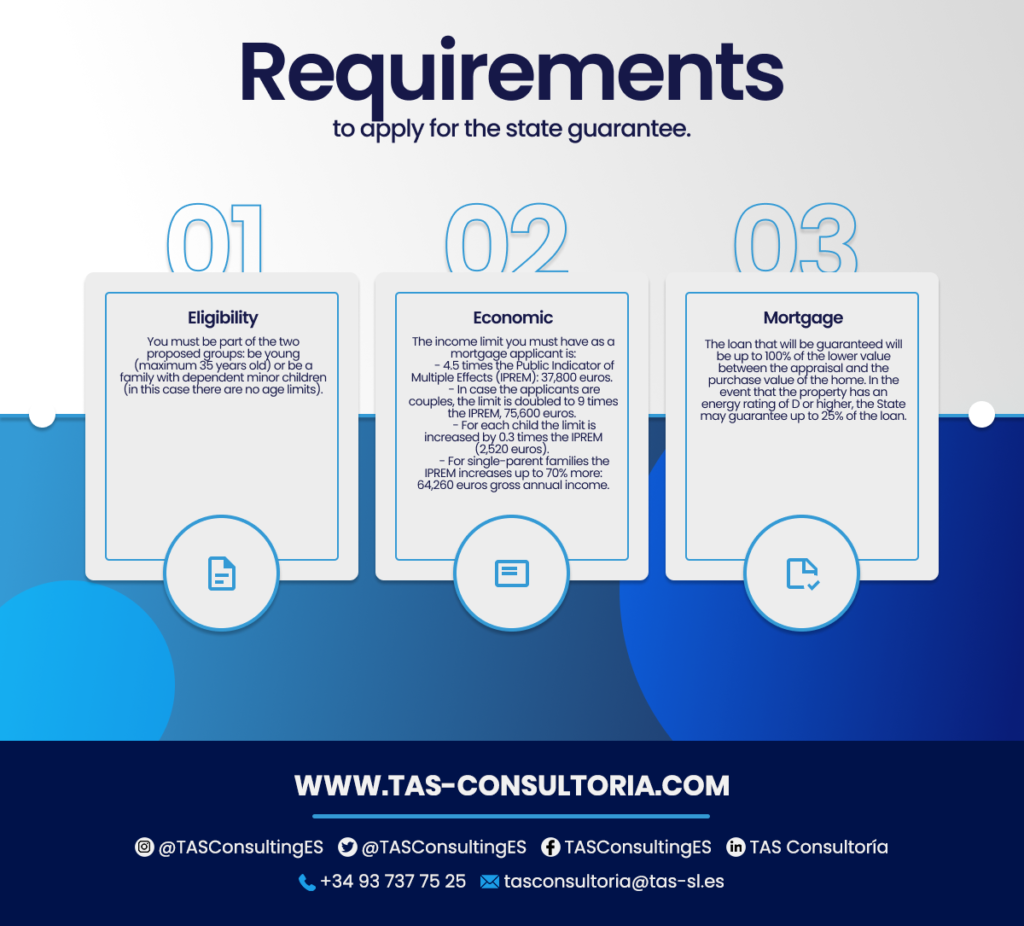

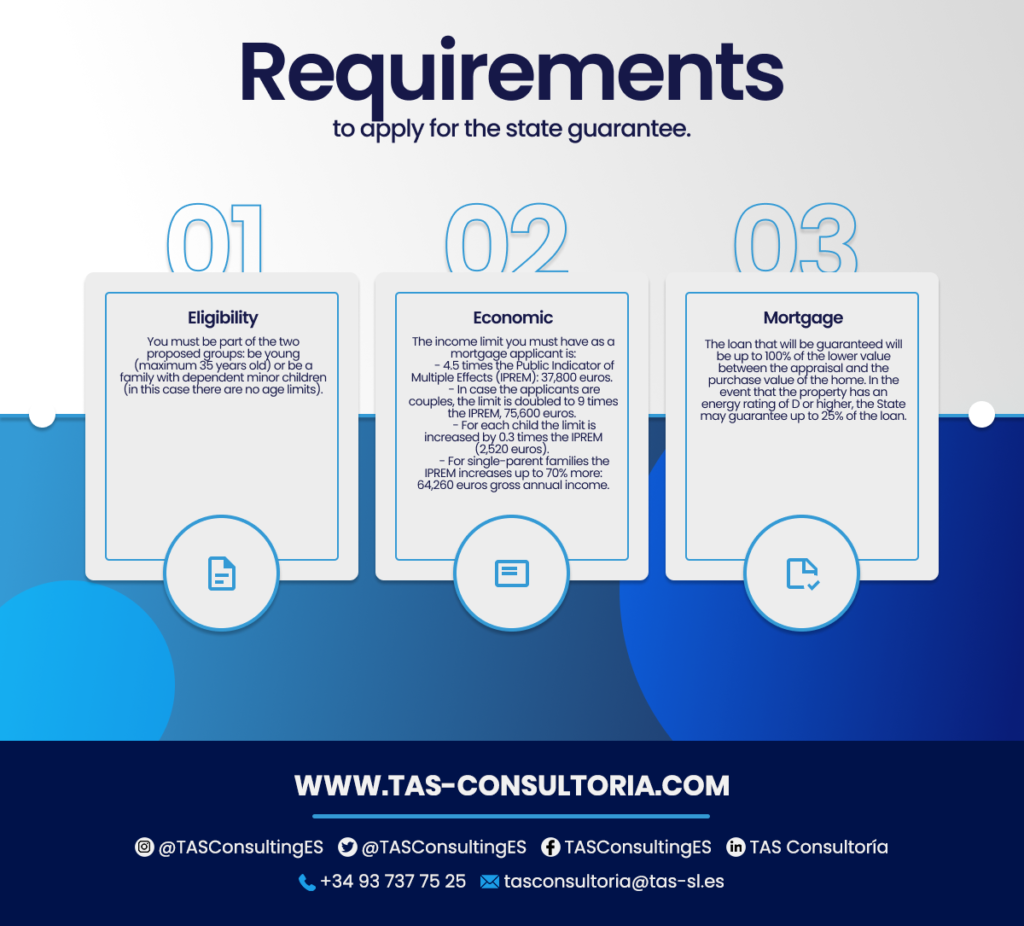

What are the requirements to qualify for the State’s endorsement?

The Government, in the Council of Ministers, has raised a series of eligibility, economic and mortgage requirements. In the following image we show them to you, keep them for you or someone who needs them:

It should be made clear that the State guarantee only covers the principal loan: interest and initial expenses are excluded. In addition, it is important to know that the term of the guarantee is a maximum of 10 years regardless of the repayment term.

You may also be interested in: Real estate situation in Spain 2022

Will the State guarantee have a price limit to apply for?

The Government indicated that yes, there will be a price limit for those applying for the endorsement. However, they have not yet specified what the limit will be. But there was talk of the possibility that this maximum limit will be different between territories.

How and when will you be able to apply for this assistance?

The deadline for the application has not yet been announced, as the measure was only approved by the Council of Ministers on May 9.

Likewise, the dates for requesting it have not been announced. However, it is possible that you can apply for it directly at the bank where you process your mortgage.

Will you have to pay back the percentage that the State guaranteed you?

Since it is a guarantor, the government is not lending money, but will stand as guarantor for 20% of your mortgage. Therefore, since it is a 100% mortgage, you will have to pay back all the money requested.

As a consequence, the installments will be much higher, or the repayment period will be longer. This will cause the interest payment to be much higher.

