As a freelancer you must be very careful with any type of financial fraud that may harm your business. In recent years, financial scams have had an increased level as a result of the use of new technologies and social networks, making entrepreneurs the most frequent victims. If you want to know how you can avoid financial fraud, stay with us until the end of this article.

What is financial fraud?

Financial fraud is considered to be any conduct by which a person or group of persons deceives another person or group of persons in order to get the latter to transfer money or other assets that generate economic damage.

In the corporate sphere, when speaking of financial fraud, companies must be faced with an alteration, falsification or manipulation of accounting records and documents, or with the omission of amounts or the intentional making of erroneous statements.

You may also be interested in: Big Data: the evolution of data management

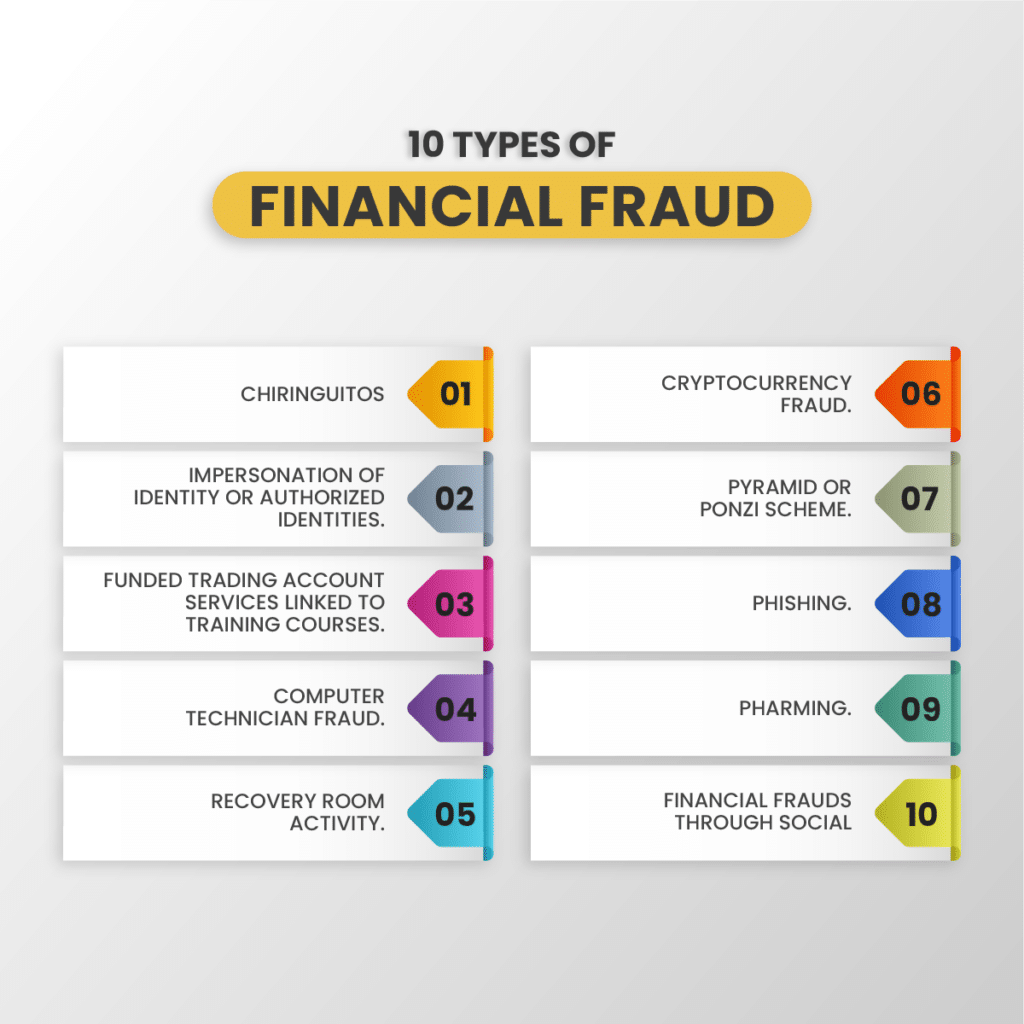

10 types of financial fraud you should know about

It is important for you to know the different methods and techniques used by fraudsters. You see, these crimes can range from document forgery to identity theft.

That said, the most common victims are SMEs and the self-employed, since they do not have sufficient financial security. For this reason, we will now tell you about the different types of fraud to which you are exposed so that you can identify them before exposing yourself to danger:

1. Financial Chiringuitos

Financial chiringuitos are entities that offer and provide investment services without authorization. These types of entities are usually fraudsters that use the same commercial channels as any official or legitimate entity such as: telephones, emails, web pages, social networks, among others.

