If you want to be an intra-community operator and trade in the European Union (EU) you have to know that this includes certain responsibilities and obligations. For example, registration in the Register of Intra-Community Operators, better known as ROI. To find out how to register, stay with us until the end. We will be telling you how to do it, what requirements you must meet and what responsibilities you acquire with the registration, join us!

What is the Register of Intra-Community Operators?

The Registry of Intracommunity Operators ROI is the tax agency registry where companies and professionals register to obtain the intracommunity NIF. Thanks to this, it is possible to carry out commercial activities throughout the European Union in a legal way.

The ROI acts as a kind of census of entrepreneurs and professionals operating as service providers or executing delivery of goods within an EU country.

This census, which operates under the ROI, is also known as the VAT Information Exchange System (VIES). It consists of facilitating intra-community operators the consultation of the Treasury when carrying out operations with customers in the European Union.

You may also be interested in: How to invoice foreign customers from Spain?

What are intra-community transactions?

Intra-Community transactions are the exchange of goods or services executed between two operators residing in different EU countries. And, it is worth mentioning that this census is regulated by the VAT Law in articles 13 to 16.

It consists of commercial transactions between two companies or professionals from different countries of the European Union. Such transactions may include the purchase or sale of products, the provision of services or the performance of professional activities.

These types of operations are not considered imports or exports, since they are carried out in territories with a single tax management system or, as it is better known, Intracommunity VAT.

The origin of these operations comes from the EU’s need for a tool to facilitate trade and promote the free movement of goods and services among its member countries. Allowing both companies and professionals to benefit from a wider and more varied market.

How does ROI work?

The first thing to clarify is that each European Union country has its own Intra-Community Operators Register (ROI), which is adapted to its VAT rate. In the case of Spain, the ROI is managed by the Spanish Tax Agency.

The ROI functions as a census of professionals and companies where only registered members are authorized to operate within the framework of intra-community VAT.

Being a member of the community operators, we are allowed to obtain the intra-community VAT number or NIF-IVA, which is the number needed to carry out intra-community operations exempt from VAT.

That said, it should be clarified that in order for intra-community transactions to be valid and exempt from VAT, both parties to the transaction must be registered in the Register of Intra-Community Operators and each have their own VAT number.

You may also be interested in: What is the Financial Transaction Tax?

What requirements do you need to meet to apply for ROI?

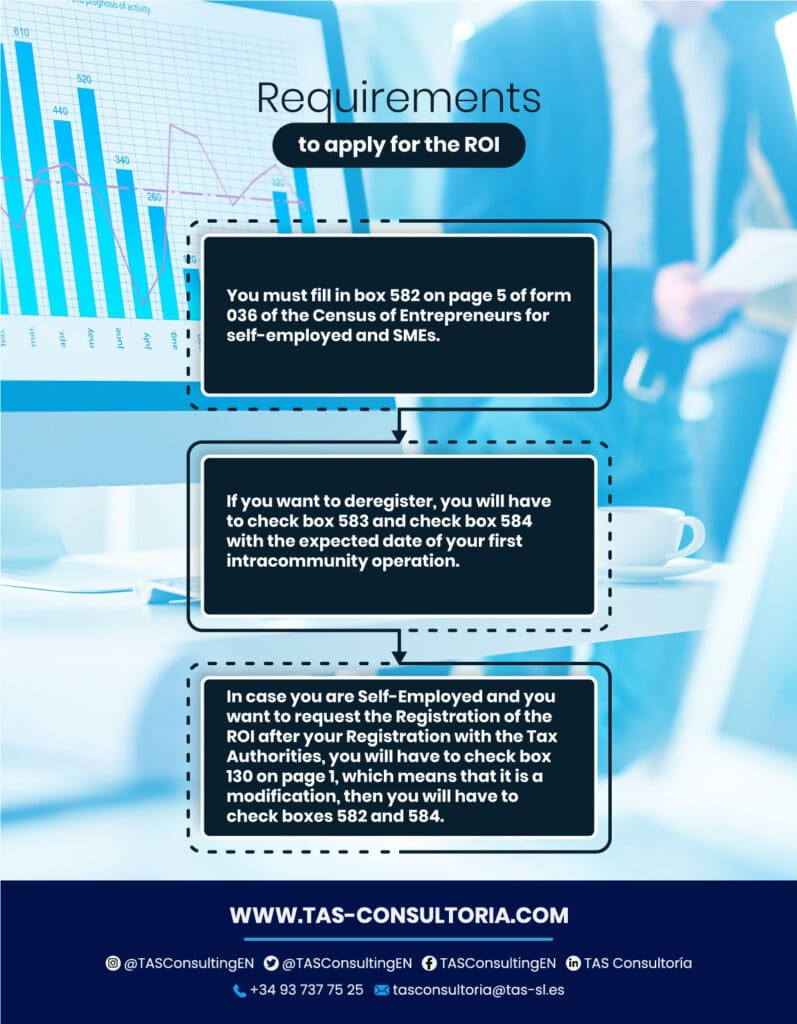

To apply for the intra-community operator registration you must request it when you register with the Tax Authorities, see here what the requirements are!

After the transition, the tax administration has a period of three months to accept the inclusion in the census. If there is no response after this period of time, it means that the request was denied.

It is possible that Hacienda will send an inspector to attend the company’s headquarters weeks after the application and check that you are complying with what you have declared in your registration. After going through all this and if the process is positive and the application is approved, Hacienda will assign you a NIF-IVA.

What is the NIF-VAT and how is it involved in tax obligations?

As mentioned above, the VAT number is assigned by the Tax Authorities and will be essential when entering the details of the intra-community sales or acquisitions that you make as a self-employed person through form 349 of intra-community operations.

Within the informative form you will have to specify and indicate the VAT number of each operator together with the country code, the name and surname, the type of intra-community operation and the amount of VAT.

It is extremely important that the information provided by customers must match the data provided by them in their intra-community operator registration.

Who must register with the ROI?

Those who must register in the Register of Intra-Community Operators and acquire a VAT number during their application for registration with the Tax Authorities as self-employed. They are the businessmen, professionals or entities that carry out or are recipients of any of the following operations:

Legal entities that make intra-Community acquisitions of goods subject to VAT must also register with the ROI.

You may also be interested in: How to register a trade name in Spain?

In TAS Consulting we have the best advisors specialized in tax, accounting and labor management. They will be able to guide you and accompany you in your process of becoming an intra-community operator that can trade throughout the European Union.

All you need to do is contact us through our email tascosultoria@tas-sl.es and request your free advice. Do not miss the opportunity to join the Register of Intra-Community Operators and boost your company in all EU countries.

Your email address will not be published .

Required fields are marked with *