Having a bank account in Spain represents a way to manage your personal and business finances, as well as taking advantage of the use of electronic payment methods to facilitate your daily transactions. Would you like to know the requirements to carry out this procedure? Do you know who is allowed to do it? In this article we tell you everything you need to know!

Who can open a bank account in Spain?

One of the most frequent doubts for people who do not have Spanish nationality today is whether it is allowed to open a bank account in Spain, and the answer is yes. This procedure is possible for both Spanish and non-Spanish residents.

Generally speaking, opening a bank account in the country is usually a simple and quick process; however, the requirements may vary depending on the bank you select and whether you are a minor or not.

Therefore, it is important that you get information on key aspects such as: opening conditions of the banks, applicable commission rates, and the type of account that best suits your needs.

Requirements to open a bank account in Spain

As we have already mentioned, the requirements to open a bank account in Spain may vary, and TAS Consultancy explains the different cases that apply:

Requirements for non-residents

Be of legal age (18 years old) or have prior authorization from parents

Possess a Foreigner Identification Number (NIE).

Proof of address to be included in the bank account, e-mail address and telephone number

Not appearing on the delinquent list

Have a valid employment contract and proof of income.

Certificate of current immigration status and monthly income

Some banks require bank references from the country of residence of origin, and the last income tax return.

All documents must be translated and notarized in Spanish (if applicable).

Requirements for residents

Be of legal age (18 years old) or have prior authorization from parents

Possess a National Identity Document (DNI).

Proof of address to be included in the bank account, e-mail address and telephone number

Not appearing on the delinquent list

Have a valid employment contract and proof of income.

Have the latest paychecks and income tax or VAT declarations

Statement of Economic Activity (DAE), according to Law 20/2010, of April 28th

Proof of the account holder’s main source of income and occupation; specify whether the account holder is self-employed, employed, or a student.

Steps to follow to open a bank account in Spain

Now that you know what you need to have on hand, the step-by-step procedure to open a bank account in Spain is simple:

Consult the different options through the Internet; in the following section you will find the main banks in the country.

Go to the commercial office of the bank of your choice.

Submit all requirements as applicable in your case.

Review the contract, read the terms and conditions, find out about possible maintenance charges and commissions.

Sign the contract for all holders

You may also be interested in: Insurance for foreigners in Spain

Main options for opening a bank account in Spain

Selecting the bank to open your account in Spain may seem a challenge, however, everything will depend on your needs, savings expectations, business vision, and with which you feel more comfortable. So, here are 5 of the most popular banks in the country today:

