If you are thinking of expanding your business in Europe, Spain is likely to be an attractive market for you. Although the process of incorporating a company in our country may require several steps, careful planning can make all the difference. In this article, we will analyze the most common mistakes when setting up a company in Spain and offer you some recommendations to avoid them. Don’t miss the opportunity to learn from others and ensure the success of your business!

Mistake No. 1: Not choosing the right legal form

Setting up a company in Spain can be somewhat complex due to the various options of legal forms that exist. It is important to keep in mind that choosing the right business structure is essential for the success of any business, as each legal form has its own characteristics, whether related to tax or legal obligations. The main ones are:

- Public Limited Company (S.A.).

- Limited Liability Company (S.R.L.).

- General Partnership (S.C.).

- Limited Partnership (S. en C.).

For example, a limited liability company (LLC) is a popular choice for most entrepreneurs because it offers a solid structure that allows them to limit their personal liability and have a clear separation between their personal and business finances.

However, it is not always the best option for all companies. Especially for those seeking greater flexibility in decision making and financial management.

When setting up a company in Spain you have other options such as the public limited company (SA), the community of goods, the cooperative or being self-employed, each of them with advantages and disadvantages. Therefore, it is essential that you know them thoroughly before making a decision.

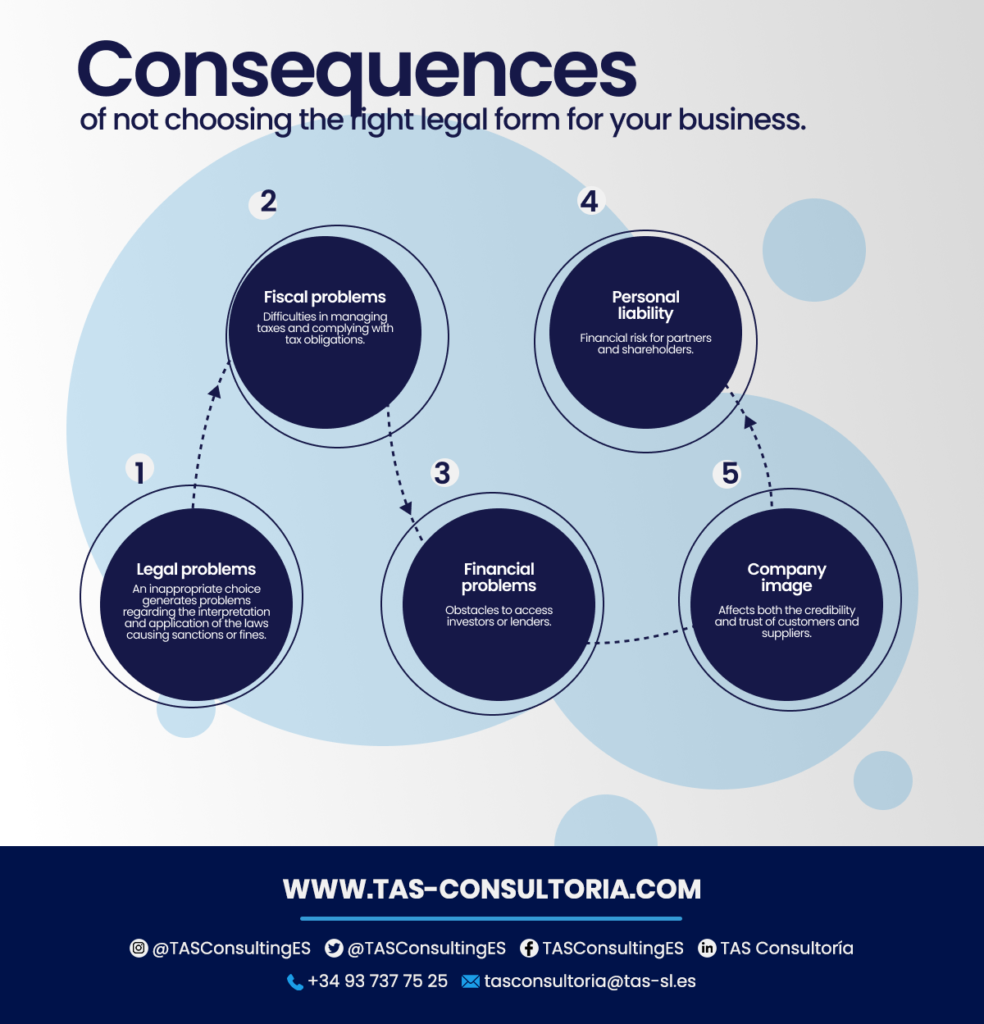

Choosing the wrong business structure is one of the most common mistakes made by entrepreneurs when setting up a company in Spain. It can have serious and lasting consequences for the company, which makes it even more important to have professional advice when taking this big step.

It may seem like an overwhelming task, but it is essential to research and understand the different legal options to ensure that you choose the best option for the type of business you will undertake.

