The VAT self-consumption refers to the obligation that every self-employed professional has to pay and influence the VAT on the use of goods and services that were deducted incorrectly. To learn more about VAT self-consumption in Spain, the first step is to stay until the end of this article and you will know what it is and how you can declare it. Let’s get to it!

What is known as self-consumption?

Self-consumption refers to a person’s need to use goods or services that he or she created to satisfy his or her own needs. This is instead of selling these products or services on the market. In other words, the entrepreneur’s work is not marketed, but used for his own enjoyment.

Also related to the word self-consumption is the idea of carrying out a specific activity for personal benefit, without it being used to sell oneself or enter some kind of special market. A simple way of looking at it, for example, is a person who learns to fix cell phones in order to repair his own.

We hope that now that we have explained it briefly you can understand more clearly the concept of self-consumption and how it is applied in these cases.

You may also be interested in: Profitable business in Spain 2022

How does the Value Added Tax law work in Spain?

In Spain, VAT self-consumption is regulated under the Value Added Tax Law 37/1992. This law specifies that self-consumption of goods and services is subject to VAT, when this can be deducted, even partially, from the input VAT of a purchase.

It is of great importance that the goods or services subject to VAT are part of your business assets.

What is VAT self-consumption?

Self-consumption in VAT is a law that seeks to legally neutralize the tax and to pass on the previously reduced quotas.

In other words, the function of VAT self-consumption is to prevent the self-employed from making privileged consumptions without paying the corresponding VAT. This is because VAT on self-consumption of goods and services is included in the purchase of a product or service as long as it can be deducted, even partially.

What is called self-consumption of goods?

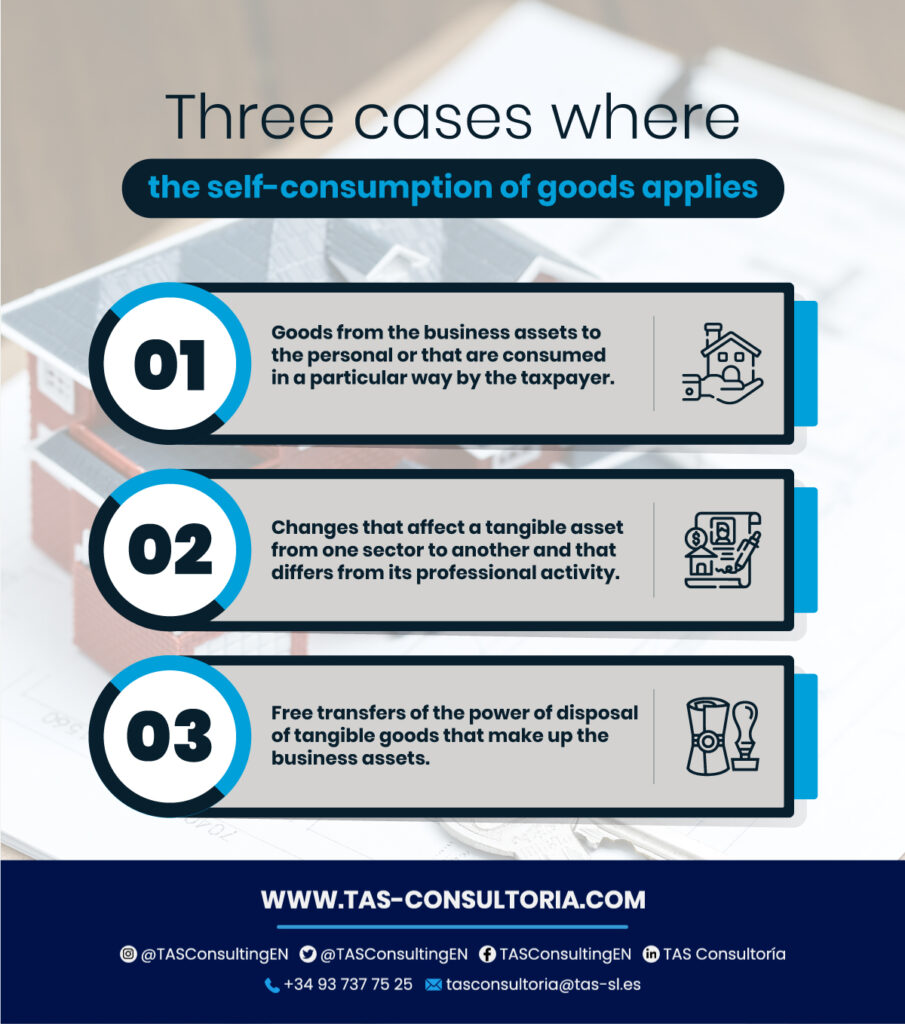

We speak of self-consumption of goods when these are used for personal use, instead of selling them to other companies. This means that you use the business goods or services to enjoy them as your own property. Here are three different cases in which this could be the case:

You may also be interested in: What’s new in the Personal Income Tax return in Spain?

What is known as self-consumption of service?

Self-consumption of service is considered when the taxable person makes some of these operations without consideration. For example:

- Transfers of rights from business or professional assets to personal assets.

- Using professional or business resources for personal purposes.

- Provision of free service to third parties

What types of VAT self-consumption can be found?

When it comes to VAT self-consumption, there are generally two types of VAT that can be adapted to any context:

- External self-consumption: refers to goods or services offered by a company that benefit the owner or third parties in a private and particular way.

- Internal self-consumption: it is carried out within a company’s own production process. There can be 2 cases of this type:

- In case the goods used in the business activity are destined to another company, within a different sector.

- When a company’s current assets are used as investment assets of the same company.

How is self-consumption declared for VAT purposes?

VAT self-consumption must be indicated in the Value Added Tax (VAT) return corresponding to the period in which the purchases of goods and services were made.

When declaring VAT consumption, the value of purchases that are considered as self-consumption must be included and the reduced VAT rate must be applied.

You should always keep the supporting documents that consider self-consumption, so you will be able to prove that the company meets the requirements of the law.

Another common case is the possibility of applying VAT self-consumption automatically, without the need to include purchases in the VAT return when making purchases from other companies that are subject to this regime.

What are the exceptions for VAT self-consumption?

We can find special cases that are considered VAT self-consumption exceptions, see them here!

You may also be interested in: VAT exempt activities: in which cases does it apply?

To learn more about the operation of VAT self-consumption, you only have to contact us at our email tasconsultoria@tas-sl.es. We have excellent advisors specialized in tax, accounting and labor management. They will be able to provide you with all the information you require on this subject and many more.

Your email address will not be published .

Required fields are marked with *