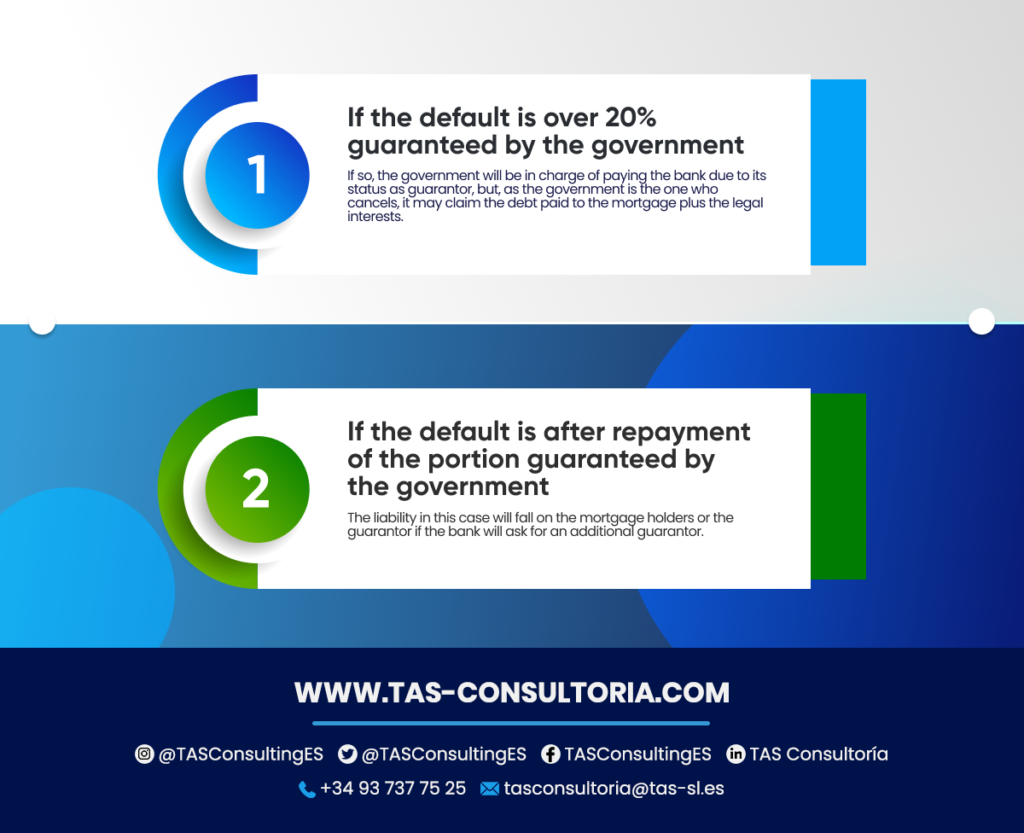

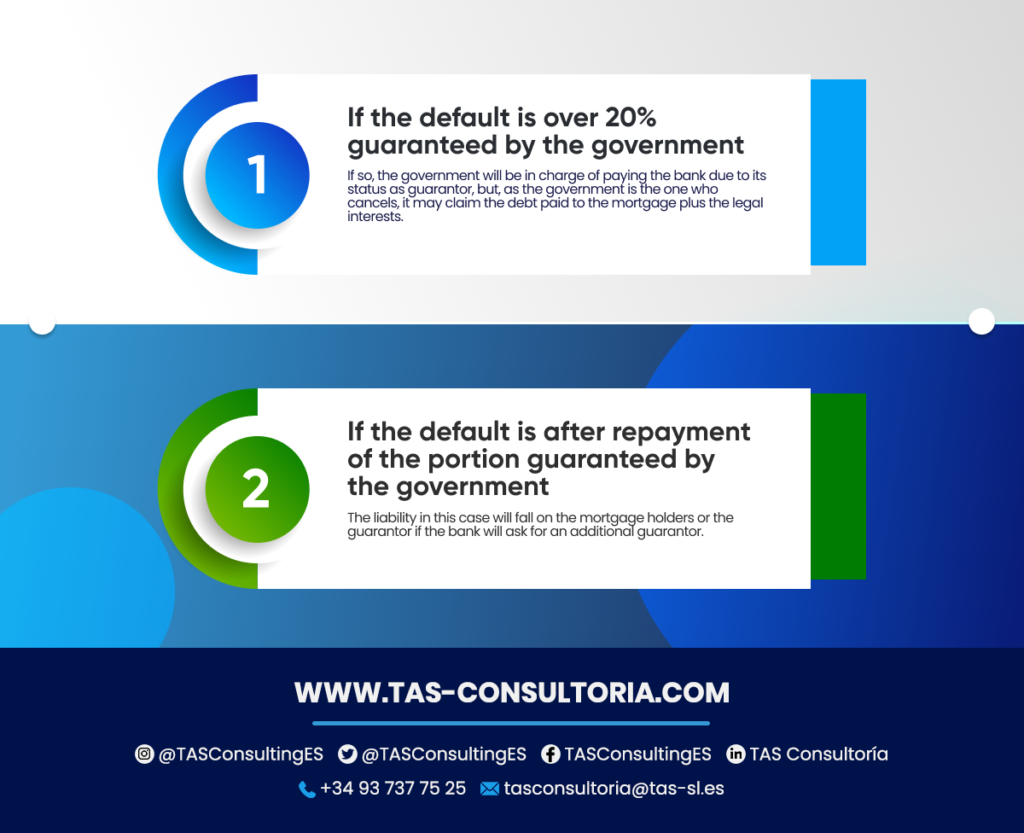

What happens if a default occurs?

