A common doubt in the commercial sector is whether it is possible to sell online without registering as a freelancer. In this regard, it is essential to know the legal and fiscal implications of not declaring your contributions. At the same time, you must take into account the obligations of being self-employed after opening an online store. In this article we will give you the keys to become an online seller and make the right decisions to meet your tax obligations, let’s go!

2 unique conditions to sell online without being self-employed

According to labor regulations, it is illegal to invoice without registering as self-employed. However, there are people who, despite not having sufficient income to cover the costs of the contribution to the Special Regime for Self-Employed Workers (RETA), decide to undertake activities on their own.

These individuals are at risk of incurring serious violations and fines from the tax authorities, as they are not complying with labor regulations.

In addition, by not registering as self-employed, these individuals lose the right to receive bonuses and subsidies available to the self-employed. As a result, the long-term success and sustainability of their business may be hindered.

It is important to keep in mind that, although it may seem like an easier path, evading the contribution and registration as self-employed can have serious consequences and limit the growth potential of your business.

In simple words, it is necessary to register with the Social Security as a freelancer when selling recurrently online.

If you are thinking of marketing products or services through a blog or online store, you should know that according to Law 20/2007 of the Statute of Self-Employment, you must register in the Special Regime of Self-Employed Workers (RETA) if the activity is recurrent.

This is independent of the income generated. However, it is only necessary to register as self-employed if the activity is recurrent and generates income of more than 950 euros gross per month. It is important to note that the registration with the Social Security must be prior or simultaneous to the registration with the Tax Authorities.

You may also be interested in: How to become self-employed in Spain if you are a foreigner?

How to facilitate the process of getting your business online?

- Make a business plan:when starting an economic activity, it is important to take into account the turnover and income that can be generated

If you meet the requirements for the flat rate, registering as self-employed will allow you to take advantage of this offer of 60 euros per month for one year, with the possibility that some autonomous communities will extend the aid for another year.

- Register in the Census of Entrepreneurs to be able to file your taxes and issue invoices.

- Monthly invoicing:the Tax Agency requires entrepreneurs and professionals to issue invoices for goods and services delivered

However, there is the option to invoice all the work in a few months and pay only for those months in which you were registered as self-employed. The general concepts will be indicated in the invoices to avoid problems with the Tax Agency. - Invoicing cooperatives: one of the best ways to join a common project without being self-employed is through a cooperative, a company in charge of registering and deregistering with the Social Security, invoicing and payroll with taxes and deductions applied.

You may also be interested in: Is it possible to hire personnel as a freelancer in Spain?

What happens if you sell on the Internet without being registered as self-employed?

The consequences of selling online without being self-employed include the loss of rights to bonuses and subsidies, such as the flat rate of €60/month. In addition, you must pay the overdue self-employment fees with a surcharge that can be from 10% to 35%.

According to tax regulations, if you invoice on a regular basis, it is mandatory to register as a self-employed person. Otherwise, you would be committing serious offenses that can result in fines of up to 3,000 euros.

Also required is the liquidation of all unpaid taxes, including penalties, surcharges and interest.

The date of registration as self-employed with the tax authorities will be established retroactively based on the estimate of the period in which the activity has been carried out. Therefore, if you have been earning income on a regular basis for a period of 14 months, the registration can be processed with effect from that date.

Responsibilities of a freelancer with an online store

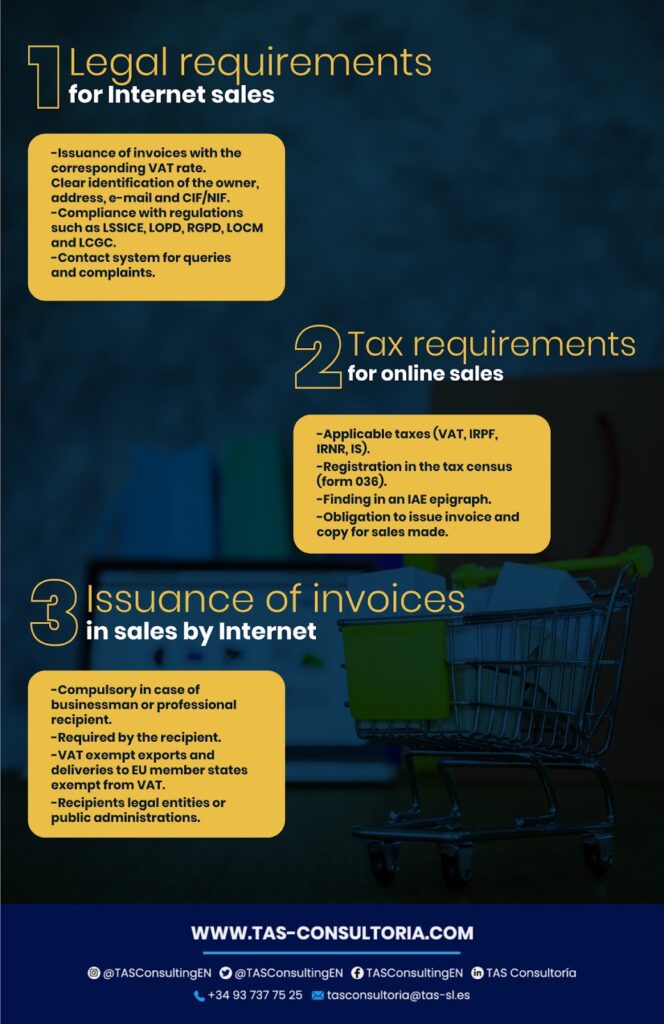

Internet commerce is a booming economic activity that offers great business opportunities, but it also entails certain legal and tax requirements that must be met when registering as a freelancer.

From the identification of the owner on the website to the obligation to issue invoices. Every online sales business must know and comply with the applicable regulations, such as the LSSICE, the LOPD, the RGPD, the LOCM and the LCGC.

In addition, Internet sales are subject to the same taxes as traditional commerce, including VAT, IRPF, IRNR and IS. It is therefore important to be familiar with the tax rules governing this activity.

In the following material you can see the main legal and tax requirements for Internet sales, as well as how to comply with them.

You may also be interested in: How can you register for Social Security?

Invoicing without registering as self-employed is considered an illegal activity and can have serious consequences. Therefore, it is advisable to develop a business plan where the tax structure is a priority.

Your email address will not be published .

Required fields are marked with *