As a result of the economic problems that the country has suffered, it is possible that corporate liquidity problems may arise. That is why one option to face it is the cash VAT, through the special regime of the cash criterion. This allows you as a taxpayer to calculate your taxes, manage VAT more easily and adjust collection deadlines. If you want to know how to do it, I invite you to stay until the end of this article, let’s get to it!

What is the special VAT regime with cash criterion?

The cash basis is a measure that helps to simplify tax compliance for small businesses and enterprises. It is a simplified and voluntary accounting system to which the self-employed can adapt if they wish to do so. However, this system requires that a series of requirements be met, which we will detail below.

This system allows entrepreneurs to calculate their taxes using the so-called “cash method”. Known for being a way of liquidating VAT tax and allowing tax to be paid on income only if sales have been collected, avoiding any business liquidity problems.

You may also be interested in: Pros and Cons of Venture Capital Fund Financing

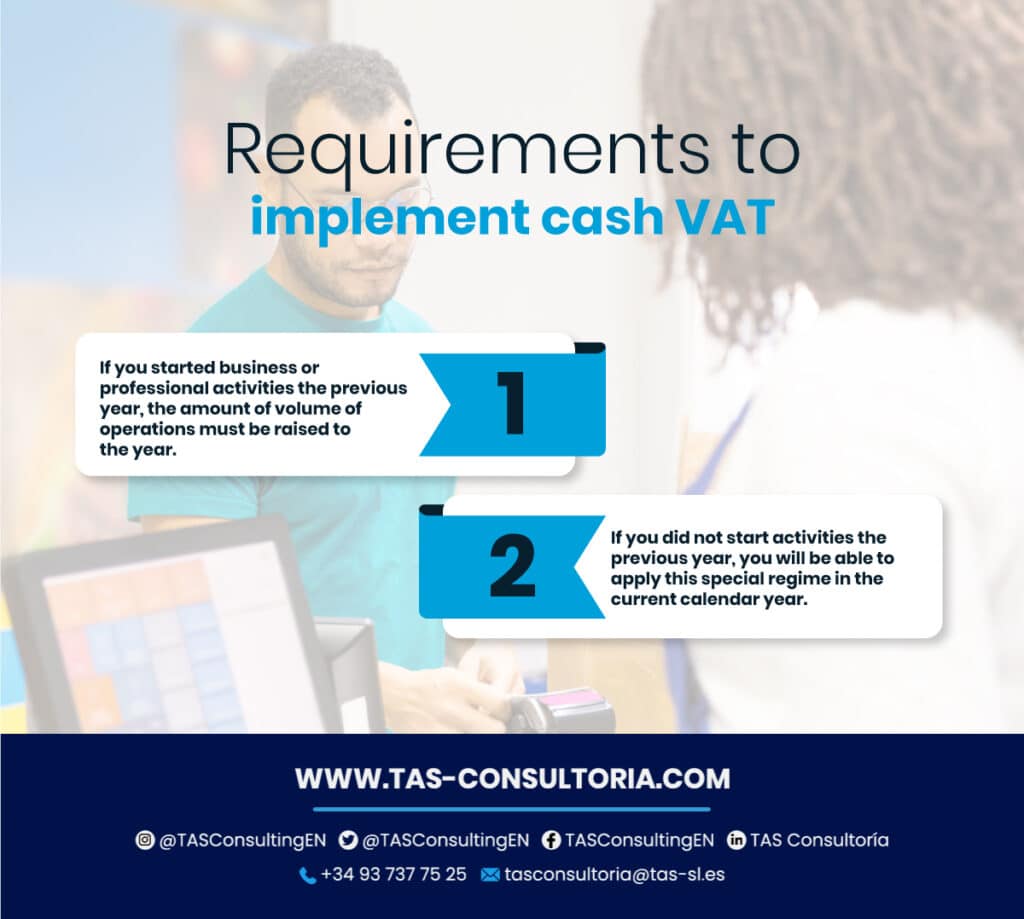

What are the requirements to apply cash VAT?

If you have a business liquidity problem, this measure can be very beneficial for you. But, you must keep in mind that it is a measure only for taxpayers whose turnover in the previous year did not exceed 2,000,000 euros and who also did not receive more than 100,000 euros from the same customer.

If so, you only have to comply with the following requirements:

How does cash VAT work?

