The term habitual residence refers to the house where you have resided for a long period of time and where the incentives proposed in IRPF take effect. To find out if your home can be considered as such, we invite you to stay until the end, because we will tell you what requirements you must meet for your home to fall into this category, let’s get to it!

What is considered a principal residence?

In order for a house to be considered a habitual residence you must have resided in it for at least three years. It should be noted that this is not a restrictive rule, as it has some exceptions.

In the event that you have moved for work, marriage, divorce or other reasonable cause, the new home in which you reside immediately acquires the status of habitual residence.

It also applies if it is a new home and you have occupied it for the following twelve months. Or if you have several homes and have resided 183 days or more per year in them. Additionally, outbuildings such as garages or storage rooms are part of the regular residence, as long as they were acquired at the same time as the property.

You may also be interested in: The lease of commercial premises in Spain

What are the requirements to register your primary residence for personal income tax purposes?

If you are wondering, what are the characteristics that your house must meet to be considered by the Treasury as a habitual residence? In the following list we will tell you:

- That it be constituted as the taxpayer’s residence for a period of at least three years. This requirement has some special exceptions that will be explained below.

- Have been effectively and permanently inhabited within a period not exceeding twelve months from the time of acquisition or completion of the works.

- The parking spaces acquired together with the house are considered for the purpose of deduction for habitual residence. There must be a maximum of two and they must be in the same building or complex and be delivered at the same time as the house.

What is the three-year rule?

In order for a home to be considered a permanent residence for Personal Income Tax (IRPF) purposes, the taxpayer must reside there continuously for at least three years.

You may also be interested in: Hiring a real estate agency: what should you know?

In which case does the 3-year law not apply?

We can always find exceptions to the rule. In the case of the 3-year law, there are special causes that can cause this rule to be breached without the property ceasing to be a habitual residence.

The General Directorate of Taxes (DGT) recognizes this special exception, when there is an abandonment of the home before 3 years for exceptional reasons such as: marriage, separation, job transfer, among other cases where it is required to move to another location.

However, the exception is valid when the circumstance is mandatory, not sufficient, with the idea that it is convenient.

What tax benefits are obtained with a primary residence?

There are several tax benefits within the IRPF related to the habitual residence, among them we have:

- Exemption of the capital gain from the transfer of the main residence for those over 65 years old. Therefore, the capital gains obtained from the sale or donation of the main residence are exempted from taxation when the taxpayer is over 65 years old, has severe or great dependence.

- Exemption for reinvestment. Capital gains obtained from the transfer of the taxpayer’s principal residence are exempt from taxation. This is the case when the amount obtained from the sale of said home is reinvested as part of the acquisition of a new home which will be the habitual residence.

- Deduction for investment in primary residence. It only applies to those taxpayers who until 12/31/2022 had the deduction for investment in their principal residence.

- Deduction for rental housing. Applied until 1/1/2015. That is, it applies only for taxpayers who have a rental contract prior to 2015.

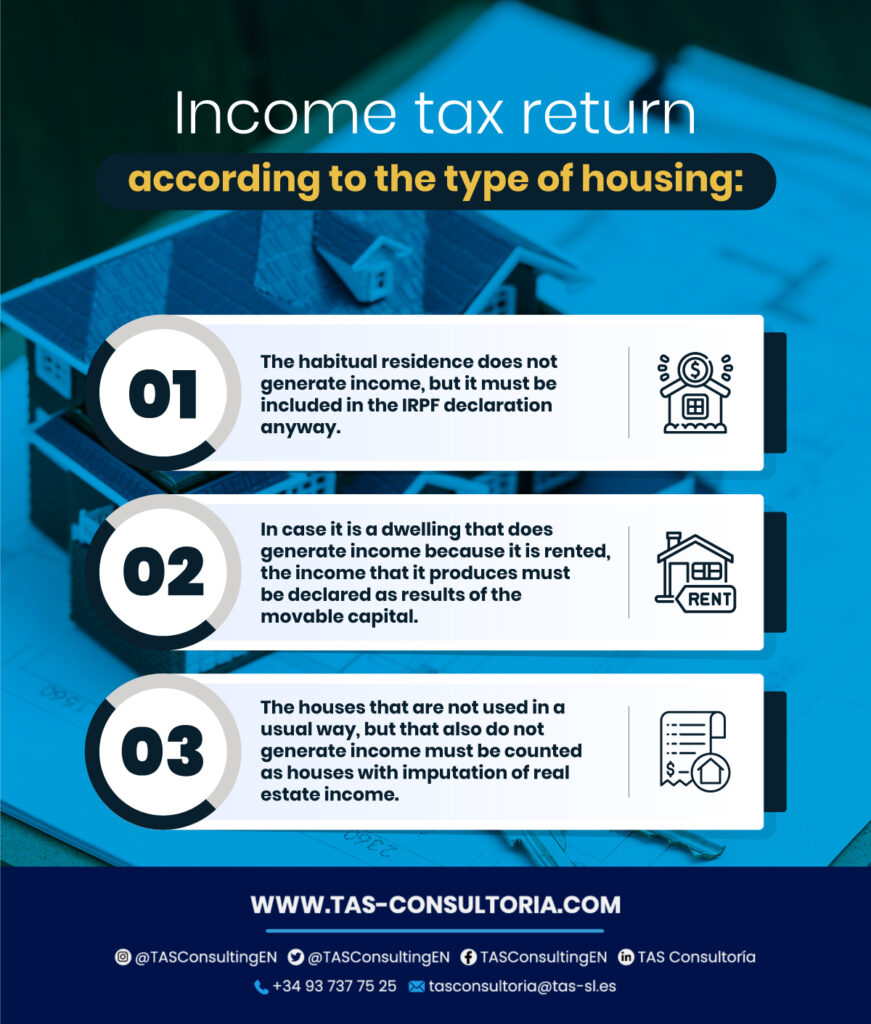

What are the differences in the income tax return depending on the type of home?

Depending on the legal status of your main residence for personal income tax purposes, you will have to tax it in different ways:

You may also be interested in: How can you register for Social Security?

To learn more about the issue of regular housing in Spain and how you can apply, just contact us through our email tasconsultoria@tas-sl.es. We have excellent professionals who will provide you with the best advice to achieve your goal. Do not wait any longer and contact us to request your free advice, do not miss the opportunity and request yours now!

Your email address will not be published .

Required fields are marked with *