The Spanish Tax Agency offers taxpayers the opportunity to file their income tax return via internet. According to their income, anyone can file a draft tax return online, a method that is used by 90% of taxpayers. Didn’t you know you could do this? Stay to the end and learn how to file your income tax return online without leaving home!

What is the income tax return?

To explain it simply, the income tax return is a mandatory procedure for all taxpayers who have received income during the fiscal year. In this, the Spanish Tax Agency is informed about the income and expenses of the previous year. This is in order to calculate the income tax to be paid or the corresponding refund.

In this sense, the income tax return is an annual process. One that must also be filed within the deadlines established by the AEAT. These usually begin in April and end in June.

In the tax return, you must include employment income, income obtained from rental property and capital gains, among others.

You may also be interested in: What are the penalties imposed by the Tax Agency?

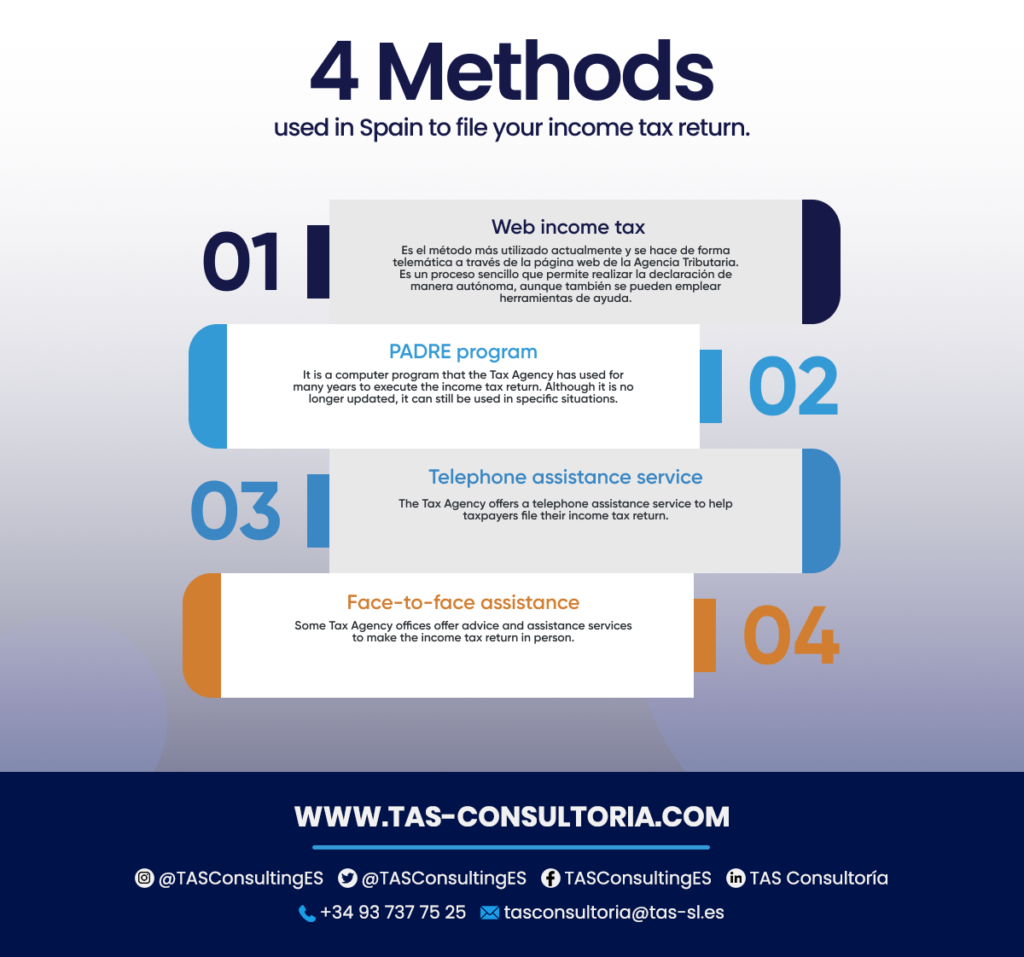

4 methods used in Spain to file income tax returns

In Spain, there are 4 methods for filing your income tax return. The best part? Most of them can be done from the comfort of your own home. Check them out below!

You should know that the method you use will vary depending on your personal situation and preferences. In any case, we recommend that you consult a professional or take advantage of the tools offered by the Tax Agency.

You may also be interested in: How to defer the payment of taxes in Spain?

What do you need to file your income tax online?

In order to file your income tax online, you will need to have certain documents that you should have on hand when making the application.

First of all, you must have your digital certificate or Cl@ve PIN to identify yourself on the Tax Agency website.

Don’t have your digital certificate yet? Go to GD Certificados website and get yours in just 30 minutes and 3 steps. All without leaving home.

5 steps to file your income tax online

If you are one of those who did not yet know that the IRS offered the opportunity to file your income tax return from home, you came to the right place. Get ready for a brief 5-step tutorial where you will only need a device with an internet connection. After that, complete these steps:

In case you are not satisfied with the draft of your tax return created by Hacienda, the Renta Web program allows you to prepare your own tax return. Save this image and consult it whenever you need it, come on!

You may also be interested in: Electronic invoicing in the Basque Country

Do you need help when filing your income tax? Contact our tax managers at tasconsultoria@tas-sl.es! There, our professionals can provide you with all the help you need, starting with a free consultation.

Don’t run the risk of making a mistake in your declaration! Make it safely with our help.

Your email address will not be published .

Required fields are marked with *