Aspects to take into account when opening a bank account in Spain

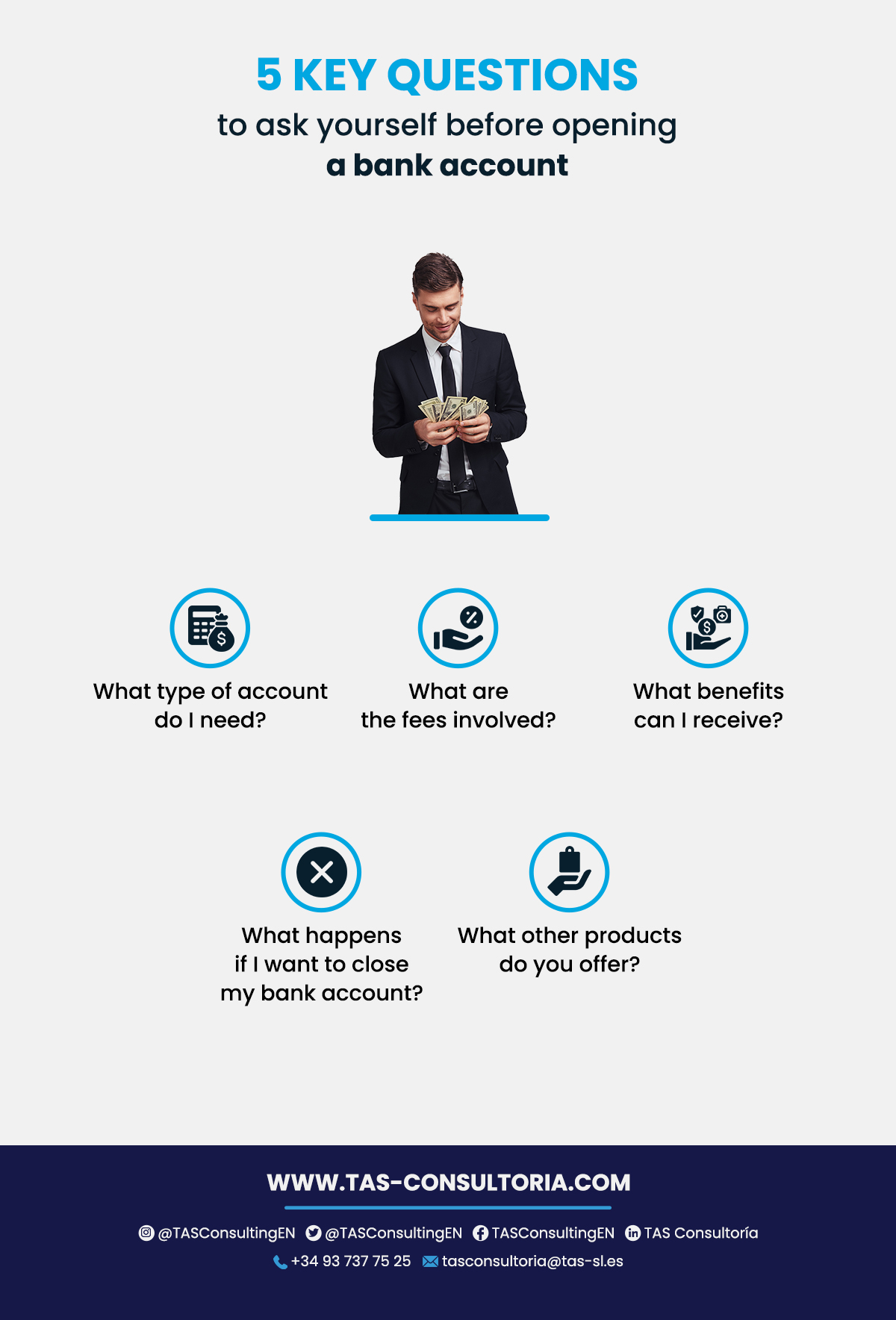

To avoid possible misunderstandings when enjoying the Spanish banking system, it is important that you ask yourself the following questions:

You may also be interested in: Why are bylaws important?

What type of account do I need?

You will be able to choose between a payroll, basic payment, savings, student or pensioner account. Don’t forget to ask your advisor which of these options best suits your needs.

Which commissions are present?

Be sure to ask about set-up fees, as well as maintenance fees, administration fees, transfer fees, ATM withdrawals and check deposit fees.

What benefits can I receive?

As well as having to pay the commissions charged, in some cases you can enjoy benefits such as bonuses and discounts when you have been a customer of the bank for a certain period of time.

In addition, another benefit included in some financial institutions is to allow free international transfers and discounts for students.

What if I want to close my bank account?

Everything will depend on the bank you select, so it is important to find out if there are any credits for closing your account, since in some cases it is common to have to pay the maintenance fee to carry out the procedure.

What other products do you offer?

Since you are initiating commercial relations with a Spanish bank, take advantage of the opportunity to consult what other products or services they have available for you. For example: credit cards, promotions for pension plans or mortgages, among others.

You may also be interested in: Opening license in Spain: how to obtain it?

So, now that you have an idea about how to open a bank account in Spain and which are the most outstanding options in the country, what are you waiting for to start your procedure? Would you like to get advice about it? Our expert accountants at TAS Consultancy will guide you to solve all your needs.

Your email address will not be published .

Required fields are marked with *