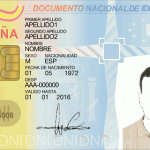

An NIE Number (Número de Identificación de Extranjero) is a tax identification number to be used in Spain.

An NIE Number (Número de Identificación de Extranjero) is a tax identification number to be used in Spain.

Both EU citizens and non-EU citizens get issued an NIE. It consists of an ‘X’ or ‘Y’ followed by 7 or 8 digits then another letter.

The NIE is not a fiscal residency identification; you can have a NIE and be fiscal resident in another country.

The NIE number is needed in order to file taxes, buy property, set up a business, open a bank account, and for almost all other forms you fill out. When forming a company, everyone who will be directors and shareholders of the company will need a NIE. This is the first step in forming a company or in buying a shelf company.

The application process is laborious and time consuming, and without the use of a service such as ours, would require normally two trips to Spain, and over 10 hours of waiting in queues, along with the filling out of complex application forms, written in Spanish.

Once issued an NIE number, it will never change, irrelevant of marital status, name changes or residence status.

TAS Consultoria can assist you during this process. Using our service, getting your NIE number will require only one day.

Feel free to contact us!

Your email address will not be published .

Required fields are marked with *