Despite the risks and uncertainties of inflation in Spain, it is important for SMEs to plan and make decisions that will help them to cushion the negative effects of inflation and to take advantage of the opportunities that may arise. Do you want to know what strategies are right for you to resist inflation in Spain? Stay tuned to the end!

What is the economic context of inflation?

Inflation in Spain reached an all-time high of 5.5% per year last October 2021. Exceeding all forecasts and being considered as the number one challenge of the economy. In addition, electricity, fuels and gas are some of the items that have experienced the highest price increases.

As a result, many businessmen and entrepreneurs are concerned about the possibility of stagflation, where the economy experiences stagnation and zero growth along with high inflation.

According to the European Central Bank, expected inflation for Spain at the end of 2023 is 1.7%. This figure is an estimate based on the latest inflation data collected by the ECB.

You may also be interested in: Expansion and Diversification Strategies

4 strategies to reduce costs in the face of inflation in Spain

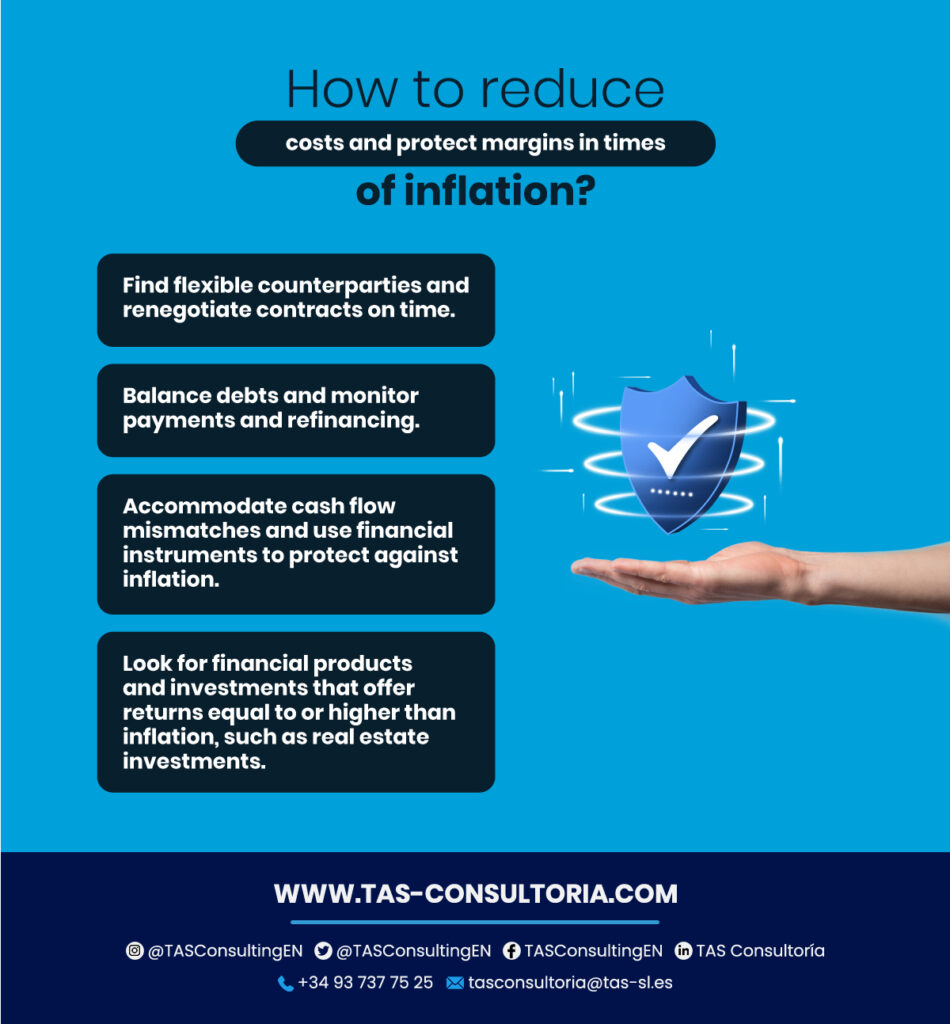

In times of inflation, protecting an SME can be a real challenge. With the above inflation data in Spain, it is important to find ways to protect profit margins to avoid falling into liquidity problems or a creditor position.