Pages such as Foto Casa have analyzed the issue of collateral and explain what would happen in the event of an alleged mortgage default. Of the cases proposed, the most feasible are:

In either case, it is advisable to ask the bank to renegotiate. It is possible to ask for a lower installment or to ask them to abide by their Code of Good Banking Practices.

You may also be interested in: Know the safest autonomous communities in Spain

Would you like to learn more about how the new State guarantee works? Get in touch with our managers and advisors at TAS Consultoría. Send us an email to our address tasconsultoria@tas-sl.es and our experts will be pleased to assist you. Contact us to request your free advice.

On May 9, the Spanish government approved a measure to guarantee 20% of the mortgage for first-time homebuyers. It is believed that this measure may benefit more than 50,000 people: among family members and young people up to 35 years of age. To learn more about this State guarantee, stay until the end, go on!

How do endorsements work?

Simply put, a guarantor is a contract where one entity or person assumes the payment of a debt of another, in the event that the former is unable to pay. This person, known as the guarantor, agrees to fulfill the obligation from all assets. Of course, as long as a limit to the liability is not established.

For this type of contract to be valid there must be a written record. In addition, this may be for an indefinite or limited period of time and may be agreed to cover all or part of the debt.

You may also be interested in: Hiring a real estate agency: what should you know?

What is the State guarantee recommended by the Spanish government about?

The Spanish Government recently approved a guarantee that will cover 20% of the mortgage for those who need to buy their first home. This is a measure aimed at people who are financially solvent, but do not have sufficient savings to afford the initial investment.

This means that, while the bank finances 80% – which is usually the most common – the State guarantee covers the other 20%. This allows people to take out a 100% mortgage.

How does the State guarantee work?

As we told you, the State will guarantee 20% of the mortgage as long as the client is unable to pay the mortgage due to a specific situation. This means that the State will not make an automatic disbursement of the money. Instead, it will only be an aid for particular situations.

What are the requirements to qualify for the State’s endorsement?

The Government, in the Council of Ministers, has raised a series of eligibility, economic and mortgage requirements. In the following image we show them to you, keep them for you or someone who needs them:

It should be made clear that the State guarantee only covers the principal loan: interest and initial expenses are excluded. In addition, it is important to know that the term of the guarantee is a maximum of 10 years regardless of the repayment term.

You may also be interested in: Real estate situation in Spain 2022

Will the State guarantee have a price limit to apply for?

The Government indicated that yes, there will be a price limit for those applying for the endorsement. However, they have not yet specified what the limit will be. But there was talk of the possibility that this maximum limit will be different between territories.

How and when will you be able to apply for this assistance?

The deadline for the application has not yet been announced, as the measure was only approved by the Council of Ministers on May 9.

Likewise, the dates for requesting it have not been announced. However, it is possible that you can apply for it directly at the bank where you process your mortgage.

Will you have to pay back the percentage that the State guaranteed you?

Since it is a guarantor, the government is not lending money, but will stand as guarantor for 20% of your mortgage. Therefore, since it is a 100% mortgage, you will have to pay back all the money requested.

As a consequence, the installments will be much higher, or the repayment period will be longer. This will cause the interest payment to be much higher.

What happens if a default occurs?

Pages such as Foto Casa have analyzed the issue of collateral and explain what would happen in the event of an alleged mortgage default. Of the cases proposed, the most feasible are:

In either case, it is advisable to ask the bank to renegotiate. It is possible to ask for a lower installment or to ask them to abide by their Code of Good Banking Practices.

You may also be interested in: Know the safest autonomous communities in Spain

Would you like to learn more about how the new State guarantee works? Get in touch with our managers and advisors at TAS Consultoría. Send us an email to our address tasconsultoria@tas-sl.es and our experts will be pleased to assist you. Contact us to request your free advice.