Some scenarios that you want to avoid and that is why it is so important to make the right decision are:

You may also be interested in: 10 steps to start your own company

Mistake No. 2: Failure to comply with legal and tax requirements

To create a company in Spain it is essential to comply with the legal and fiscal requirements established by law to establish a company, here we present them to you :

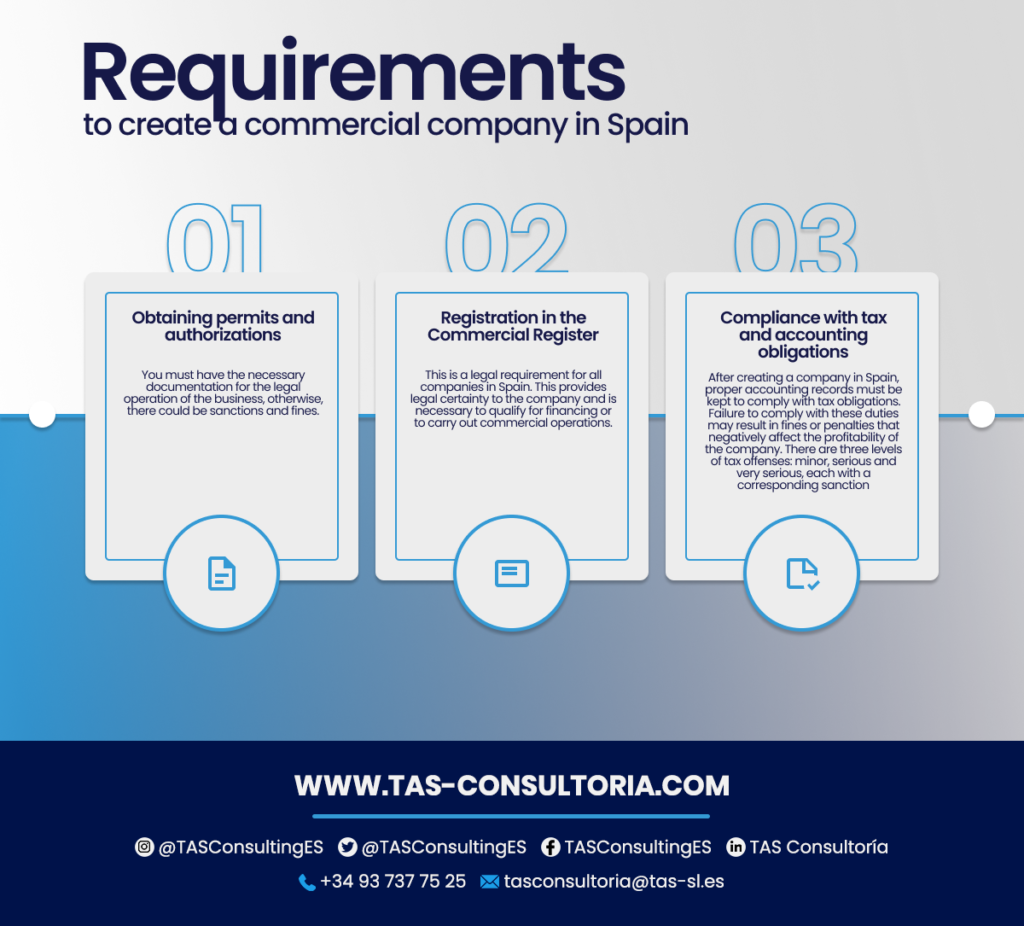

Obtaining permits and authorizations

Compliance with legal and tax requirements when setting up a company in Spain begins with obtaining the necessary permits and authorizations for the foundation and operation of the company. Without them, the business will not be able to operate legally and could be exposed to sanctions or fines.

Registration in the Commercial Registry

Registration in the commercial register is a legal requirement in Spain for all companies. This registration gives publicity and legal certainty to the company and protects the interests of partners and third parties.

In addition, registration in the commercial registry is also required for obtaining financing or conducting business operations.

Also, after creating a company in Spain, you must comply with the filing of a tax return, either corporate, VAT or other taxes depending on your activity.

Compliance with these legal duties is also important to maintain good credibility with the authorities.

Compliance with tax and accounting obligations

After setting up a company in Spain, you must keep proper records to comply with its accounting obligations. This is necessary to maintain good financial health, ensuring that the company has a clear view of its income or expenses, and also to comply with tax obligations.

Failure to comply with such requirements may result in fines or penalties, which in turn may negatively affect both the company’s reputation and profitability.

Current tax legislation classifies tax offenses into three levels: minor, serious and very serious. Spanish law establishes the criteria to determine in which of these three levels each infraction is classified and the penalty corresponding to each one of them:

- Minor infringement: the penalty for a minor infringement shall be a proportional fine of 50%.

- Serious infringement: will involve a proportional fine ranging from 50% to 100%. If there has been economic damage to the Treasury or if the infringements have been continuous, the minimum percentage of 50% may be increased.

- Very serious infringement: a proportional fine ranging from 100% to 150% will be applied. Likewise, the minimum percentage of 100% may be increased according to the aforementioned circumstances.

In short, to create a company in Spain it is important to seek professional advice and ensure compliance with all legal obligations.

You may also be interested in: How is investment risk measured?

Mistake No. 3: Not having good legal and tax advice

Compliance with legal and tax requirements is fundamental to creating a sound and successful business in Spain. However, the regulatory compliance process can be complex and constantly changing.

Here we list the steps that a business advisor can follow to guide his client in the quest to establish a company in the Spanish market:

Good legal and tax advice may be the key to comply with all requirements and avoid potential legal, tax or financial problems.

You may also be interested in: All about the entrepreneur visa in Spain

In short, setting up a company in Spain may seem complicated, but by avoiding the most common mistakes you can get off on the right foot from the start.

If you are interested in creating a company in Spain and need help to avoid these mistakes, do not hesitate to contact us for a personalized and professional consultancy. Together we can make your business grow without worrying!

Your email address will not be published .

Required fields are marked with *