Here are some strategies that can help your SME cope with inflation and maintain its profitability:

1. Implement long-term contracts

While they can be a way of guaranteeing a fixed price for a period of time, they can also leave both parties in a vulnerable position.

In adverse economic situations, such as inflation in Spain, costs can increase significantly, which can affect the budget and the contractors’ ability to pay.

Therefore, it is important to be flexible and seek out flexible counterparties. Renegotiating a contract in time can save a relationship and avoid falling into a creditor position in a complex insolvency proceeding.

2. Balancing the company’s debts

At first glance, taking on debt may seem advantageous in difficult economic times, as is the case with inflation in Spain. This is because payments are not indexed and their value depreciates as prices rise.

However, it should be noted that excessive leverage can make it difficult to refinance your SME.

In addition, one of the consequences of inflation is likely to be an increase in interest rates. Therefore, it is important to monitor the repayment and refinancing schedule and ensure that debt is at a manageable level.

3. Analyze the effect of inflation on your SME’s cash flow.

In such situations, both payments and collections can be higher than expected, which can lead to cash flow mismatches.

It is of great importance to have tools and data for agile cash management. It is essential to be prepared to adjust to any mismatches so as not to undermine the credibility and payment capacity of the company or the profitability of the business. In addition, the available financial instruments must be analyzed to avoid or accommodate possible mismatches.

4. Research financial products that protect your business from inflation.

Self-employed individuals with investments, savings and surplus-generating businesses can look for financial products and investments that fit this situation.

In any case, it is important that financial or investment products offer returns equal to or higher than inflation.

Investing in real estate assets can be a way to protect against inflation, as real estate tends to appreciate in value over the medium and long term, and rental prices tend to increase when prices rise in general.

You may also be interested in: Pros and Cons of Venture Capital Fund Financing

4 strategies to adjust prices and assertively communicate these changes

As long as inflation exists in Spain, you will need to take appropriate measures to adjust prices and communicate them effectively to both your employees and customers. Here are 4 strategies for adjusting prices and communicating changes:

1. Caring for the company’s employees

Inflation can affect their purchasing power and, as a result, encourage their departure to other companies. To retain valuable employees, you should consider retention measures and plan for alternatives in case they decide to leave.

It is essential to have flexible and intelligent leadership to assist in the transitions that must be faced.

2. Rethink the company’s investment projects.

Inflation in Spain may cause some investments to become meaningless and depress demand, increase costs and change the timing of decisions. In some cases, investments may need to be liquidated in an orderly fashion. In others, the way in which resources are combined may need to be changed to adapt to the new circumstances.

Products can be varied to adapt them to new circumstances and work with alternative scenarios to make appropriate decisions.

3. Redesign the marketing strategy

In a context such as inflation in Spain, raising prices means running the risk of customers opting for cheaper options. In view of this, the marketing strategy can be reoriented to add more value to the product, present services in a new way and improve the shopping experience for customers.

Email marketing is a powerful tool that can help raise product awareness, express brand personality more directly and build lasting relationships with customers.

4. Betting on the automation of manual processes

To free employees from work that does not add value to the company, companies that opt for automation are able to face crises with greater stability, obtain more stable revenues, avoid disruptions in the supply chain and promote productivity.

In short, it is important to talk to an advisor to find out how you can increase the real value of your assets and protect your company’s equity during inflation. For, these situations often test the resilience of SMEs. But, if the right steps are taken, the company’s position can be strengthened.

You may also be interested in: Frequent mistakes when setting business goals

By making the smartest decisions, you have the best shield against an unfavorable economic outlook such as inflation in Spain. Remember that you can book a consultation with our professionals and start the next quarter of 2023 at the top of your game. Contact us at tasconsultoria@tas-sl.es!

Your email address will not be published .

Required fields are marked with *