The first thing to know is that in order to be part of this regime, the company or professional must apply for it by means of the model 036 0 037 in Hacienda. All at the time of filing the declaration at the beginning of the year or in the month prior to the beginning of the calendar year in which the application begins.

Thus, it would be understood that the self-employed would be taxed under the regime from that moment and it would be taken as extended. Then, in the operations they choose, the tax will accrue at the time of collection, either total or partial of the amount received.

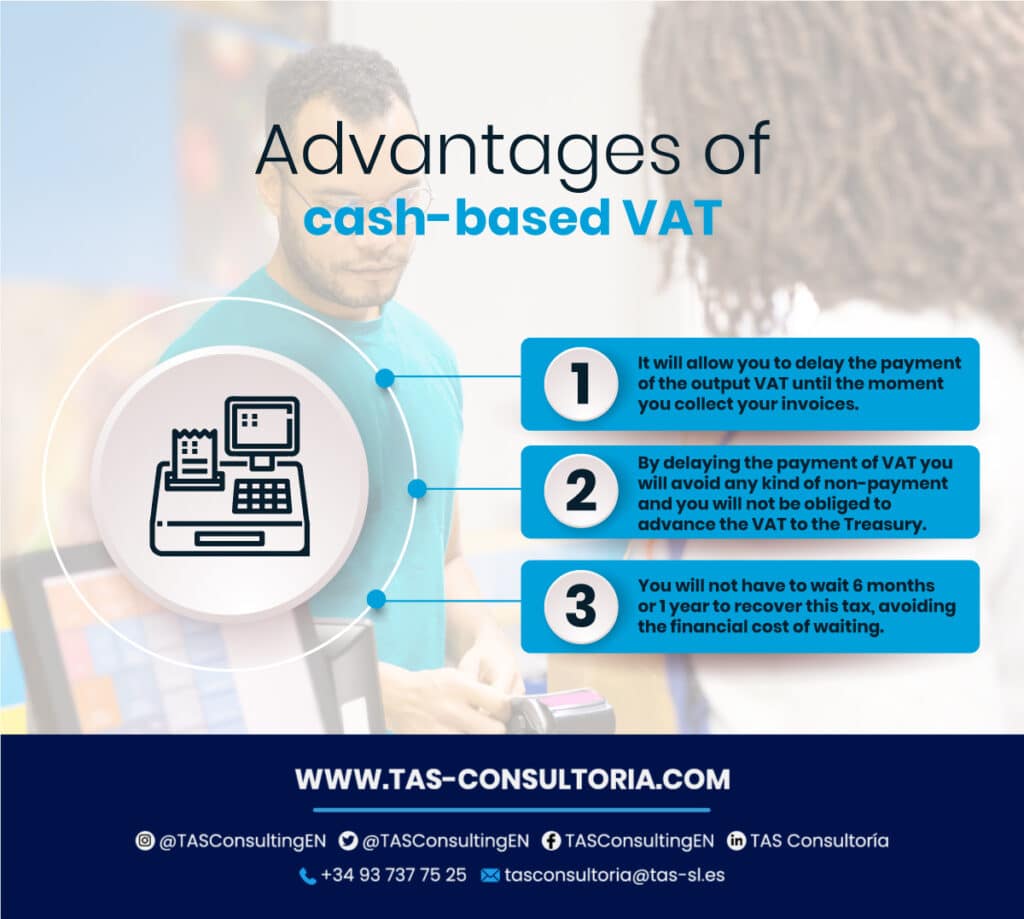

What are the advantages of cash-based VAT?

As we have mentioned, the VAT with cash criterion has several advantages for the self-employed if they have business liquidity problems. See what they are!:

You may also be interested in: Basic guide to bookkeeping as a freelancer

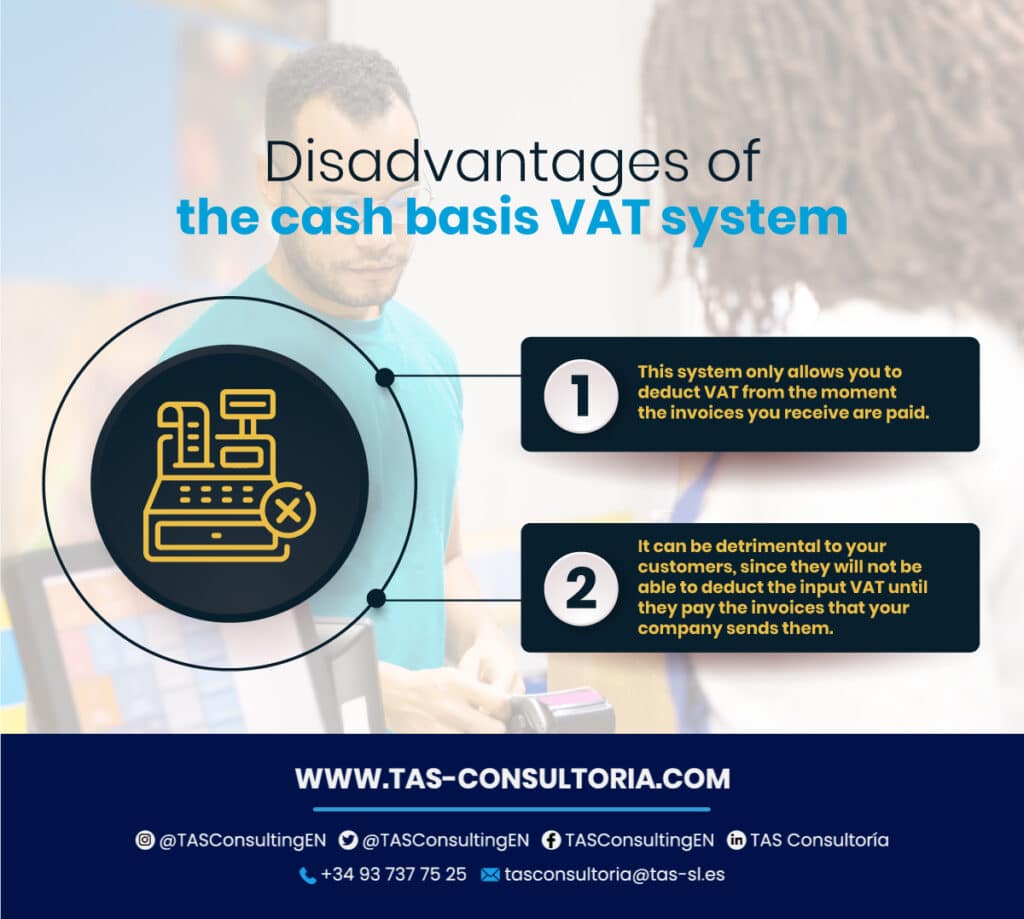

What are the disadvantages of cash-based VAT?

As with any new system that is implemented, it must be taken into account that opting for it can generate disadvantages. For example:

Who cannot apply the cash basis?

As mentioned above, no taxpayer who exceeds 2,000,000 euros per year will be able to adhere to the cash basis or those who received more than 100,000 euros from the same client.

Also, it will be impossible for those who have waived the cash basis in the last 3 years. In addition, there are activities that are exempt from this regime:

What is form 303 in the special cash criterion regime?

Even if you operate under the cash criterion, you cannot ignore form 303. The quarterly VAT return form 303 is the simplified annual return and includes information to identify the company (CIF/NIF number and registered office), the period covered by the return and the total amount of income.

This model is affected by the VAT with cash criterion due to the fact that it is in this model where the VAT declaration is made:

- Settlement and payment of VAT: only invoices collected are declared on this form.

- VAT deduction: VAT can only be deducted on expenses that have already been paid.

Remember, this is a form that is filed quarterly and the deadlines are subject to the tax calendar.

What is Form 347 and how does it relate to the cash basis?

Form 347 is an annual informative document that must be filed by any self-employed person who has had transactions with customers or suppliers of more than 3,005.6 euros.

In this situation, the transactions in the cash basis model must include:

- Information on amounts collected or paid.

- Amounts accrued up to December 31 as a result of having reached the accrual time limit for uncollected invoices.

- Appropriation on an annual basis, which is different from the rest, which are appropriated on a quarterly basis.

This is why it should be taken into account that this VAT cash basis regime affects both entrepreneurs who decide to comply with it to avoid liquidity problems of companies, as well as those who do business with these entrepreneurs.

You may also be interested in: Collaborative accounting: what is it and what does it consist of?

If you want to understand and know more about the VAT regime with cash criterion and how to deal with it to avoid liquidity problems of companies. I invite you to contact our advisors through our email tasconsultoria@tas-sl.es.

There they can provide you with all the information you need to boost your business. All you have to do is contact us and schedule your free consultation, don’t miss the opportunity to become a better entrepreneur!

Your email address will not be published .

Required fields are marked with *