2. Impersonation or impersonation of authorized identities

This case occurs when companies that are not authorized use the identification data of authorized companies registered in CNMW. The purpose of this is to confuse potential investors by offering them an image of a legal company.

These fake companies often illegitimately use elements that identify authorized and registered companies, going so far as to use the same URL, with minimal and almost imperceptible changes to carry out the financial fraud.

3. Funded trading account services linked to training courses

There are many websites that offer services that are generically known as funded trading accounts. These sites offer the possibility of accessing a securities account to buy and sell shares.

The particularity of this method of financial crime is that the victim does not risk his own capital in these operations, but receives a supposed profit. The real detail is that in order for the user to access this account to operate, he must go through a “course” where the rules to be followed are explained.

It is in these “courses” where these accounts have access to people’s assets. Do not forget that in these cases they always ask to cancel a previous amount, which in many occasions has a value of thousands of euros.

4. Computer technician fraud

Scam companies often use computer tools to connect to victims’ devices. In that way, they have the opportunity to appropriate their data, whether it is their access codes, passwords or any information that allows them to operate on the investor’s different accounts without their authorization.

In order to carry out this financial fraud, the criminals pose as computer technicians of the investment platform or any other known company. In this case, they claim to have “noticed” a problem with the computer, cell phone or any other device.

To solve these supposed problems they usually ask to download a program or application that allows them to connect to the victim’s computer and take remote control of it.

5. Recovery room activities

This type of financial fraud targets companies called recovery rooms, which are dedicated to contacting people who have been victims of other scam companies. Supposedly, it is to manage the recovery of losses or to repurchase shares or securities acquired through unauthorized companies.

Many times these supposed recovery rooms come from the same company that scammed them previously, or from other people or companies that have acquired the victims’ list.

6. Cryptocurrency fraud

Frauds involving cryptocurrencies often involve investing in fake cryptocurrencies with the promise of quick and high profits. Fraudsters of this type may create and sell cryptocurrencies at inflated prices with the promise of quick profits.

7. Ponzi or pyramid scheme

It is perhaps the most common financial fraud and one that always promises high returns with very little effort. This fraudulent scheme often requires investors to recruit other investors to finance the investment.

In pyramid schemes the money is not invested or is invested only in parts. This means that the scammers usually pay profits to the first customers by using new investors. As a result, it usually ends up collapsing and causing many investors to lose their money.

8. Phishing

It is perhaps the technique most commonly used by cybercriminals to obtain confidential information such as passwords or bank details by masquerading as a legitimate entity.

These types of scammers often send fake e-mails, text messages or make fake phone calls to trick potential victims.

9. Pharming

This is a cybercrime similar to phishing but more elaborate. In this type of scam, criminals infect your computer with malware, which allows them to redirect traffic from legitimate sites to fake websites that look just like the original and were created to collect sensitive data.

In this way, they can trick investors into entering all their confidential data without any fear and without knowing that they are being referred to fake accounts.

10. Financial fraud through social networks

Social media can often provide valid and beneficial information for investors. However, they also create the opportunity for large scams and frauds to originate.

It is because of this that, nowadays, the networks are a source of information and advice for new investors and freelancers. This is where fraudsters take advantage of this trend to find their new victims.

You may also be interested in: International telework regulation

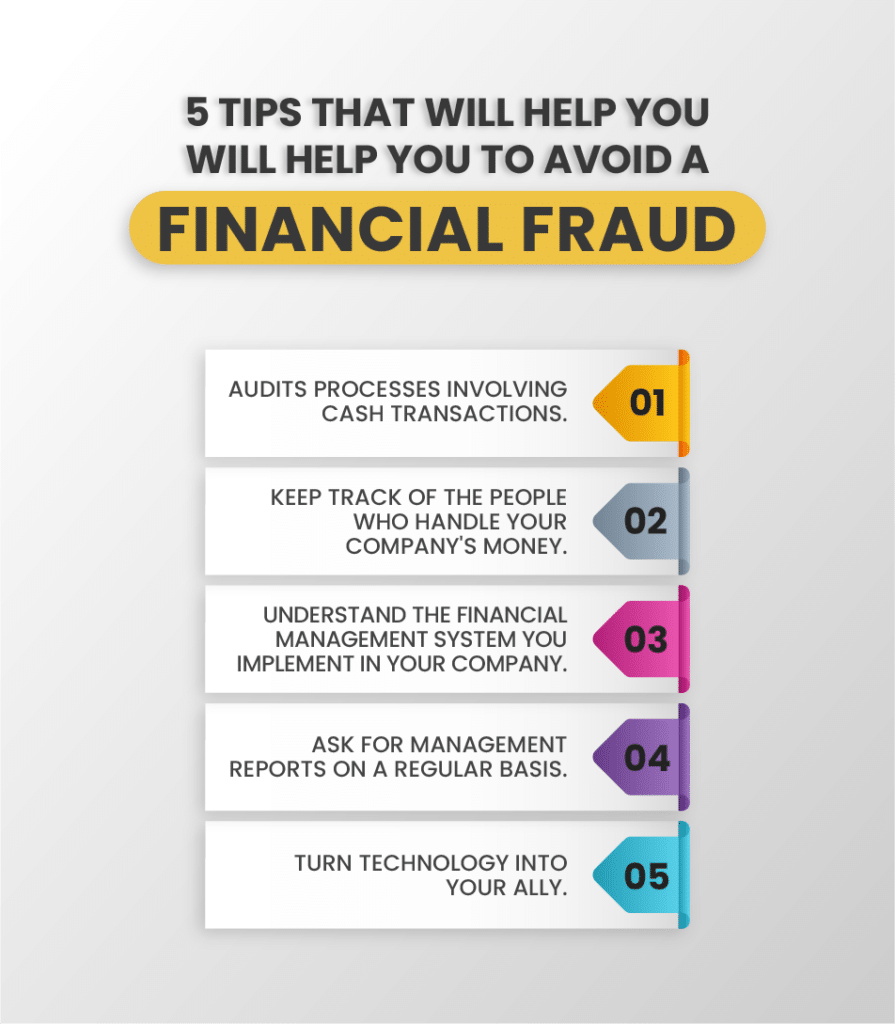

5 tips to avoid becoming a victim of financial scams

As a freelancer and entrepreneur, taking care of your money and your investment should be one of your main concerns. For this reason, you should always be vigilant and wary, as this is the only way to avoid becoming a victim of financial frauds that can harm you and your company.

Because we care about your financial and overall security, here are 5 key tips that will protect you from financial fraud if you follow them carefully:

1. Audits processes involving money transactions

As a freelancer it is very important that you know all the processes of your business, as it is a necessity when it comes to knowing what is happening with your money.

That’s why you should constantly track every transaction, every movement and every financial exchange your company makes so that you get an overview of how your expense management is working.

2. Keep track of the people who handle your company’s money

As the manager of your company, it is important that you know who are the people who make up the financial team. This point is as crucial as knowing how your company’s financial procedures work, since there are people who are susceptible to making mistakes.

Therefore, any mistake involving money can be considered a scam and you must make sure that all the money reaches its respective destination.

3. Understand the financial management system you implement in your company

Many times financial fraud has its origin in records that are poorly kept or that do not have a rigorous supervision. For that reason it is very important that you know the financial control system used in your company.

In this way, you will be able to control the manager’s access, allowing access only when necessary, and you will be able to verify any irregularities that may arise.

4. Ask for management reports periodically

To reduce the possibility of fraud or diversion of your money, it is important that you frequently request cost, expense and income reports for specific periods.

It is best to do this audit on a monthly basis and always dedicate one day to review all reports carefully. If your case is that you do not have the financial and accounting knowledge, it is best to include in your staff a compliance professional to perform such analysis.

5. Turn technology into your ally

This is the best advice we can give you. Nowadays there are many technological systems that can help you automate different processes in the management of your company.

As a result, they will help you avoid financial risk, making it possible to integrate all financial movements in order to have an accurate and detailed report of the possible risks that may arise and assign responsible parties to deal with them.

Therefore, we recommend that you always hire software that facilitates operational risk management and allows you to monitor non-financial risks within your company. In Gestión Direct you can get different business management software that will keep your company safe and always up to date.

If you follow these simple tips, you will be able to know and detect any type of financial fraud that may occur or of which you want to become a victim. That way, you will be able to notice it from the beginning and prevent your company from being affected.

You may also be interested in: Financial data protection: How are customers protected?

If you want to learn more about financial fraud and how it can affect self-employed entrepreneurs, I invite you to contact us through our email tasconsultoria@tas-sl.es. With us, you can find the ideal specialists who can provide you with all the legal information you need on this topic and much more.

In addition, you will be able to request your first consultation totally free. So do not miss this opportunity and contact us.

Your email address will not be published .

Required fields are marked with *